That's AFTER another round of $1,400 checks went out AFTER passing another $2Tn Stimulus Bill and AFTER another round of Business Loans have been handed out specifically to help companies maintain employees. Prior to Covid, we averaged 220,000 unemployment claims per week – that is "normal" turnover for our 165M-person labor force. Labor demand will have to bounce back much more before employment returns to pre-pandemic levels. Labor Department data show that although job openings neared a record high in February, the 7.4 Million openings were still fewer than the number of unemployed Americans, which totaled nearly 10 Million that month.

All these people ooing and ahing over the economy remind me of when your Grandpa is terminally ill and you go to visit him in the hospital and he can't talk and he can barely not his head and your relatives say "he's doing so much better today!" That's our economy now – any sign of life gets people so excited but we are nowhere near where we are and, without constant life support, we'd probably be dead.

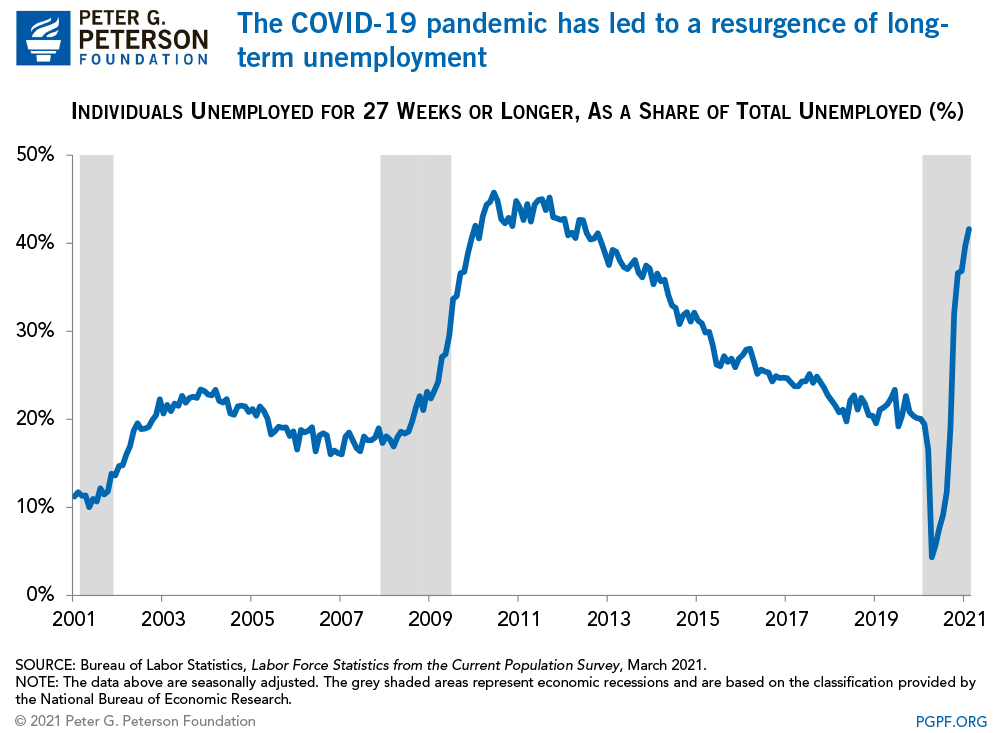

More than 4.2M people had been unemployed for six months or more in March, the most since 2013. Total continuing claims, a proxy for the number of people receiving benefits, hit 18.2 million in the week ended March 13th. The majority of these received aid through two federal pandemic programs that were recently extended, what happens if we cut them off?

More than 4.2M people had been unemployed for six months or more in March, the most since 2013. Total continuing claims, a proxy for the number of people receiving benefits, hit 18.2 million in the week ended March 13th. The majority of these received aid through two federal pandemic programs that were recently extended, what happens if we cut them off?

We are still a long way from better and that was what the Fed was indicating in their minutes yesterday. Knowing the Unemployment number would be bad is probably why the Fed scheduled Powell to speak at noon today – in case the markets get into a panic again – especially into the start of Q1 Earnings Reports next week.

Ontario, Canada is back on lockdown for 4 weeks as they deal with a resurgence of the virus. "The situation is extremely serious. We need to hunker down right now," Ford said at a briefing in Toronto. "What we do until we start achieving mass immunisation will be the difference between life and death for thousands of people," he said. The order requires people in Canada's most populous province (14M of 38M total in Canada) to stay in their residences except for essential reasons, including exercise, vaccination appointments or grocery trips.

Last week, Ontario shuttered all indoor and outdoor dining, a move that fell short of what the government's expert advisory panel said was necessary to avoid catastrophically high COVID-19 case numbers. On Tuesday, Canada reported 6,520 cases of covid. On Tuesday, the US reported 73,200 new cases – more than 10 times more than Canada and no, we do not have 10x their population so things are worse in the US than they are in a place where they are going back to emergency lockdowns.

On the bright side, "only" 2,564 people died on Tuesday – that's an improvement but, on the dark side, one in three people who contract covid are left with "Brain Disease or Psychiatric Disorders" – so it still might be something you should try to avoid! 20% of our population is now fully vaccinated and 1/3 have had at least one shot (including me!) but this country is acting like the crisis is over and 2,564 newly dead people might disagree with that assessment – and 2,500 more today and 2,500 more tomorrow, etc.

We WANT the crisis to be over but by acting like it's over too early – we may be prolonging it. Ontario recognize that fact based on numbers we are completely ignoring. Prime Minister Trudeau looked very foolish having to close the schools the day after he made a speech saying the re-opening had been a great success. Liberals don't bury science to score political points and if Biden has to shut things down again he will – but that scenario isn't priced into the market AT ALL!

Be careful out there!