About 1/3 of the S&P 500 reports this week so there should be lots of opportunities for baragain hunting – unless, of course the earnings are not good and we finally begin to deflate this bubble market. This will be the first week in 4 years that there is likely to be more focus on the markets than the Government as the Government goes back to "normal" functions with a President who doesn't try to dominate the news cycle.

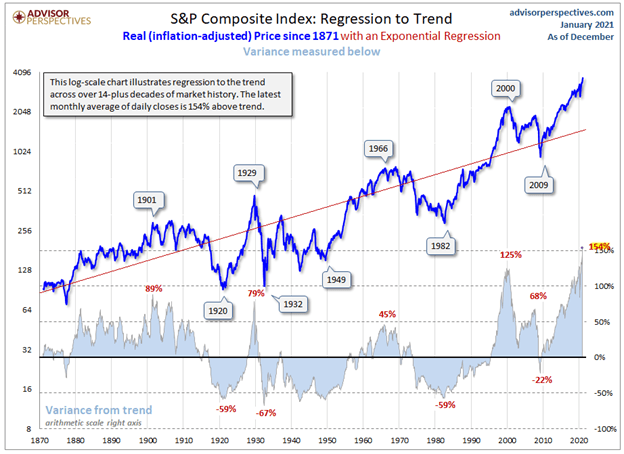

That shifts the focus back to earnings but one might wonder how earnings can possibly justify the sky-high valuations we have been giving most stocks in the past few years. According to Jill Mislinsky at DShort: "The peak in 2000 marked an unprecedented 129% overshooting of the trend – substantially above the overshoot in 1929. At the beginning of December 2020, it is 154% above trend. The major troughs of the past saw declines in excess of 50% below the trend. If the current S&P 500 were sitting squarely on the regression, it would be at the 1457 level."

154% above treand. That's a lot! While I don't see the S&P going all the way back to 1,457, I do see a 20% correction almost inevitable, back to about 3,000 and, while we may go higher, we'll still pull back at some point so 3,829 (this morning's open) is a very tough pill to swallow on the S&P 500.

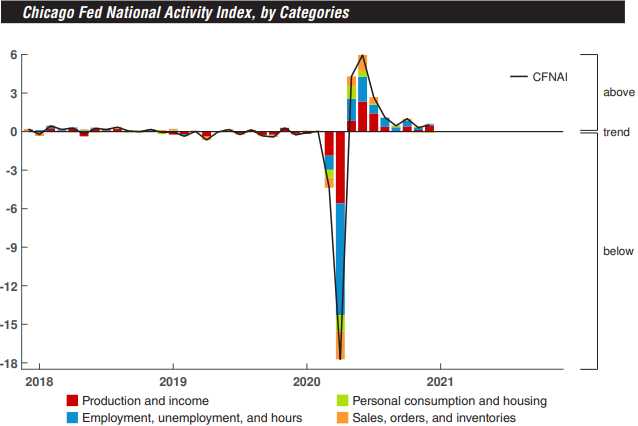

We do have a Fed Meeting on Wednesday and the Chicago Fed National Activity Index was in-line this morning but again, 20% of our GDP is stimulus and we are celebrating very slight growth – this is a very dangerous thing to get used to!

We do have a Fed Meeting on Wednesday and the Chicago Fed National Activity Index was in-line this morning but again, 20% of our GDP is stimulus and we are celebrating very slight growth – this is a very dangerous thing to get used to!

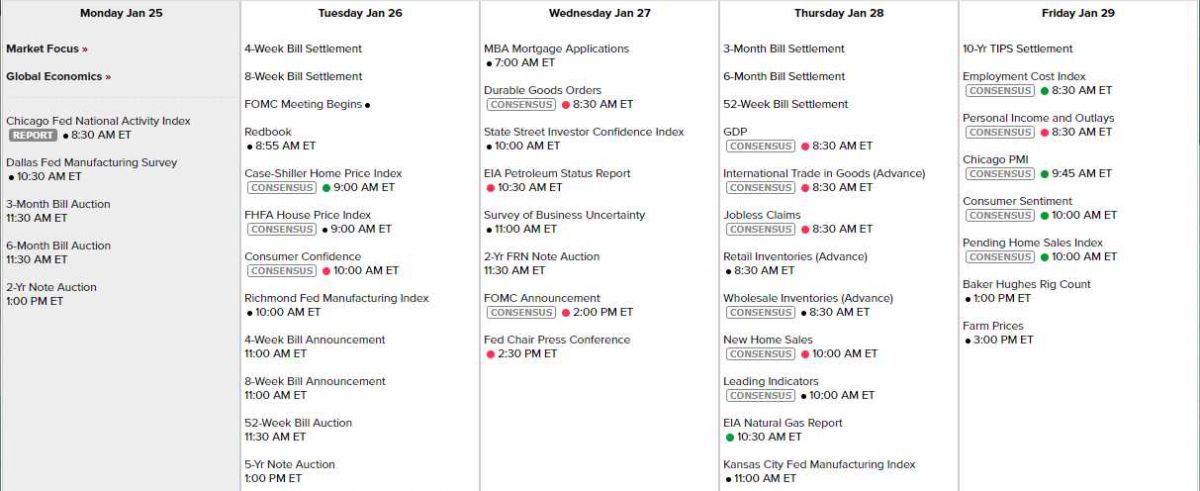

Dallas Fed comes out at 10:30 and tomorrow we get Home Prices and Consumer Confidence, Wednesday it's Durable Goods, Investor Confidence, Business Uncertainty and the Fed and then Thursday we have GDP, Retail Inventories (very important after Christmas), New Home Sales, Leading Economic Indicators and the KC Fed. Friday we finish the week with Personal Income, PMI and Consumer Sentiment – a very busy data week with NO Fed speak – other than Powell's press conference on Wednesday, of course.

What a great week to see how the market stands on its own, without all the political turmoil or endless promises of MORE FREE MONEY. Will we get through the week still holding these lofty levels? Stay tuned to find out…

- Fed Takes U.S. Fiscal Temperature in New Era of Biden: Eco Week.

- Pandemic-Era Central Banking Is Creating Bubbles Everywhere.

- Emerging Markets Gripped by Greed Now Turn to Fed for Fresh Spur.

- Bullish Stock Bets Explode as Indexes Keep Hitting Highs.

- Morgan Stanley Asks What To Do About All This Optimism.

- Goldman's Clients Are Freaking Out About A Stock Bubble: Here Is The Bank's Response.

- China surpasses U.S. as largest recipient of foreign direct investment during Covid pandemic.

- Iraq to Lower Oil Production to Compensate for OPEC Breach.

- Saudi Exports Dropped in November, With Oil Revenue Down 40%.

- Covid-19’s Financial Toll Mounts on Homeowners.

- The U.S. is racing to adapt against new Covid strains, says Biden surgeon general pick.

- Companies are racing to build digital passports for people to prove they’ve had the Covid vaccine.

- Americans Are Fleeing Lockdowns, When They Can Afford It.

- Manufacturing Rebound Has Suppliers Struggling to Keep Up.

- On the 100th Anniversary of ‘Robot,’ They’re Finally Taking Over.

- Ray Dalio: "We Are On The Brink Of A Terrible Civil War".

- Is The Dis-Uniting Of America Now Inevitable?

- Competitive Currency Debasement 101 Class Is In Session.