Still going up – kind of.

Still going up – kind of.

Sure we posted a record high on Friday, with the S&P closing at 3,943.34 but we hit 3,950.43 on Feb 16th (right after the holiday, when it was super-slow) but we were also hitting the 3,930s the week before and the week after so, unless we are going to sustain this level for a couple of weeks – this could be the double top to the rally we've been waiting for. Biden is coming on TV at 1:45 to discuss all the exciting ways we can spend $1.9Tn but that gift has been given – "What have you done for us lately?" is the question the markets will ultimately be asking.

There's a Fed meeting this week and we're very unlikely to get "good" news out of that as the Fed is already doing all they can and more to keep the money flowing. They've already said they'll do that essentially forever but yesterday I scraped my leg while bike riding and WHERE WAS MOM? She said she'd "always" fix my boo-boos but she didn't – just another broken promise by the power-brokers!

I don't love Mom any less for enjoying her retirement but how are we going to feel about Jerry Powell when he tells us to grow up and fix our own boo-boos? Trump completely freaked out when Powell said he wasn't going to do more for the economy and that was what seemed a lifetime ago (remember when Donald Trump was our President – or was that just a bad dream?).

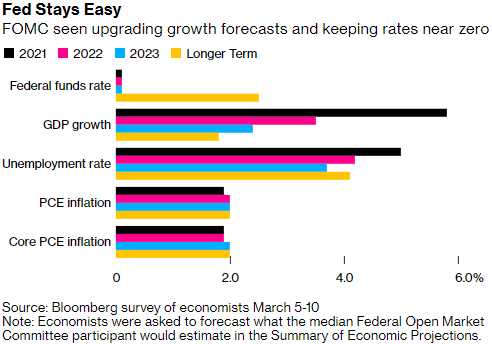

Not even the most dedicated dead-heads will be chanting "Jerry" when Powell turns off the spigots but the real focus this week will be on the Fed's Economic Forecasts, which Bloomberg leading Economorons predict will show 5.8% GDP Growth this year. That is possible as we DECREASED by 2.3% in 2020 so up 5.8% is net 3.5% growth since 2019 or, essentially, back to our normal(ish) around 2% annual growth – and it only cost us $9Tn (50% of our GDP) to do it!

Not even the most dedicated dead-heads will be chanting "Jerry" when Powell turns off the spigots but the real focus this week will be on the Fed's Economic Forecasts, which Bloomberg leading Economorons predict will show 5.8% GDP Growth this year. That is possible as we DECREASED by 2.3% in 2020 so up 5.8% is net 3.5% growth since 2019 or, essentially, back to our normal(ish) around 2% annual growth – and it only cost us $9Tn (50% of our GDP) to do it!

Unemployment is projected to persist around the 5% mark and inflation is projected to be contained unless, of course, you bought a tank of gas this weekend for $75 – then maybe you are thinking these economic forecasts are simply BS that have little or no link to reality.

Powell has said the economy isn’t close to achieving the necessary progress to trigger a shift in bond buying and that he will signal any tapering well in advance. That isn’t seen happening until 2022 in the view of a narrow majority of economists. Most of the surveyed economists also don’t expect any near-term change, such as a shift to buying long-term Treasuries. The Fed is certainly concerned about the yield-curve but, so far, they are determined to convince us it's a short-term problem. The way they did in 2007 – that was so helpful, wasn't it?

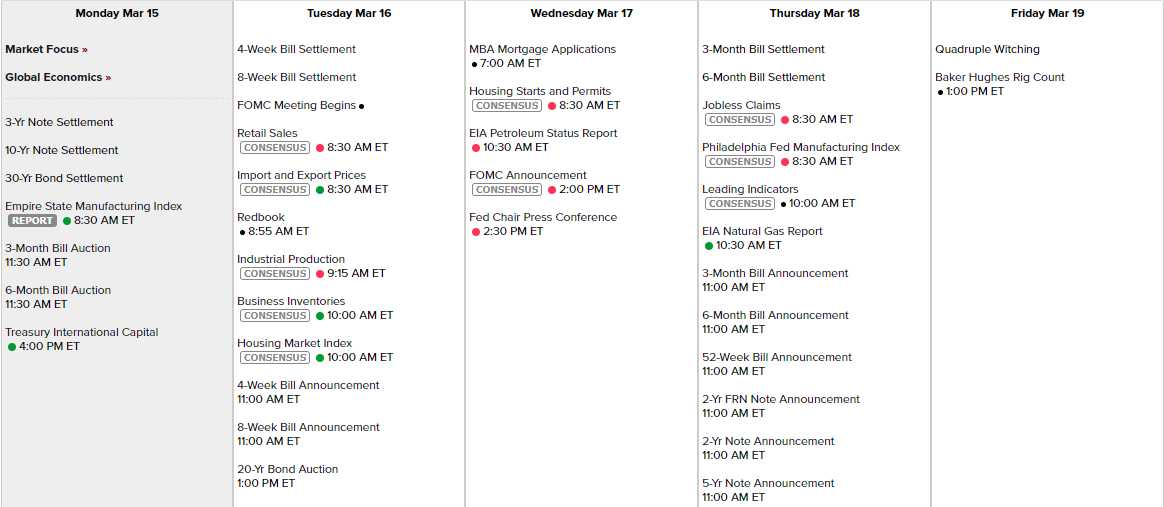

Other than the Fed, there's not a lot of data this week, even though it's a Quad-Witching Friday as we wrap up the quarter (from a market perspective) and our oil shorts should be paying off this week as we're done with the catalysts (see Thursday's Report).

There are still quite a lot of companies reporting earnings too: