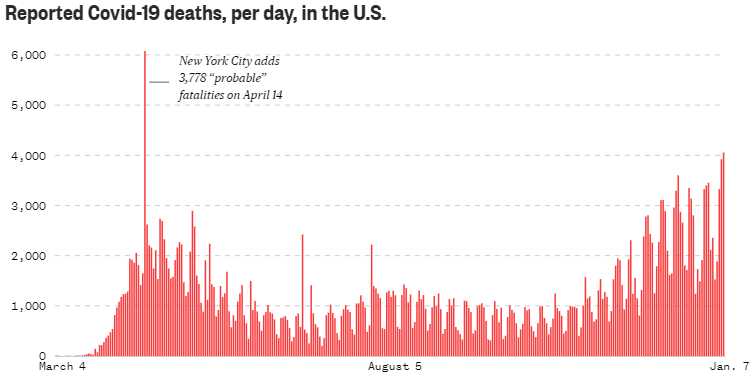

If this were a stock chart, what would you predict?

If this were a stock chart, what would you predict?

The only thing outperforming BitCoin and Tesla in 2020 is the number of people dying from the virus every day in the US and, just like the stock market, we are setting new records almost every day. Over 4,000 Americans died yesterday but we're too distracted by the revolution to keep the asshole in power who got us into this mess to pay any attention to the actual mess.

Certainly Donald Trump isn't paying any attention to the virus or the inept roll-out of the vaccine or the complete failure to provide PPE equipment to protect our people. None of this has been on his agenda and President Thanos will do whatever it takes to stop Joe "Iron Man" Biden from doing something about it. 365,000 people have died in the US so far from Covid-19 (yes, it's been a full year as it's now 21) yet, if 4,000 of them died yesterday, that's a pace of 365,000 in 91 days. So, at this pace – which is accelerating rapidly – as many people will die in the next 3 months as have died in the last 9 months.

So far, we have vaccinated 5M people in the first month and that's a bit less than 2% of the population so only about 50 months and we'll get to everyone. Since the vaccine doesn't stop people from spreading the disease – it will have very little effect on slowing the spread until about 1/3 of us are vaccinated which, at the current pace, will be mid-2022. Hopefully Joe Biden will do better than Donald Trump and, thankfully, Mitch McConnell will no longer have the power to stop him.

The market, meanwhile, does not stop going higher – no matter what happens. This is fantastic for those of us who own stocks but not very good for the rest of humanity, who are seeing the largest wealth gap in modern history grow away from them day by day.

The market, meanwhile, does not stop going higher – no matter what happens. This is fantastic for those of us who own stocks but not very good for the rest of humanity, who are seeing the largest wealth gap in modern history grow away from them day by day.

We're playing the S&P Futures (/ES) short at the 3,800 line – simply because it's a good percentage hedge over the weekend as the S&P 500 could easily drop 50 or 100 points for gains of up to $5,000 per contract and the Dow (/YM) Futures can be shorted at the 31,000 line with tight stops above and those pay $5 per point and the Dow has very little support back to 30,000 – also good for a potential $5,000 gain per contract on a pullback. The Nasdaq (/NQ) Futures are also a good short at the 13,000 line at $20 per point, per contract.

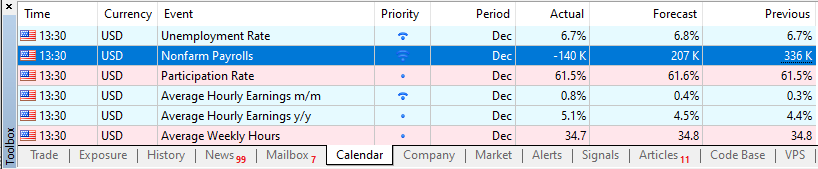

8:30 Update – No surprise at all that the Non-Farm Payroll Report is showing 140,000 jobs lost to mark the last month of the Trump Error. Our leading Economorons had forecase GAINS of 71,000 so they missed by less than 300%, which is pretty good for our economic experts. It's hard to imagine what planet these people live on as anyone who walks down a street or has friends or family who actually work at real jobs knows how rough it is out there for the average American – besides all the dying, I mean.

Of course more deaths and less jobs mean MORE STIMULUS, so we can't be sure how the markets will take these negative reports but I'll certainly feel better with some additional hedges in place over the weekend – just in case there's an attack of reality at some point. On the bright side, 135,000 jobs have been added to the prior 2 months but the trend is clearly not our friend here and it remains to be seen how much of a shot in the arm this second round of stimulus will provide.

A big negative that leading economorons may not notice is the 0.8% rise in average hourly earnings for those who are still working as that is a leading indication of inflationary pressure and also negatively impacts Corporate Profits and 0.8% is 4x what was expected and highly inflationary.

That's another factor in the upcoming Biden Presidency – an acceleration of rising Minimum Wages as well as a move back towards labor benefits like Health Insurance, Child Care, Pension Protection, Paid Leave, Safe Working Conditions… If you are a Republican, we will wait for you to finish throwing up….

Just when we thought we had rolled back all the Labor Progress our fellow Americans fought and died for over the last 100 years, here comes another Democrat to protect all those snowflake workers. Is it too late to storm the Capitol? Earnings have been pretty good so far with only Greenbrier (GBX), Acuity (AYI), Bed, Bath & Beyond (BBBY) and Lindsay (LNN) missing this week out of 22 reports. That's still almost a 25% miss rate but it's a small sample and not a disaster considering the state of things this year.

Earnings season begins in earnest next week and we'll look for clues in the guidance now that we finally know Joe Biden will be President with a Democratic Senate and a Democratic House. While the party may be over for Big Business – it should be just the boost the other 99% of the country needs to get America working again and maybe put a stop to all the sensless deaths caused by the negligence of the current Administration.

Have a great weekend,

– Phil