Greetings from Marco Island.

Greetings from Marco Island.

I'm still on vacation with the family, heading home tomorrow afternoon but I'll do my best to keep up with the market as we start the new year. It's only the other side of the state from where I live so we get sunsets at the beach instead of sunrises but it's just nice to be anywhere else for a few days as we approach a full year in quarantine.

This week will be dominated by the upcoming election in Georgia and good old President Trump is still trying to overturn the election, also in Georgia, where he's no in trouble for blatantly tampering in a recorded conversation with Georgia Election Officials which was, of course, full of lies and conspiracy theories. Don't worry though, Trump fans – as we know, Trump never actually faces any consequences for anything he does – he's just too cute to prosecute!

Judges across the country, and a Supreme Court with a conservative majority, have rejected nearly 60 attempts by Mr. Trump and his allies to challenge the results. “Look, they can do whatever they want,” said Senator Chuck Schumer of New York, the Democratic leader. “On Jan. 20, Joe Biden will be president and Kamala Harris will be vice president no matter what they try to do. I think they are hurting themselves and hurting the democracy,” he added, “all to try to please somebody who has no fidelity to elections or even the truth.”

BitCoin finally stopped going up over the weekend, dropping from $34,000 all the way back to $27,7000 before settling in at $31,000. I would point out that you can't realistically transact in a "currency" that swings 20% in a day but pointing out anything logical regarding BitCoin gets you in trouble these days so this is one I'm just watching from the sidelines.

BitCoin finally stopped going up over the weekend, dropping from $34,000 all the way back to $27,7000 before settling in at $31,000. I would point out that you can't realistically transact in a "currency" that swings 20% in a day but pointing out anything logical regarding BitCoin gets you in trouble these days so this is one I'm just watching from the sidelines.

"If we want to see some support zones on Bitcoin and expecting where we're going to move from, the first area is around $29,600, second area is around $27,600," Bitcoin analyst, Michael van de Poppe, said just before the major losses took hold. As Cointelegraph reported, statistician Willy Woo was unfazed on Sunday about a significant pullback, arguing that only a freak occurrence could take BTC/USD to $24,000 — the site of a "gap" in Bitcoin futures markets left from December. $27,700, meanwhile, fills the gap created on CME Bitcoin futures markets over the weekend, a classic move that had been absent from previous weeks.

The Futures are, as usual, up this morning but not very much and we start getting earnings this week, mostly on Thursday from good-sized names like BBBY, CALM, CCL, CAG, HELE, FIZ, MU and WBA, who were our runner-up for Stock of the Year for 2021 – so we'll be very interested in that report.

Earnings Season begins in earnest next week, when we hear from big names Thursday and Friday like BLK, C, DAL, FRC, JPM, PNC, SCHW, TSM and WFC so we'll see how that goes before we start placing our bets for the new year.

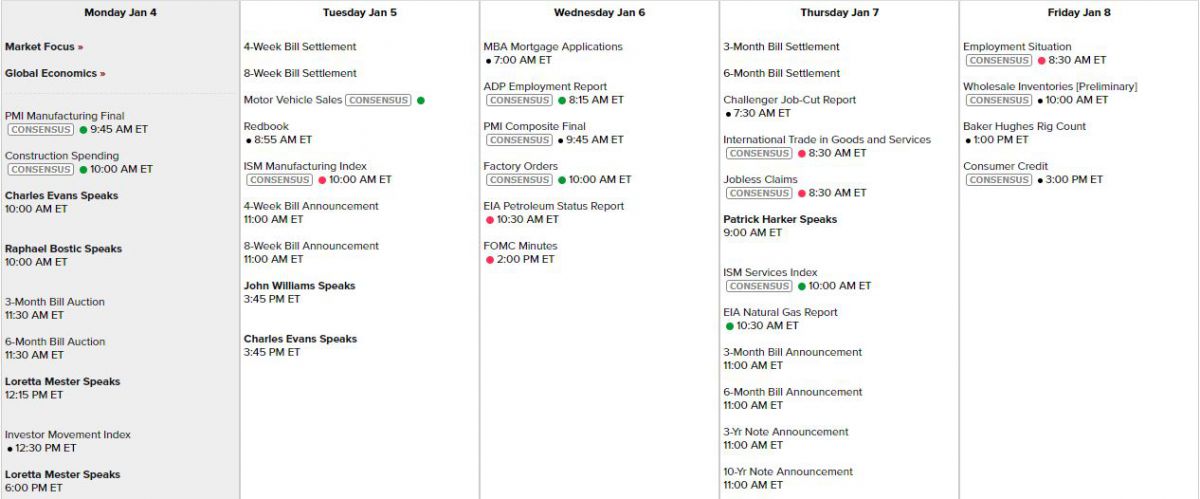

Fed Minutes are out on Wednesday and there's a lot of Fed Spin this week with 9 Fed speeches on the calendar. This morning we get PMI and Construction Spending, ISM tomorrow, PMI and Factory Orders with the Fed Minutes on Wednesday with ISM again on Thursday and Non-Farm Payrolls on Friday. Still, it's the Georgia Senate Elections tomorrow that decide the fate of the Nation for the next two years….

Other news:

- Welcome to the Era of Nonstop Stimulus.

- Investors Bet the ‘Everything Rally’ Will Continue.

- Double Stock-Market Bubble Brings Toil and (Perhaps) Trouble.

- Full Year-Ahead Calendar: All The Key Events In 2021.

- Trump to attend D.C. protests against Congress certifying Biden victory.

- Trump Rages "When In Doubt, Call It COVID" As Pressure To Clean Up Death Toll Mounts.

- ‘It’s a Desperate Time’: Crush of Covid-19 Patients Strains U.S. Hospitals.

- U.K. Bolsters Mass Vaccination With Oxford Shot as Covid Surges.

- How the American Mortgage Machine Works.

- Homebuyers Face Affordability Crisis, Worst In 12 Years .

- Breadlines Stretch Across America: This Economic Collapse Is Much Worse Than You Are Being Told.

- Startups Using SPACs Have Fewer Limits on Promoting Stock.

- China Oil Majors May Face U.S. Delisting After Telcos Cut.