-

Best Buy Is Cutting Some Store Workers’ Jobs, Reducing Hours

Best Buy Is Cutting Some Store Workers’ Jobs, Reducing Hours

- Uber’s Food-Delivery Business, Cost Cuts Cushion Pandemic Hit

- Biden Administration Says Schools Have Reopened If They Are Open One Day a Week

- How Germany Lost Control of the Virus

- Restaurant Brands falls 2% after Tim Hortons drags on results

- Seadrill files for Chapter 11 bankruptcy, second time in four years

These are not the headlines for a record-high market.

Best Buy isn't cutting jobs because the 2nd quarter is going to be fantastic, are they? The Biden Administration isn't cutting school expectations because everything is going to be normal after the Summer break. The virus isn't resurgent in Germany because it's about to go away, Seadrill isn't going Bankrupt again because the oil industry is rebounding.

At what point do we plan on getting realistic? We don't have to because Uncle Sam keeps writing checks and everything is awesome until the money runs out (and maybe it never will). Meanwhile, we're being asked to pay record-high prices for stocks based on future expectations that everything will remain awesome for years so come and will, in fact, get much better because, currently, we're paying 30-40 times the earnings potential of these stocks. That means it will take 30-40 years for those companies to generate a return on our investment – AWSOME!

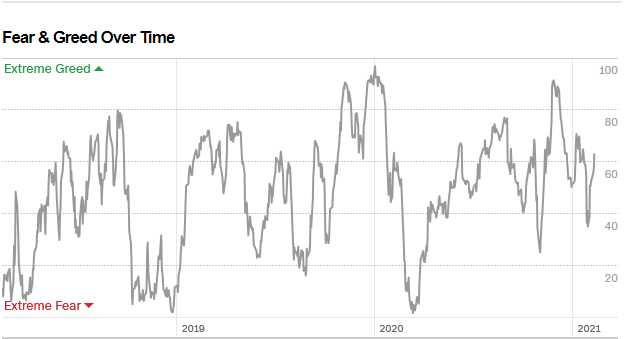

That means people are either buying stocks with irrational expectations or they are rationally using them solely as trading vehicles and have no intention of being long-term investors. To the extent that is true, market sentiment can turn on a dime and, if it does and if there are no fundamental investors to underpin the stock prices – what is going to happen when that sentiment changes?

That means people are either buying stocks with irrational expectations or they are rationally using them solely as trading vehicles and have no intention of being long-term investors. To the extent that is true, market sentiment can turn on a dime and, if it does and if there are no fundamental investors to underpin the stock prices – what is going to happen when that sentiment changes?

The change in sentiment in February led to a 35% correction in the market and it could have been worse but the Government quickly stepped in with FREE MONEY and, since then, we've been promised MORE FREE MONEY over and over again and, though we are still waiting for it – it does seem very likely that it will be here in a few weeks. March's FREE MONEY led us to a very nice market recovery and promises of FREE MONEY have kept things going but, at some point, we need to get the actual economy working again for all this to have a lasting effect.

4,000, if we get there on the S&P 500 (/ES), is going to be a great shorting line as it's almost certain to be rejected on the first attempt. If we measure the rally off the break over the 200-day moving average at 3,000, it's a 33%, 1,000-point run that should pull back at least 200 points (weak retrace) and possibly 400 points, back to the 3,600 line – which has already shown signs of consolidation (indicating it is, indeed, significant support/resistance).

SDS is the Ultra-Short for the S&P 500 and the March $11 calls are 0.65 and SDS is at $11.30 so you are paying an 0.35 premium for the position but SDS is a 2x short on the S&P so, if it does drop 20% in the next 36 days, that would pop SDS 40% – to $15.82 and the $11 calls would be $4.82 in the money for a gain of $4.17 or 641%.

So, if you have a $100,000 portfolio and you are worried about losing $20,000 on a 20% S&P drop, you can mitigate that loss by buying 50 of the calls for $3,250 and they will pay $20,850 in profit at $15.82 and, if you put a stop on the short position at 0.40, you limit your loss to 0.25 x 50 contracts – $1,250 – not a big price to pay for insurance over the holiday weekend!

Be careful out there!