10M jobs.

10M jobs.

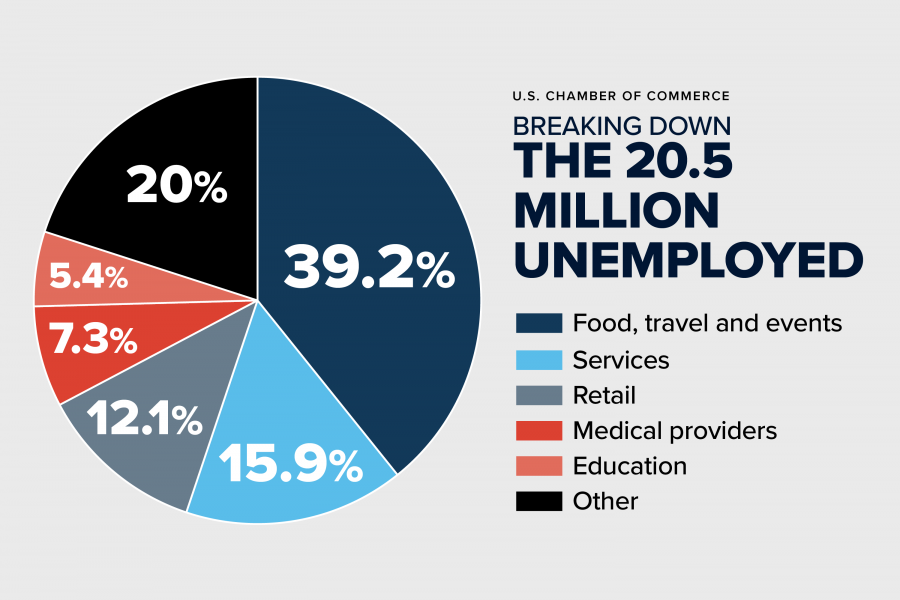

That's how many jobs we need to make up just to get back to where we were, which still wasn't full employment. Let's say those 10M people made an average of $50,000 per year so that's $500Bn in wages lost and wages are generally less than 1/3 of revenus so that's $1.5Tn (7.5%) of our $20Tn economy still lost in the pandemic, reflected JUST in those 10M wageless people. Add that to the overall slowdown in the rest of the economy and you can see why "maximizing employment" is what the Fed is all about. The economy is all about putting people to work and I know you are trained to think PRODUCTIVITY will save us but Q4 productivity was DOWN 4.2% – the worst drop in 39 years (1981).

Hours Worked for those who still have jobs were down 10.1% from Q4 2019 but Unit Labor Cost was UP 6%, meaning it was costing more money to get the same amount of productivity from the workers. Why is that? Working at home is slightly less efficient and the supply chain is a total disaster, which causes parts and material shortages so, if you show up at the factory to make a car but there are no tires…. well, you are not going to be as productive, are you?

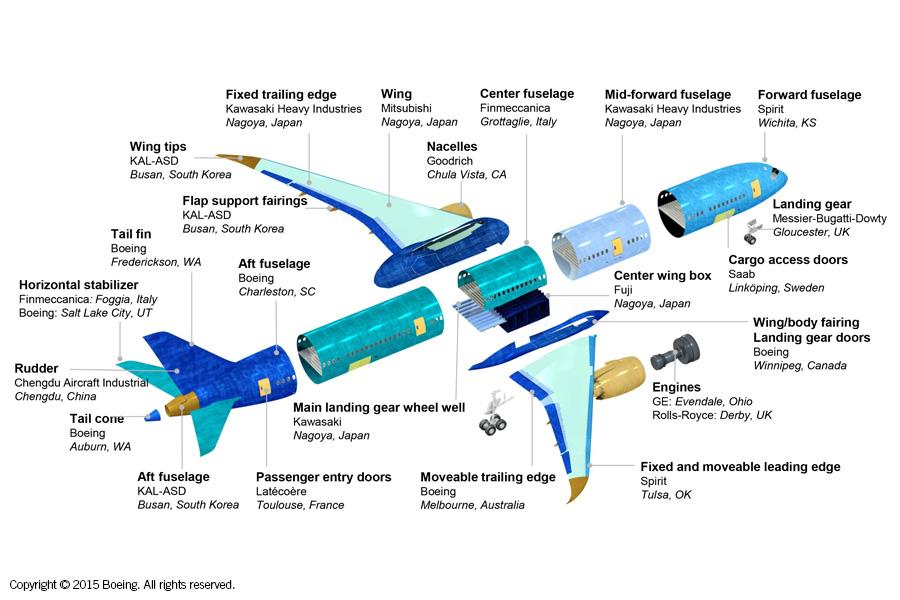

Of course, it doesn't have to be a whole tire that stops you from making a car, just missing a lug nut or that little thing where you put the air in can stop you from making the whole car. Right now it's chips that are causing the biggest problems across many industries – you can't make most products without microchips these days. So the whole World has to be healthy in order for our economy to be healthy – just putting America First doesn't get you into first place.

Looking at the Boeing plane, for example, if any plant from any of their 100s of global suppliers is shut down or disrupted – the whole plane won't fly. This is a Global problem and we keep applying Regional solutions to it – that's a mistake. Globalization is how we got to have a $20Tn GDP, going back to 100% US-made would send our economy back to the stone age and take many years to accomplish even if we had the materials locally to accomplish that goal.

So we're starting to see where that $9Tn in stimulus went last year. There were more like 20M people unemployed for half the year so that's about $3Tn and we made the Top 666 people in this country $1Tn richer and productivity is down 10% and that's $2Tn and $1Tn went to fake economic growth and the rest went into the money that was sent to the rest of us ($1Tn) and, of course, pumping up the market used up the rest.

That's why we need another $9Tn this year. First of all, the 666 MUST have another Trillion – that's not even up for discussion. We're still losing $1.5Tn from the people who are still unemployed and growing the economy 5% is another $1Tn and the Government needs to borrow $2-3Tn and we still need to prop up the stock market. No wonder Powell had trouble inspiring confidence yesterday – even though he said all the right words.

8:30 Update: 379,000 jobs were added in February and that's just a drop in the bucket but it's a lot better than last month, which has now been revised from 44,000 to 166,000, which is why all these reports are nonsense anyway but this one will be taken as a positive by the markets so now we'll see how much of a bounce we get off this news.

8:30 Update: 379,000 jobs were added in February and that's just a drop in the bucket but it's a lot better than last month, which has now been revised from 44,000 to 166,000, which is why all these reports are nonsense anyway but this one will be taken as a positive by the markets so now we'll see how much of a bounce we get off this news.

Keep in mind, at this pace, it will only take 2.5 years to get back below 4% unemployment. As Powell said yesterday at the WSJ Jobs Conference (and he had these numbers) "We're still a long way from our goals." Nonetheless, the 10-year Treasuries extended losses and inflation expectations reached new session highs as Powell spoke, with some traders disappointed that the Fed chair didn’t provide any specifics on what the central could possibly do to tamp down long-term rates if they desired.

In a note to clients, Krishna Guha, vice chairman at Evercore ISI, had this to say about the Fed chair’s performance: “Powell stays dovish but not dovish enough to prevent further increases in yields.” The Fed has said it will keep short-term interest rates pinned near zero until the labor market has reached maximum employment and inflation has risen to 2% and is on track to moderately exceed that level for some time. What else can they really say? As I've pointed out recently – the Fed is out of firepower but traders need MORE FREE MONEY to sustain these completely irrational market valuations that assign unrealistic growth projections across the board. Anything less than MORE is not enough.

The S&P has fallen 5% from 3,950 to 3,750 in the past 3 weeks so we'll be looking for a weak bounce of 40 points (20% of the drop) back to 3,790 at least and the strong bounce is 40 points over that at 3,820 – that's the real line to watch – especially as it's also the 50-day moving average (not a coincidence). If it fails and the weak bounce fails – then we are lilkely to head lower next week (the 200-day is 10% below us) but if the weak bounce, at least, holds for the session, then we have a good chance of making more progress next week.

Have a great weekend,

– Phil