Up and up we go.

Up and up we go.

It's truly amazing that the Nasdaq has actually doubled off the March lows and it only fell 30% in March so we're up almost 50% from our pre-pandemic levels and was Trump really that bad for the economy that his policies were holding the market back from a 50% gain at the time?

Much as I disliked Trump and his policies, no, they were not responsible for our "poor" market performance. The Nasdaq was around 5,000 when he took office in 2017 – back to where it had peaked out in early 2000 – and Trump's tax cuts and low rates and weak Dollar rammed us up 140% higher by the time he left office to just under 12,000. We were back to 7,000 last March on virus fears and now it turns out the virus must have been great for the economy as we're up to 14,000 – with Biden adding 2,000 more points (16.66%) in just two months of presidenting.

Will we ever see a top to this market or will it just keep going and going? CNBC had Tom Lee on yesterday and he predicts a "face-ripper rally" in April – as if 8% per month is a slow start to the year. "I think there’s a level of surprise coming in April because we already had a strong finish beginning Wednesday of last week. It’s really three days of strong rallies and history shows this is really building up to be what could be a, potentially, S&P 4,200 before the end of the month,” Lee said.

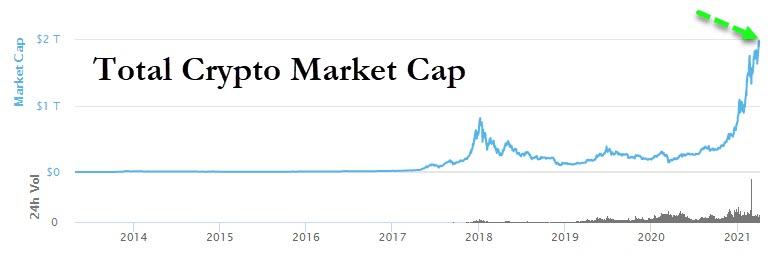

Well, 4,200 is only up 5% for the month, so it's actually slowing and not ripping any faces that I can see but it makes a good headline and sound-bytes are what matter, right? Meanwhile, the entire stock market rally is nothing compared to the explosion in Crypto Currencies in the past year as that market has goine from $200Bn last March to $2,000Bn today – up 10 times in 12 months!

Where did that $2Tn come from? What does it matter anymore? The NFT market is likely to pass $2Tn as well as it's a much broader market and single NFTs are already being auctioned off for tens of millions of Dollars while a single Bitcoin is on "worth" $50,000. The key issue here and in most of the market these days is people don't actually understand money anymore and they certainly don't understand debt, as evidenced by John Oliver this weekend – who tries to explain why we shouldn't worry about our $28,000,000,000,000 National Debt:

I love John Oliver but, as he will admit, he's only as smart as his writers and his writers are only as smart as their Facebook feeds and this idiocy that being $28Tn in debt doesn't matter in a $20Tn economy is no better than the climate denial or vaccine avoidance he rants and raves against on a regular basis. Since I don't have an HBO show, I'm going to simply refute a few of the BS talking points he's spewing to justify our current infinite debt policies:

1) No, people don't come to collect the National Debt with baseball bats if you don't pay. What does happen is that people stop lending you money, forcing you to print more money, devaluating your currency and placing a stealth tax on your people in the form of inflation. Asset-class holders may come out OK but renters who live paycheck to paycheck (about half our population) get crushed.

2) Yes, there is nothing wrong with deficit spending if it is going to lead to economic growth but $1,400 checks do not lead to long-term economic growth, do they? Giving out tax breaks so the Top 0.01% can make an extra $1Tn during the crisis last year does not improve our economy over the long run. Roads, Bridges, Clean Water, Schools – these are INVESTMENTS in our future that are worth funding and even Biden's impressive-sounding Infrastructure Bill only allows for $300Bn a year for those things – about the same total as the $1,400 giveaway.

3) No, it doesn't matter that we owe China money – unless we don't pay them. Then we are in default and, when you default to anyone, the other people you owe money to may decide you are a credit risk – and then you can't borrow money from anyone and then back to #1. You can only default if you don't need more money (like Iceland) – then you don't care if people think you are a credit risk as you're not looking for credit. America is running a $3-4Tn deficit in 2021 and we're not likely to kick that habit in the near future, are we? If we still need to borrow money – yes we care about owing money.

4) America is not Amazon or Tesla – that's a terrible example. Amazon spent money (and built infrastructure) to gain market share in a $6Tn retail economy and, after 20 years, has about 5% of it. Tesla spent money to build car factories, also addressing a massive market and also has a tiny bit of it still. It could also be argued that they are both wildly over-valued but let's not get into that. The US, on the other hand, is 25% of an $85Tn Global Economy already and, as we are not often enough remined – there is no Planet B – this is all we have to work with. We don't have 10x or even 2x economic growth in our future – unless inflation goes completely out of control or we kill everyone else on the planet – both plans are being considered, of course – some would say are in progress, in fact…

5) Yes, there is such a thing as too much debt. Too much debt is when the cost of servicing the debt impacts you ability to function. That is what the real concept of economic slavery is – you end up working just to pay the debt and make no progress and have no way to escape your situation. Here is where Oliver goes very far off the rails due to his lack of understand of how debt works. No, we don't automatically riot when the debt goes too high but the reason the Greeks rioted was because the Government had to keep cutting back on services and laying off workers in order to service their debt and things got so bad in the country that people began to protest and riot. Cause and effect.

The "magic" Oliver is pointing to is that somehow we have massively increased our debt while the cost of our debt service has gone down. That's simply because the cost of borrowing money has gone down but THAT in itself is an illusion – a magic trick being played by the Federal Reserve to make it look like it's cheap to borrow money, only the Fed is artificially keeping the borrowing cost low by becomming the primary debt-holder – more than China, more than Japan – of our National Debt.

As you can see on this chart, we USED to sell our debt to foreign Governments but they got smart and stopped buying years ago and now, over 90% of our debt goes to Pension Funds (that's you, sucker!) and our beloved Federal Reserve – who have bought $3Tn worth of notes in the past two years – essentially all of them. Does the Fed ever have to stop buying? We'd better hope not or we are completely F'd!

The Fed is a magic trick, it's a distraction to make it seem like we're not just printing money to pay our bills but that's exactly what the Fed is doing – it's like the banker is cheating in Monopoly and uses the bank to buy properties – it ruins the game for everyone else and, more often than not, they stop playing with the cheater. Well, we're the cheater and the rest of the World hasn't walked away yet – but what if they do?

As John Oliver notes, if we can borrow money at 2% and use it to make 5%, then it's a good deal but we CAN'T borrow money at 2% except from the fake bank of ourselves and we're certainly not making 5% from it – our GDP has not grown much in the past 5 years – DESPITE the massive stimulus.

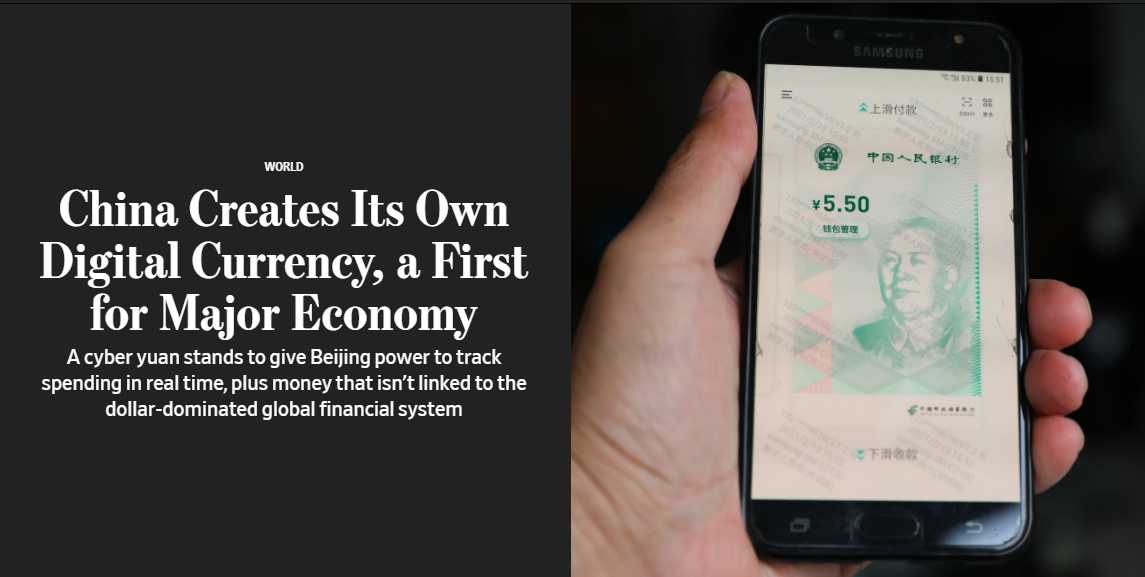

And there is a way China, or any of our creditors can screw us over and that's to no longer lend us money and demand to be paid. That is the beginning of the end of this game as it forces us to double down on the money printing (already happening). China has fired the first shot in the currency war this week by releasing the Cyber Yuan – its very own cryptocurrency.

And there is a way China, or any of our creditors can screw us over and that's to no longer lend us money and demand to be paid. That is the beginning of the end of this game as it forces us to double down on the money printing (already happening). China has fired the first shot in the currency war this week by releasing the Cyber Yuan – its very own cryptocurrency.

This is state-sanctioned crypto that WILL be used in transactions in the World's 2nd-largest economy and, if China plays this right, they can turn the digital Yaun into a reserve currency to rival the Dollar and the Euro, which carries the danger of seriously devaluing our ever-expandable fiat currencies. Beijing is positioning the digital yuan for international use and designing it to be untethered to the global financial system,

China’s version of a digital currency is controlled by its central bank, which will issue the new electronic money. It is expected to give China’s government vast new tools to monitor both its economy and its people. By design, the digital yuan will negate one of bitcoin’s major draws: anonymity for the user. Digitization wouldn’t by itself make the yuan a rival for the dollar in bank-to-bank wire transfers, analysts and economists say. But in its new incarnation, the yuan, also known as the renminbi, could gain traction on the margins of the international financial system, where it is currently involved in just 4% of all global transactions (vs 88% for the Dollar).

So, like Amazon or Tesla, China has a lot to potentially gain by fixing the amount of Yuan in circulation using block-chain while the US can do nothing but lose market share and, in our current state of debt and deficits – we're in no position to stop printing Dollars. It's a really good magic trick – but it's the same trick over and over and the Global audience is beginning to catch on to our trick and they are going to get bored and move on. That's already happend in the bond market – if it happens in our reserves then you can start flashing those riot pictures as a preview of things to come….