Here we are again!

Here we are again!

Dow 30,404, S&P 3,735, Nasdaq 12,840, NYSE 14,405 and Russell 1,996. Not only did the new $900,000,000,000 stimulus bill get signed but IMMEDIATELY after that, President Trump teamed up wiith the House Democrats to pass an additional $1,400 per citizen (of Georgia) handout to help us pay those Christmas Credit card bills and decide who to vote for in Thursday's Senate Run-Offs.

One of my big concerns is there would be selling ahead of the end of the year but clearly that hasn't happened, possibly because most people's gains are too short-term to have consequences for timing long-term capital gains, which may increase significantly next year under Biden (especially if the Democrats win the Senate). That hasn't happened so there's no significant pressure to sell and the volume of trading is virtually none so it takes very little to manipulate the market higher and give 2020 a fantastic close – no matter what's actually wrong with the economy:

| Date | Open | High | Low | Close* | Adj Close** | Volume |

|---|---|---|---|---|---|---|

| Dec 28, 2020 | 371.74 | 372.59 | 371.07 | 372.17 | 372.17 | 38,851,900 |

| Dec 24, 2020 | 368.08 | 369.03 | 367.45 | 369.00 | 369.00 | 26,457,900 |

| Dec 23, 2020 | 368.28 | 369.62 | 367.22 | 367.57 | 367.57 | 46,201,400 |

| Dec 22, 2020 | 368.21 | 368.33 | 366.03 | 367.24 | 367.24 | 47,949,000 |

| Dec 21, 2020 | 364.97 | 378.46 | 362.03 | 367.86 | 367.86 | 96,386,700 |

| Dec 18, 2020 | 370.97 | 371.15 | 367.02 | 369.18 | 369.18 | 136,542,300 |

So, if things have seemed quite to you on the trading floor, that's because no one is there! Just a few bots doing some automated trading and some ETFs automatically putting people's paychecks into overpriced stocks at the end of each day – the market at its finest…

New highs on low volumes don't count – they are unproven and untested and often unrealistic but we'll have to wait a week or so before the traders come back to make real decisions and, by then, we should be getting reports of the holiday virus surge which will hopefully be couter-acted by positive vaccine results and a more concrete roll-out schedule. Meawhile, between now and next Tuesday, 15,000 more Americans will die from Covid – about 1/2 of the World's total deaths for the week – that's how disproportionately poor our handling of the virus has been!

New highs on low volumes don't count – they are unproven and untested and often unrealistic but we'll have to wait a week or so before the traders come back to make real decisions and, by then, we should be getting reports of the holiday virus surge which will hopefully be couter-acted by positive vaccine results and a more concrete roll-out schedule. Meawhile, between now and next Tuesday, 15,000 more Americans will die from Covid – about 1/2 of the World's total deaths for the week – that's how disproportionately poor our handling of the virus has been!

We are going to ring in the New Year in the US celebrating our 20,000,000th infection and we're going to honor it by carelessly gathering in large groups – isn't that special?

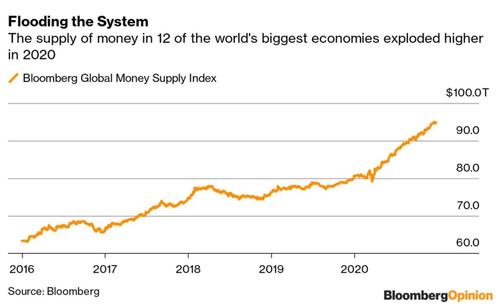

The only special number we have to worry about is $14Tn, that is the amount of money Central Banks have added to the Global Money Supply this year, up almost 20% from the 80Tn start. 20% more money and no inflation – that is very odd? Will we have a massive, inflationary boom next year or will it take another $14Tn next year just to fill the gaping hole that's been blown in the Global Economy by Covid?

The only special number we have to worry about is $14Tn, that is the amount of money Central Banks have added to the Global Money Supply this year, up almost 20% from the 80Tn start. 20% more money and no inflation – that is very odd? Will we have a massive, inflationary boom next year or will it take another $14Tn next year just to fill the gaping hole that's been blown in the Global Economy by Covid?

Stay turned and we'll see.