Good morning!

Good morning!

There's some issue with our site certificate, which is supposed to be valid THROUGH 11/30 but I'm getting an error message this morning so I'm sorry if some of you are having trouble accessing (Edge lets you bypass the issue, Chrome does not). I hope everyone had a great Thanksgiving. We've already pulled back a lot of our trades for the holidays as we expect a dip between now and January and we've had a great year so why risk it? It is making it hard for met to find a good Trade of the Year, though – and I have the pressure of having to announce it next week on Money Talk (Weds, 7 pm).

As you can see from the image above and this one here, Black Friday was a bust for in-store Retailers but a boom for on-line though I very much doubt it's possible that on-line sales made up for retail as on-line has been only 10% of all sales so, of in-store was down 20%, on-line would have to be up 200% to make up for it and that's just not at all likely.

As you can see from the image above and this one here, Black Friday was a bust for in-store Retailers but a boom for on-line though I very much doubt it's possible that on-line sales made up for retail as on-line has been only 10% of all sales so, of in-store was down 20%, on-line would have to be up 200% to make up for it and that's just not at all likely.

Today is, of course, Cyber Monday but that's kind of out the window too with everyone working at home all the time. Hope springs eternal in the Retail Sector but, as we predicted, Christmas is officially cancelled as Dr. Fauci said yesterday that "restrictions and travel advisories will be necessary for the Christmas holiday season."

In fact, Cyber Monday sales are only projected to grow 15-35% this year and that will never be enough to cover the drop in Retail and the indexes are reflecting that this morning with a bit of weakness that is not surprisign any of our Members, who had a nice relaxing weekend with their CASH!!! Up 35% would push Cyber Monday sales to $12.7Bn, out of $6,000,000,000,0000 in Retail Spending, that's 0.2%

Real-time shopping data from both RetailNext and Sensormatic Solutions showed in-store traffic plunged by roughly 50% compared to last year's Black Friday. In-store traffic on Black Friday was already on the decline. Per Sensormatic Solutions, foot traffic fell over 6% in 2019 from the prior year. In 2018, in-store shopping fell by 1.7% compared to 2017.

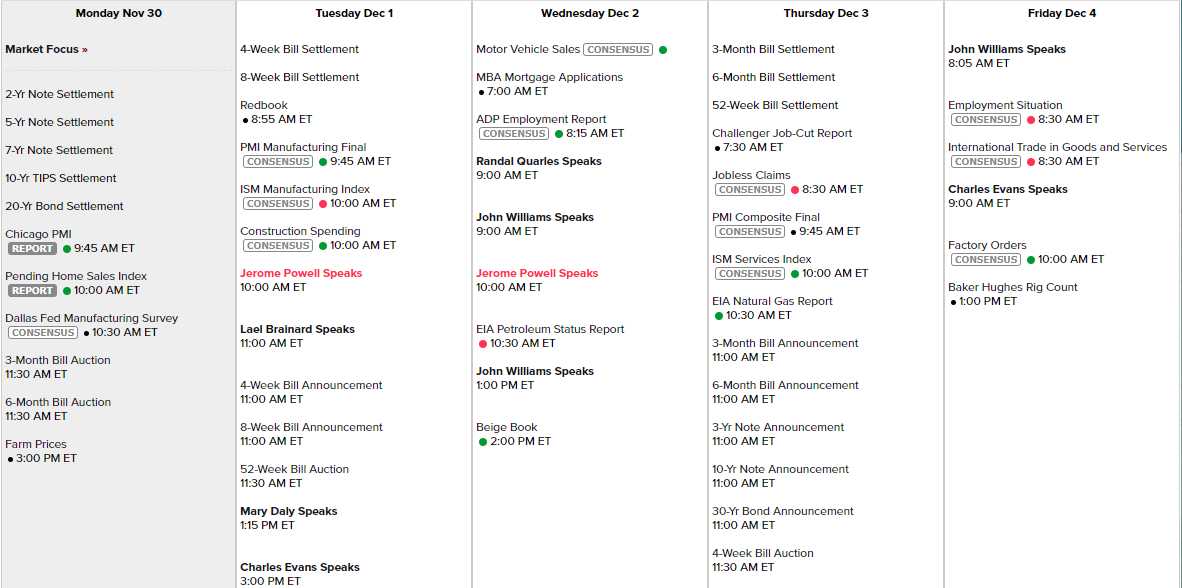

It's going to be a busy data week with Chicago PMI and the Dallas Fed this morning. Powell speaks to Congress tomorrow and Wednesday buffered by 8 other Fed speeches this week and tomorrow we have PMI, ISM and Construction Spending followed on Wednesday with Vehicle Sales, ADP and the Beige Book. Thursday we have PMI & ISM and Friday it's the Non-Farm Payroll Report along with Factory Orders.

After that, we can all lock ourselves down until New Year but then, unless a miracle happens, President Biden will probably lock us down again in Q1. What on Earth is there to be bullish about?

Of course the virus will be cured but that only gets us back to a NORMAL economy and this market is priced for Super-Normal, at least. If a guy who runs a 4-minute mile gets sick and is barely kept alive – when he gets better you don't predict he'll leap off the hospital bed and run a 3-minute mile, do you? Well, that's how they are pricing this market – as if we're going to fully recover in 30 days and fly into 2021 at a mile a minute.

It it a bird, is it a plane? No, it's bullshit….