Holy cow!

Holy cow!

I mentioned the Dollar weakness the other day but we thought the 90 line was going to hold and we did have a very brief bounce but now we're looking terminal as that line fails to hold as well thanks to Wednesday's Fed Statement and Powell's press conference where they said they won't be changing their policy – even if the US Economy does improve.

While FREE MONEY FOREVER may be great for the stock market, it's not very good for the value of the currency those stocks are priced in and that too is then good for the stock market – how convenient! Dollar weakness also reflected rising expectations that Washington lawmakers will finally agree on an economic rescue package that’s seen as necessary to shore up a sagging recovery.

The Fed, in its last policy meeting of 2020, on Wednesday reassured investors the central bank would maintain its easy monetary policy stance, including its bond-buying program, until the economy shows “substantial progress” toward recovering from the damage inflicted by the virus. Fed Chairman Jerome Powell, in his news conference, indicated the central bank wouldn’t be hasty in unwinding its monetary stimulus measures even though the central bank’s economic forecasts appeared a bit more upbeat than previous iterations.

The Fed, in its last policy meeting of 2020, on Wednesday reassured investors the central bank would maintain its easy monetary policy stance, including its bond-buying program, until the economy shows “substantial progress” toward recovering from the damage inflicted by the virus. Fed Chairman Jerome Powell, in his news conference, indicated the central bank wouldn’t be hasty in unwinding its monetary stimulus measures even though the central bank’s economic forecasts appeared a bit more upbeat than previous iterations.

“The FOMC’s dot-plot looked hawkish…Mr. Powell’s comments were anything but,” wrote Kit Juckes, global macro strategist at Société Générale, referring to the individual rate forecasts produced by members of the policy-setting Federal Open Market Committee.

On top of Powell's comments, Congress does seem to be moving towards another $900Bn stimulus bill so the printing presses continue to fun at full speed as $900Bn may not sound like a lot these days but it's still 5% of an $18Tn economy – as our smallest stimulus of the year.

Your household budget would seem fine too if, every few months, someone dropped an additional 5% of your income into the checking account, right? And what possible harm could that do? It's just free money. Oddly enough, the same people who scream for more free money are the ones who think a Universal Basic Income would be wrong as it incentifies poor economic behavior – go figure!

Your household budget would seem fine too if, every few months, someone dropped an additional 5% of your income into the checking account, right? And what possible harm could that do? It's just free money. Oddly enough, the same people who scream for more free money are the ones who think a Universal Basic Income would be wrong as it incentifies poor economic behavior – go figure!

Since not many people are buying houses and money is free (for the rich), mortgage rates have hit their 15th all-time record low of the year, now averaging 2.67% for a 30-year mortgage. Much like the low Dollar inflates stock prices, low interest rates inflate home prices as people don't really buy a house – they buy a mortgage.

The monthly payment on a $500,000 loan at 2.67% is just $2,020 per month but here's the trap. You buy that $500,000 home but the taxes go up so if $2,020 was a stretch – it makes it hard to afford to stay there and then, when you go to sell your home and rates have gone up to 4.9%, it will cost your prospective buyer $2,654 a month to pay you for your $500,000 home – and they'd be buying a home with a higher tax base than you did. That then puts pressure on you to take a loss.

That's how free money now can lead to decades of problems later as we could end up with an affordability gap in housing and commercial real estate that can take a decade to unwind (these are 30-year mortgages). Also, when you buy home with a $500,000 mortage at 2.67%, what are the chances you'll be able to borrow by refinancing? Pretty slim. Even 1.67% would only drop you down to $1,767/month as most of your payment is principle, not interest – so there's not much effect from lower rates and 1% lower would be a Fed funds rate of -0.75% – they would be paying people to borrow money!

That's how free money now can lead to decades of problems later as we could end up with an affordability gap in housing and commercial real estate that can take a decade to unwind (these are 30-year mortgages). Also, when you buy home with a $500,000 mortage at 2.67%, what are the chances you'll be able to borrow by refinancing? Pretty slim. Even 1.67% would only drop you down to $1,767/month as most of your payment is principle, not interest – so there's not much effect from lower rates and 1% lower would be a Fed funds rate of -0.75% – they would be paying people to borrow money!

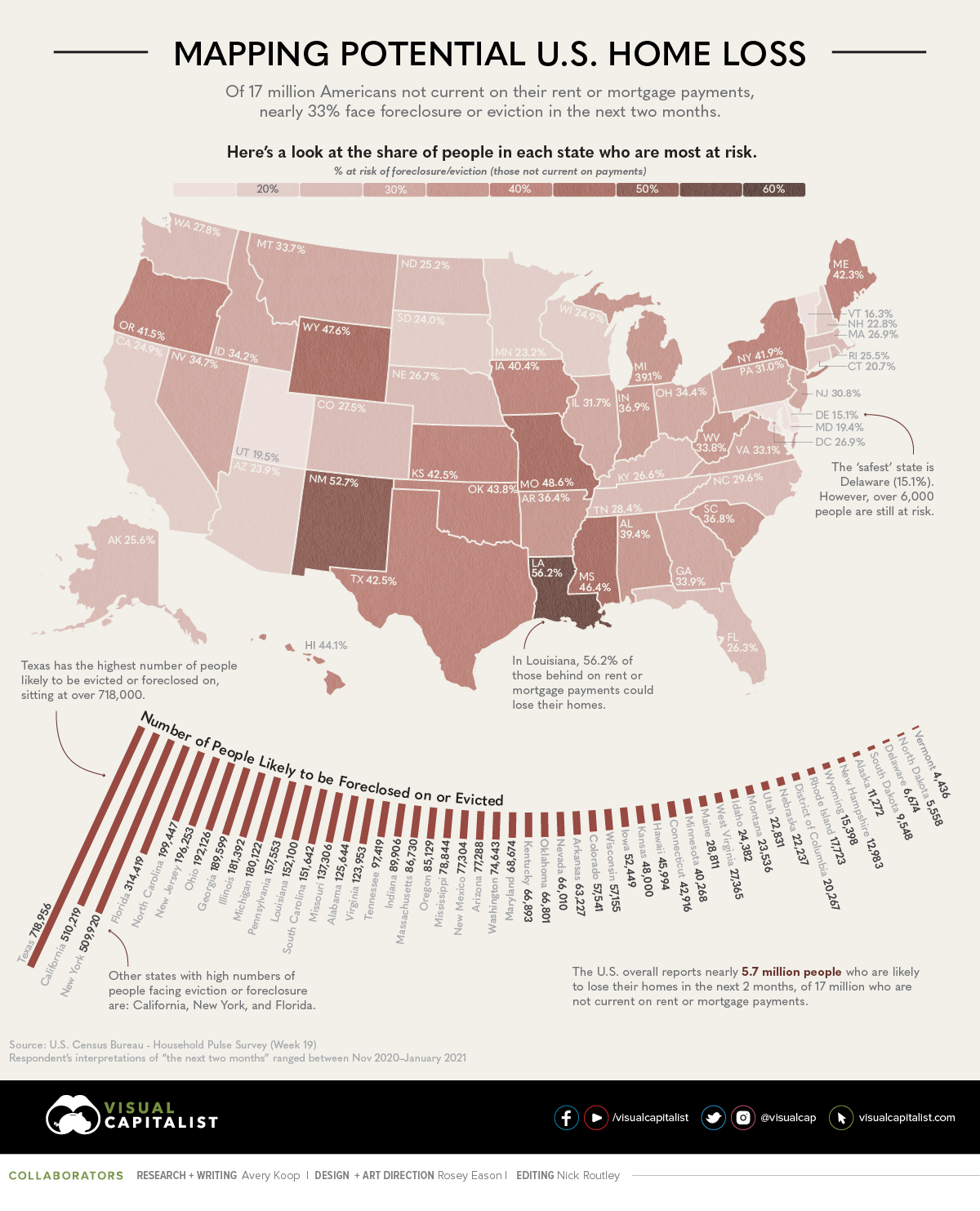

17M American homes are currently behind on their mortgages – about 15% of all homes. 1/3 of them are facing eviction in the next two months (60 days) if Congress does not act to help them. That's 17M families, about 50M people – facing homelessness in 60 days. Trump and his ilk are doing the same nothing about this as they are doing about the fact that 3,500 of those people died yesterday of Coronavirus. Oh well, right?

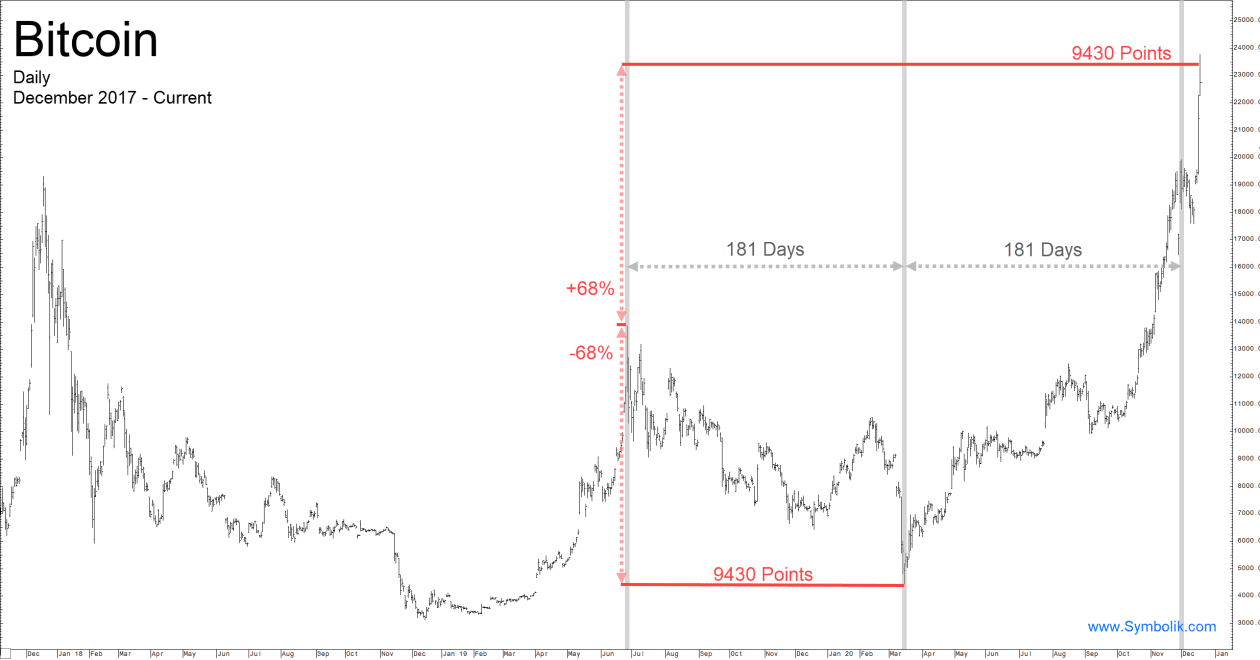

Meanwhile BitCoin has blasted over it's bubble high of 20,000, set back in 2017 and we're at $23,000 now because people around the World are losing faith in Governments and the Fiat Currencies they back. The ultra-weathly are starting to use BitCoin as a way to hide their money and there are only 21M possible BitCoins with 18.5M already mined and the last 2.5M getting harder and harder to create every day (as they were designed to be).

The rarity of the BitCoin coupled with the difficulty in creating new ones (unlike the Dollar) and the near-impossibility of counterfeiting them makes them a better currency than the rest that are out there but their lack of actual transactional use makes them a ridiculous currency substitute. For example, you know lots of people with BitCoins but have you EVER bought or sold anything with BitCoins? Then how is it a currency?

It's not a currency – it's a collector's item and it's in short supply with high demand so, just like beanie babies – it's a big fad and the prices are climbing to the sky.

So be careful buying houses, be careful with Bitcoins – I guess stocks are still the only place to put our money – as crazy as that seems as well. Speaking of crazy, Virginia State Senator Amanda Chase made headlines this week for publicly calling for Trump to invoke martial law so the military could hold a new election.

"Make no mistake. We are at war. The Democratic Party hijacked our 2020 Presidential Election and have committed treason. Where the hell are the Republicans? Did Dominion Voting Systems buy you out too? I hear nothing but crickets. If legislators, courts and Congress don't "follow the Constitution," the Virginia state senator said Trump should invoke martial law to allow the military to oversee a new "free and fair federal election."

It ain't over 'till the crazy lady sings.

Have a great weekend,

– Phil