Up we go again.

Up we go again.

Index Futures are up 0.666% and the Dow (/YM) is testing 30,000 again, which is a really good shorting line. We had fun shorting the Nasdaq (/NQ) at 12,500 yesterday into the close and it's back over it again this morning so it will be a lagger to the Dow if it crosses back below and also playable with tight stops above.

Why short? Because 30,000 on the Dow and 12,500 on the Nasdaq are good lines of resistance and likely to be rejected without an actual catalyst and everyone is already expecting Stimulus and more Fed Action so it's easier for bullish traders to be disappointed than rewarded.

The S&P, for it's part, is having trouble at the 100-hour (2-week) moving average at 3,666 (so also a good short on /ES) and has no real support all the way back to the 400-hour (2 month) moving average at 3,525. As this is a 2-hourly chart, these moves can be very quick. Most of the gains came in the first week of November, when the S&P popped 200 points on relatively low volume to 3,640 and we're pretty much still there a month later – that's not real strength.

.jpg)

At the moment (and it changes from moment to moment), we're looking at "just" a $748Bn spending package from Congress, which is nothing like the $2Tn package of March 27th but it should get us through Christmas before the issue has to be addressed again in the next Congressional Session (Jan 5th).

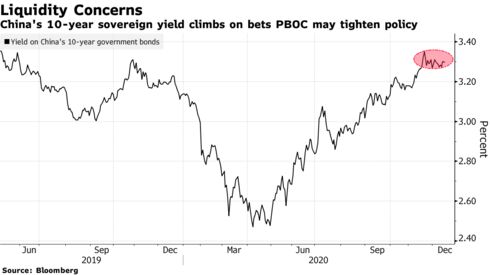

China is busy injecting cash into their banking system this morning as bonds roll over. The PBOC added $145Bn to offet 150% of December's maturing securities and that's 5 months in a row the PBOC has bailed out the banking sector this way. The need to buoy the amount of liquidity in the financial system has becoming more pressing after a spate of corporate defaults squeezed lending in China’s interbank market.

China is busy injecting cash into their banking system this morning as bonds roll over. The PBOC added $145Bn to offet 150% of December's maturing securities and that's 5 months in a row the PBOC has bailed out the banking sector this way. The need to buoy the amount of liquidity in the financial system has becoming more pressing after a spate of corporate defaults squeezed lending in China’s interbank market.

10-year rates in China have jumped to 3.33% and, if something like that were to happen in the US with our $27Tn debt levels, it would cost the Government $900Bn a year just to pay the interest on the debt (we are currently paying less than $300Bn) and that would blow an additional $600Bn annual hole in the Federal Budget. And the US is "only" 150% of its GDP in debt, a gauge tracking China’s level of debt has surged to 277% of the country’s gross domestic output.

Keep that in mind – it's not just the US's house of cards economy that's in danger of collapsing but the rest of the World is on very shaky ground after having borrowed and spent whatever it took (and is still taking) to fight the virus and stave off a Global Economic Meltdown. We are certainly not out of the woods yet!

Stock-market uncertainty runs high headed into Fed’s final meeting of 2020.

BofA Lists "Five Volatility Inducing Surprises" For 2021.

U.S. Deaths Surpass 300,000; London Faces Curbs: Virus Update.

Vaccine’s Initial Scarcity Leads to Tough Choices for Hospitals.

Pfizer negotiating with U.S. to provide an additional 100 million Covid vaccine doses, CEO says

Hotels Consider Requiring All Guests To Have COVID Vaccination.

Jim Cramer says stay-at-home trade is back on — ‘Lockdown is where we’re headed’.

More U.S. Homeowners Seek to Delay Mortgage Payments.

Doug Casey On What Happens When The Suspension On Evictions Ends.

Oil Holds Near $47 as Investors Weigh Lockdowns Against Vaccine

Semiconductor Analysts Bullish on 2021, But Valuation a Risk.

Another Paradox: Consumer Spending Expectations Surge, Despite Dismal Income, Earnings.

Google Outage Jolts Users Globally.

Government agencies, private companies secure networks, begin to assess damage from massive hack.

FTC Demands Data From Big Tech Companies.

AMC Entertainment’s stock plunges after disclosure of massive share-sale plan.

One Little Problem With The "All-Electric" Auto Fleet: What Do We Do With All The "Waste" Gasoline?