Wheeeeee!

Wheeeeee!

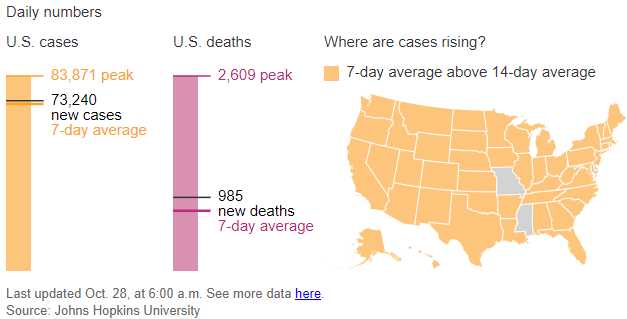

Down we go again as US cases hang around their record highs and Europe is starting to catch up as another wave of the virus goes global. No country, of course, can match the US in number of cases or number of deaths because we are truly the most incompetent Government on the planet. Of 50 US states, only 2 (Mississippi and Mossouri) do not have rising numbers of viral cases – only 2.

The does not, of course, stop Donald Trump's White House from announcing that it has "successfully ended the COVID-19 pandemic" on the same day that 73,240 Americans came down with the disease.

“We have exploding case counts. Death rates will undoubtedly rise. They are living in a parallel universe that bears no relation to the reality that Americans are living,” said Dr. Tom Frieden, former director of the Centers for Disease Control in the Obama administration. “And this idea that we should let it spread and protect the vulnerable is a really dangerous mistake. The idea that it [containing the virus] can’t be done ignores reality.”

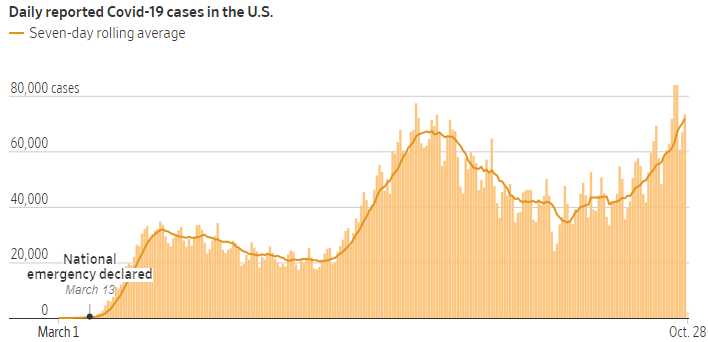

Do you see where it says "National Emergency Declared"? That was 7 months ago when the US had less than 2,000 cases and now, on October 27th, with 8,779,839 American infected (73,240 in a single day), the White House has declared the National Emergency is over, not because it's actually over, but because it's a week before the election and Donald Trump likes to claim he defeated the Coronavirus at his rallies and now he can say "it's official".

1,000 Americans per day are dying. 3,393 Americans have died from Terrorist attacks yet 1,000 people, EVERY DAY, are being killed by Trump's virus and he's declaring "Mission Accomplished". 20 years later, we still have to scan our bags and take off our shoes at the airport and even the incompetent George Bush II formed the entire Department of Homeland Security in response to 9/11 and the TSA was formed on November 19th, 2001, 5 weeks after the attack on the World Trade Center.

Why? To prevent more American deaths. To help Americans return to their normal lives despite the threat of additional attacks. That is a NORMAL response to a threat – to prevent it from happening. Donald Trump's response is more like that of an ostritch, putting his head firmly in the sand while the rest of the GOP puts their heads up his ass!

Why? To prevent more American deaths. To help Americans return to their normal lives despite the threat of additional attacks. That is a NORMAL response to a threat – to prevent it from happening. Donald Trump's response is more like that of an ostritch, putting his head firmly in the sand while the rest of the GOP puts their heads up his ass!

226,728 of us are DEAD! That's 70 9/11s and another 2 9/11s are happening EVERY WEEK under this lunatic yet the polls show he might still be re-elected? Seriously???

The death count is rising and is a lagging indicator behind the people who are getting sick every day. Almost 500,000 of us caught the virus in the past 7 days – that's the most in any week for any country since the virus began. 90,220 Americans died in the entire 21-year Vietnam War – but at least they knew they were being drafted. 116,516 Americans died in World War I and 405,399 died in World War II – we're certain to beat that number before this thing is over and possibly much, much worse if we continue on the insane path this country is currently taking.

So vote like your life depends on it in the coming week – it just might…

Meanwhile, as we expected (I did say DOOM!!!) once we failed our key support line of 3,420 on the S&P, there was nothing holding the index up and it's been a pretty solid drop for the last couple of days and today is not looking any better as we're already down 2% in the Futures. Oil is down 5% this morning as yesterday's API Report showed a 4.5M barrel build in inventories. $37.50 should be bouncy on Oil Futures (/CL) with our EIA Report coming out at 10:30 so that's a fun way to play if you need a bullish bet (with tight stops under $37.50, of course).

Meanwhile, with the 15% line of 3,277.50 now in sight on the S&P 500 (/ES) it's a good time to take profit on our hedges as that line should be bouncy. How bouncy? Well if we count this as a 10% drop from the 25% line then the weak bounce should be 2% or, more exactly, 3,562.50 is the 25% line so we had a 285-point drop which means we will have a 57-point weak bounce to 3,335 and a strong bounce would take us to 3,392 and that is the now-declining 50-day moving average.

Now, keep in mind we haven't actually hit 3,277.50 but, if we see the strong and weak bounce lines from that PRESUMED drop acting like they matter – then that's a pretty accurate predictor that we WILL be testing our 15% line again. Still, even if we do, the bounce back to 3,335 is almost inevitable – even if we're going to drop another 5% or more, so NOW, at 3,319, is a good time to cash out our hedges and get ready to take advantage of the bounce.

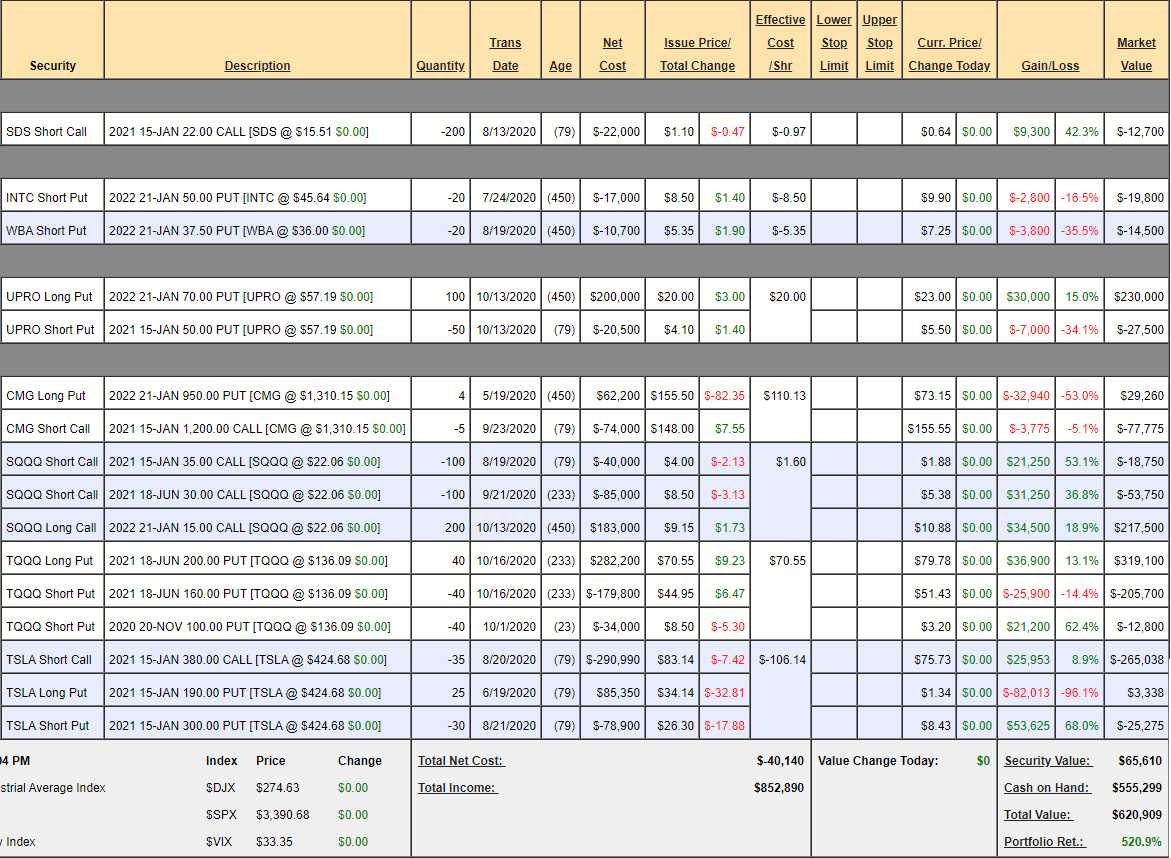

We did our last Short-Term Portfolio Review back on Tuesday, the 13th, when the S&P was at 3,500 and the STP was at $484,069 and now it's up to $620,909 so up $136,840 in two weeks is a very nice hedge for our Long-Term Portfolio (LTP), which has fallen from $1,070,623 to $974,283 – down $96,340 so we're making more money on the way down than up and today being a big down day – it's a good day to take profits on our shorts.

It's been brought to my attention, however, that the TSLA stock split in the STP was not accounted for correctly and roughly 1/3 of the gains ($141,420) since before the split (9/1) are overstated. That has no bearing on the gains from other positions, of course, but TSLA is a big position and, as that's very difficult to unwind in the context of this STP so I think the prudent and educational course is to start a new Short-Term Portfolio that is capable of protecting a $1M LTP in this market environment.

This is a great opportunity to cash in and re-position and we'll carry forward just $200,000 to protect our just-under $1M LTP with the following new hedges.

- Sell 5 CMG Jan $1,300 calls for $82 ($41,000)

- Buy 6 CMG 2022 $1,300 puts for $220 ($132,000)

- Sell 3 CMG 2022 $1,100 puts for $130 ($39,000)

- Sell 3 CMG Jan $1,150 puts for $25 ($7,500)

That's net $44,500 on the $120,000 spread but it's really more than that as we can roll the short puts along to lower strikes and widen half the spread. Also, it's really less than that (net) as we have several mre short put sales ahead of us and we should be able to knock down at least 1/2 of that net cost which makes this a very efficient hedge offering $80,000(ish) of downside protection.

SQQQ – Up to $23.75 at the moment!

- Buy 100 SQQQ 2022 $20 calls for $11 ($110,000)

- Sell 75 SQQQ Jan $25 calls for $4.70 ($35,250)

- Sell 25 SQQQ Jan $21 puts for $3.10 ($7,750)

That's net $67,000 on a rollable $50,000 spread but the 2022 $35s are $8.40 so we can pick up $30,000 more (net $37,000) and widen the spread to $150,000 but I sure hope the Nasdaq doesn't crash that hard. This keeps us flexible without taking too much risk on the bounce.

TSLA – Still too high! The problem is we don't have huge profits to play with so it's not a great fit.

So that's it for now, we'll see what kind of bounce we have and add more protection as needed.