What a ride.

What a ride.

GameStop (GME) went from $75 to $483 to $112 and now $335 pre-market and it's like watching a ball bounce around a roulette wheel at the moment except, at least on a roulette wheel – the numbers fall within a particular range. This, on the other hand, IS CRAZY!

But it's also a great lesson in valuation as, clearly, the business of GameStop hasn't changed this week and even the perception of the value of GME hasn't changed this week ($100 is a stretch) but the SENTIMENT has been all over the place, hasn't it?

The GME debacle is nothing more than what goes on every day in the markets but this is a close-up look at what happens in high-speed mode with running commentary from 1,000 analysts trying to dissect every move (I'll be on Bloomberg at 11 am, in fact). What's fascinating about GameStop is that, rather than Wall Street Criminals manipulating the stock, ordinary traders are now doing it. If we allow ordinary traders to manipulate stock prices, how will Goldman Sachs make money? And if "Government Sachs" can't make money – Congress springs into action. When this guy does it, they just yawn:

Let's keep in mind that, for 20 years, Jim Cramer, a self-confessed market manipulator, has gotten on TV and told his army of followers to BUYBUYBUY or SELLSELLSELL stocks every day and, very clearly, they do exactly that at the open the next morning. Not one investigation has ever been launched yet the moment some ordinary traders do the same thing – CONGRESSIONAL INVESTIGATIONS!

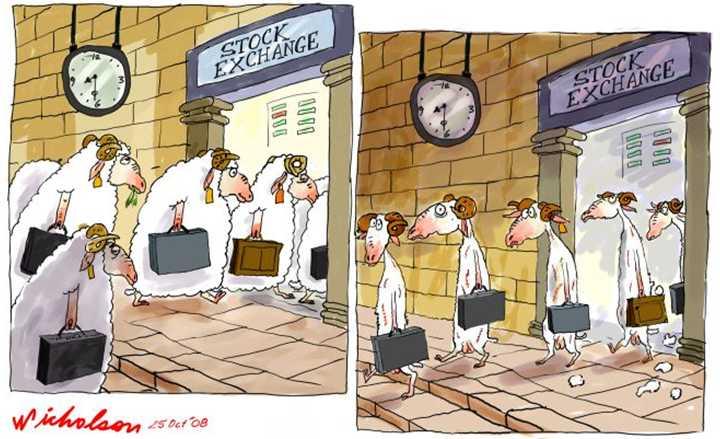

That's because Jim Cramer works for the elites, sending the beautiful sheeple into the slaughterhouse for the benefit of his Wall Street buddies but the second the sheep object and try to take matters into their own hands, the Wolves of Wall Street cry FOUL! and beg the SEC to step in and stop the madness. Even our brokers turn against us because we retail invesors are nothing compared to the hedge fund money that drives their revenues.

That's because Jim Cramer works for the elites, sending the beautiful sheeple into the slaughterhouse for the benefit of his Wall Street buddies but the second the sheep object and try to take matters into their own hands, the Wolves of Wall Street cry FOUL! and beg the SEC to step in and stop the madness. Even our brokers turn against us because we retail invesors are nothing compared to the hedge fund money that drives their revenues.

“The longer you’ve been around, the more you realize that something like this is less a massive break in the functioning of markets and more a reflection of risks that were always there,” says Michael Cembalest, the chairman of market and investment strategy at JP Morgan Asset Management. Manias have been parts of markets for centuries. So have short squeezes. And in this case, the hedge funds betting against GameStop might have received just deserts for a really dumb bet.

All this excitement has helped the first month of 2021 just fly by and, before we know it, it will be September and we'll all have been vaccinated (hopefully) and the virus will not have mutated enough to re-infect us anyway (hopefully) and the economy will recover (hopefully). So we have that to look forward to.

Have a great weekend,

– Phil