That's how much the M2 Money Supply has grown (26%) in the past 12 months (vs around 5% in a typical year) and it's going to grow another $4Tn this year as the Fed continues their easing policy. This is the biggest growth since 1943, when war-time Money Printing was all the rage. The looming danger for the economy isn’t only that the monetary printing presses have been in overdrive since the pandemic began, but also that they are already set for the same in 2021. A monetary surge for this year is locked in.

This is like giving kids an extra piece of candy the day after Halloween – it doesn't change anything, you're not going to get much of a reaction and the effort is probably wasted….

It’s worth tallying the list of policy measures that got us where we are. The first and largest source of M2 growth in 2020 was the Fed’s purchases of Treasurys and mortgage-backed securities. When the Fed buys such securities from nonbanks, which is its normal practice, it gives the seller a check or payment, credited to the seller’s bank deposit account. This increases M2. Since March 2020, the Fed’s holdings of Treasurys and mortgage-backed securities have increased by almost $3 trillion. M2 has increased by roughly the same amount.

The second largest source of M2 growth has been commercial bank purchases of short-term Treasurys and other debt securities, including mortgage-backed ones. These transactions create deposits in the same way as new loans do, with the deposit account of the seller or borrower being credited. Since the start of the pandemic last year, the increase in banks’ holdings of these assets has added almost $1 trillion to deposits and, therefore, to M2.

The U.S. money explosion isn’t over. Bank reserves, currently $3.2 trillion, will increase by about $1.4 trillion this year simply from Fed purchases of Treasurys and mortgage-backed securities at a promised $120 billion a month. In addition, the Treasury indicated in its February Refunding Statement that it will run down its Treasury General Account at the Fed by about $820 billion this year. This money will be spent through federal fiscal programs. These expenditures will further boost deposits counted in M2.

The U.S. money explosion isn’t over. Bank reserves, currently $3.2 trillion, will increase by about $1.4 trillion this year simply from Fed purchases of Treasurys and mortgage-backed securities at a promised $120 billion a month. In addition, the Treasury indicated in its February Refunding Statement that it will run down its Treasury General Account at the Fed by about $820 billion this year. This money will be spent through federal fiscal programs. These expenditures will further boost deposits counted in M2.

Of course we're setting ourselves up for an inflationary nighmare – as Dr. Seuss pointed out the last time the Government was on a money-printing spree (he was a political cartoonist) – all this money-printing is bound to lead to inflation and inflation always seems like fun at first – but then it can turn ugly very quickly!

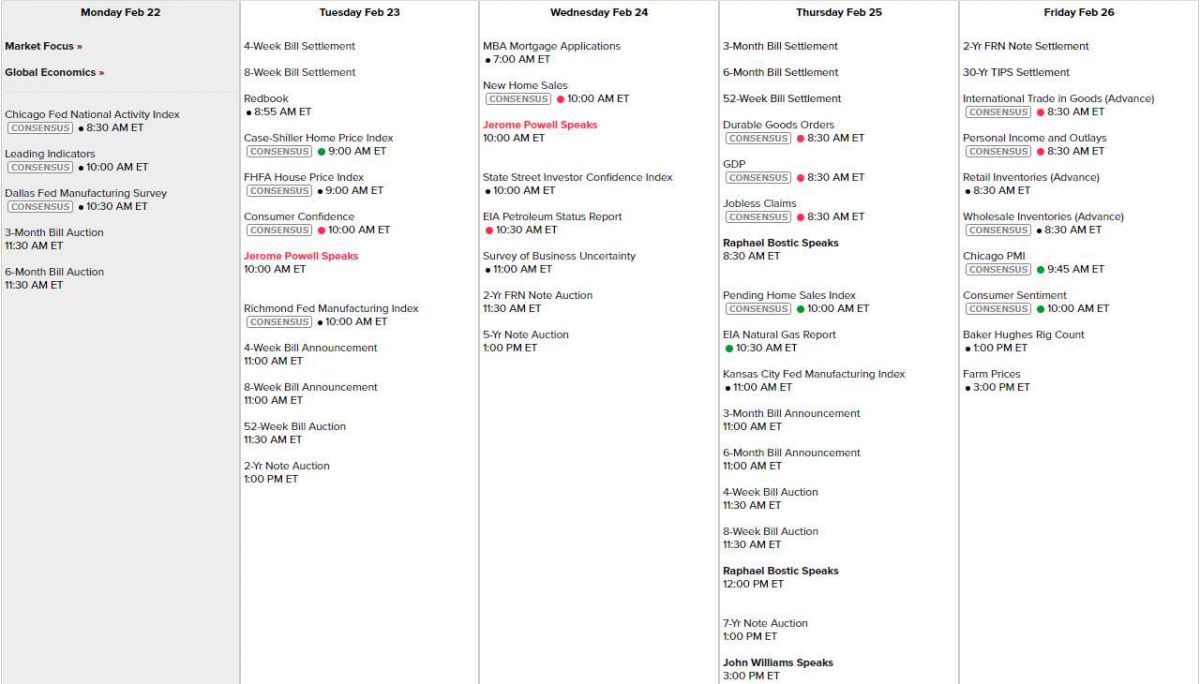

We had a lot of inflationary data last week and we're right back into it with Leading Economic Indicators this morning at 10am. Tomoorow we get the Home Price Index and Consumer Confidence, followed by New Home Sales and Investor & Business Confidence Wednesday, Durable Goods and GDP (2nd estimate) Thursday and Friday we have Personal Income & Spending to go with PCE Prices, the Chicago PMI and Consumer Sentiment.

Powell testifies to Congress tomorrow and Wednesday though, so we could be right back on the FREE MONEY train by mid-week.

Investors’ bets on an economic rebound later in the year have contributed to a selloff in U.S. government bonds in recent weeks. Declining bond prices result in rising yields, which have stoked concern that highflying stocks are starting to look less attractive than assets considered to be risk free.

Investors’ bets on an economic rebound later in the year have contributed to a selloff in U.S. government bonds in recent weeks. Declining bond prices result in rising yields, which have stoked concern that highflying stocks are starting to look less attractive than assets considered to be risk free.

“As the yield goes up, there is more demand for [government bonds] in relation to other assets,” said Hani Redha, a portfolio manager at PineBridge Investments. “How much are you willing to pay for stocks? If you’re only getting a very low yield from bonds, you should be willing to pay a higher amount for stocks. But that starts to change when bond yields go up.”

Boeing (BA) has another grounding this morning, this time it's the 777 jets as one of them had an engine explode on Saturday. Fortunately they were able to land the plane. That will take a bite out of the Dow and S&P 500 and we'll see what the effect is on Boeing, who can ill-afford more problems just when they are getting the 737 flying again.

Which reminds me. They are now requiring Covid tests to travel and XpressSpa (XSPA) runs those little mini-Spas in Airports and that has been a bummer for them but now CEO Doug Satzman has made a brilliant pivot and the company (since it already has clearence and staff for most airports) will now become a testing center for pre-flight screenings. In addition to rapid tests, the "Travel Ready Center" also offers PCR or antigen tests. The centers are so far available in Newark, San Francisco and LAX airports, with plans to expand.

XSPA has a $232M market cap at $2.47 on $50M of pre-Covid revenues and a $20M loss. It's a dicey investment but the Jan $1 calls are $1.60 and the $3 calls are $1 so we can pick up the Jan $1/3 bull call spread for net 0.60 with a $1.40 (233%) upside and we're starting out $1.47 in the money so let's buy 50 of those for our Future is Now Porfolio and see if we can make $7,000 to pay for those spa treatments while we're waiting for our test results.