MORE FREE MONEY!

MORE FREE MONEY!

That's what this economy is based on and that's what the people expect. The way we make money in America is by MAKING MONEY – literally printing it and giving it away like… money. I was going to say like candy but you can't create candy out of thin air so, if you tried to give away $6Tn in a year, you would go bankrupt and create sugar and labor shortages and even Bazooka Joe would run out of ideas for clever cartoons on the wrapper. But MONEY – that is created by simply flipping a switch at the Fed that adds another zero to the balance sheet.

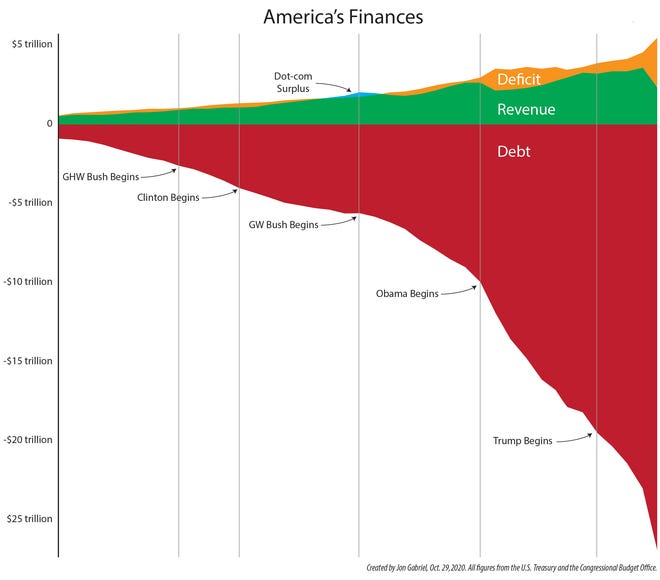

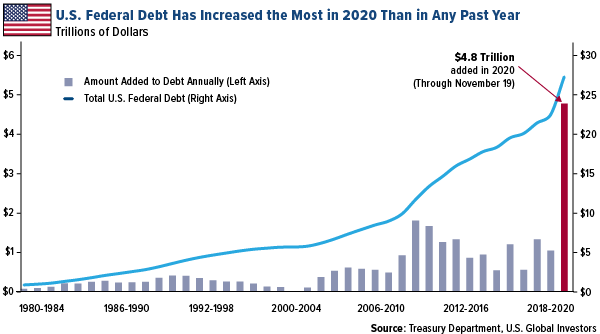

Since 2008, our National Debt has climbed from a shocking $8Tn to what is a now a "Who gives a f*ck anymore?" $27Tn and, whether now or next quarter, the market is execting AT LEAST $2Tn of additional stimulus and at least $2Tn of additional debt in 2021 (there's no way to stop Trump's fiscal-year budget now) so we'll be over $30Tn in debt by the end of Q1 – more than 150% of our GDP. How long do you think this can go on?

$19Tn of additional debt in 12 years is $1.5Tn per year, close to 10% of our GDP is debt financing and our GDP was $15Tn in 2007 and let's even pretend it's $20Tn now, that's up 25% in 13 years so 0.5% annual growth which means our REAL, unstimuluted GDP is FALLING but, thanks to 10% annual stimulus – we're fine, right?

And we are fine, as long as we never, ever, ever have to pay that money back. And we probably don't have to pay it back because it's not possible to pay it back so our lenders have to either accept this ongoing fantasy and keep lending us 10% of our GDP per year (30% this year) or put us in default, which would surely collapse the global economy. So party on boys – they can't touch us!

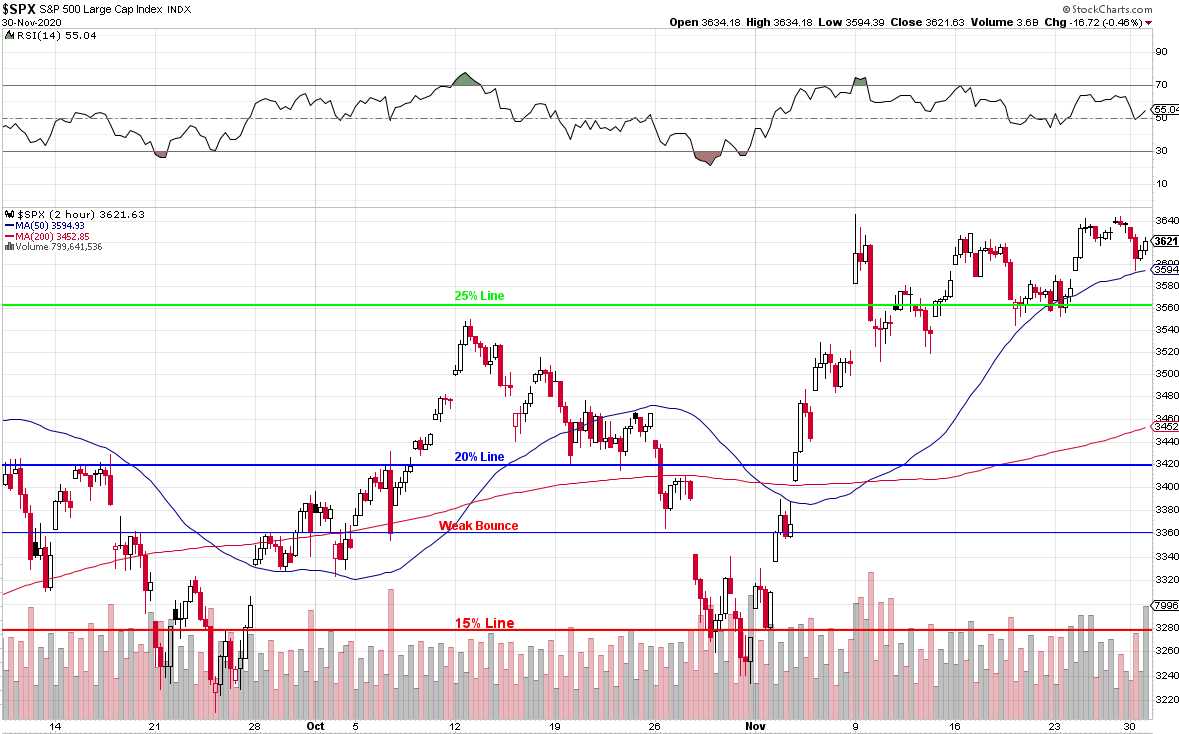

The markets are certainly celebrating this endless orgy of over-spending with the Futures more than reversing yesterday's little sell-off already. 3,640 was the previous top of the S&P channel and the S&P Futures are up 40 points this morning, blasting through that so, tempting though it may be, we can't short /ES until/unless it breaks back under that 3,640 line.

The markets are certainly celebrating this endless orgy of over-spending with the Futures more than reversing yesterday's little sell-off already. 3,640 was the previous top of the S&P channel and the S&P Futures are up 40 points this morning, blasting through that so, tempting though it may be, we can't short /ES until/unless it breaks back under that 3,640 line.

The S&P 500 is 66.6% above the March lows and that may seem like a sign to short but, taking a look at our 5% Rule™ Chart, it's the 30% line at 3,705 is the next major resistance but the 27.5% line at 3,634 is lined up as the place to watch for the moment. If we are on the way to 3,705 then 3,634 should not be much resistance but, if it is, then it's more likely we'll re-test the 25% line at 3,562 and that would be a very nice gain on /ES shorts from 3,640 – so there's the positive risk/reward ratio we like to look for.

Other than that, it's pretty much watch and wait into the holidays. We'll see what Powell has to say as he testifies to Congress this morning but mostly he's been saying they need to spend MORE MONEY as $6Tn in one year doesn't seem to be enough to get us back on track. Just gotta keep swinging and maybe one day we'll hit the ball?

- Trudeau to Raise Canada Debt Ceiling 57% to $1.4 Trillion.

- Beijing "Unexpectedly" Injects $30 Billion Into Financial System, Sparking Doubts About True State Of China's Economy.

See – everyone is doing it!

- Powell stresses importance of lending programs, calls economic outlook ‘extraordinarily uncertain’.

- Despite "Positive News" On Vaccine Front, The Outlook Remains "Extremely Uncertain" Powell Tells Congress In Prepared Remarks.

- JPMorgan Downgrades US Stocks To Neutral, Just Weeks After Hiking 2021 S&P Price Target To 4,500.

- California's Newsom Warns Of "Dramatic, Arguably Drastic" New Restrictions To Come As Hospitalizations Hit Record Highs: Live Updates.

?