$95,615!

$95,615!

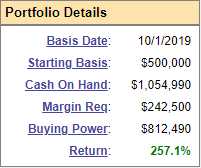

That's how much our Long-Term Portfolio has gained since our March 18th review and it's only April 9th! We only had $634,785 worth of positions on the 18th and now they are $730,400 (the rest is over $1M in CASH!!!) so that is a completely insane gain of 15% in 3 weeks. That's an annulized return rate of 260% – do you really think this is sustainable?

I know we keep trying to cash in the LTP but then we keep deciding the positions are perfect and we certainly can't argue with the results but the whole thing simply has to collapse at some point. It's the market that is causing this idiocy – our strategies just eggagerate the gains as we use options to leverage the upside momentum and, since the broad market never goes down and we tend to make sensible value picks – we make outized gains in our virtual portfolios.

Gains are, of course, lovely on paper but you have to make sure you keep them and that's the trick as the Fear of Missing Out on a contiued rally tends to keep us from sensibly cashing in our gains. We're 2/3 CASH!!! in the LTP and most of our portfolios so imagine what we'd be making if we were gung-ho bullish but we learned our lesson in 2000 and 2008 that rallies can end in a snap and you can't simply unwind your positions at the first hint of trouble – that's just not the way it works.

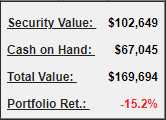

So we hedge using our Short-Term Portfolio (STP) and, as I mentioned on Wednesday, that $200,000 portfolio was down 3.1% and now, with the extended rally, it's down 15.2%, with the rally knocking us down by about $26,000 so the net gain of our paired portfolios is "only" about $70,000 for the month.

So we hedge using our Short-Term Portfolio (STP) and, as I mentioned on Wednesday, that $200,000 portfolio was down 3.1% and now, with the extended rally, it's down 15.2%, with the rally knocking us down by about $26,000 so the net gain of our paired portfolios is "only" about $70,000 for the month.

What that means though, is that the hedges are on sale and, since we just made net $70,000, we should certainly be putting a portion of that money to work buying more hedges. The STP positions we have at the moment gave us about $500,000 worth of downside protection but now we have $95,615 in additional positions to protect, don't we?

Still, we don't have to go crazy as the rally shows no signs of slowing and we are adequately covered so we'll just be looking to make small maintennence adjustments to our positions. For example, we are up 65.3% on the short SQQQ 2023 $30 calls we sold on November 6th:

| SQQQ Short Call | 2023 20-JAN 30.00 CALL [SQQQ @ $11.27 $-0.37] | -100 | 11/6/2020 | (651) | $-78,500 | $7.85 | $-5.13 | $-0.54 | $2.73 | $-0.18 | $51,250 | 65.3% | $-27,250 | ||

| SQQQ Long Call | 2022 21-JAN 10.00 CALL [SQQQ @ $11.27 $-0.37] | 200 | 2/8/2021 | (287) | $104,000 | $5.20 | $-1.85 | $3.35 | $-0.20 | $-37,000 | -35.6% | $67,000 | |||

| SQQQ Short Call | 2023 20-JAN 30.00 CALL [SQQQ @ $11.27 $-0.37] | -100 | 2/4/2021 | (651) | $-45,000 | $4.50 | $-1.78 | $2.73 | $-0.18 | $17,750 | 39.4% | $-27,250 |

Our long calls have held up well by comparison (down 35.6%) so the position is profitable – even though SQQQ certainly went the wrong way. That's because we sold more premium than we bought (being the house, NOT the gambler!). But making a profit on paper doesn't do you any good unless you cash it in at some point. Clearly we don't need to cash the short $30 calls as they are almost 200% above the current price so the Nasdaq would have to fall over 60% to put those in the money. What we can do, is sell 100 of the Jan, 2022 20 calls at $1.70 ($17,000) and those will help pay for us to roll our 2022 $10 calls at $3.35 to the 2023 $10 calls at $4.80 for net $1.45 ($29,000).

Now we've spent just net $12,000 and bought ourselves another year of protection (and another year to sell short calls) and when 2024 options come out (July), we will roll our 200 short 2023 calls to 100 short 2024 calls for about even and then we will be back in balance. So we're risking that the market won't fall more than 30% between now and July but, if it does – we can simply buy more longs or buy back more of our short calls to blance things out again. If the market continues to go up, all the short calls will go worthless and we'll sell some more to pay for the next roll of our long position.

That's why, in the long-run, our hedges are far more cost-effective than they seem – because we are able to maintain them with relatively cheap adjustments. This is a $400,000 spread but really we don't see SQQQ likely to go over $20 so we'll call it a $200,000 spread that we netted into for a $19,500 credit and now we're spending $12,000 to adjust it so STILL a free spead – and free protection for our long portfolio!

Going the opposite way, TQQQ is the ultra-long ETF for the Nasdaq and we are experimenting to see if we can make more money shorting that than being long SQQQ (the ultra-short).

| TQQQ Long Put | 2022 21-JAN 100.00 PUT [TQQQ @ $105.36 $3.19] | 20 | 12/7/2020 | (287) | $68,000 | $34.00 | $-12.78 | $34.00 | $21.23 | $-1.13 | $-25,550 | -37.6% | $42,450 | ||

| TQQQ Short Put | 2022 21-JAN 70.00 PUT [TQQQ @ $105.36 $3.19] | -20 | 12/7/2020 | (287) | $-34,500 | $17.25 | $-7.70 | $9.55 | $-0.45 | $15,400 | 44.6% | $-19,100 | |||

| TQQQ Short Put | 2021 16-APR 80.00 PUT [TQQQ @ $105.36 $3.19] | -7 | 3/12/2021 | (7) | $-3,500 | $5.00 | $-4.90 | $0.11 | $-0.10 | $3,427 | 97.9% | $-74 |

Here we spent net $30,000 on the $60,000 spread and the short April $80 puts will expire worthless and we could sell the June $85 puts for $5 but I'd rather do that on a pullback as they were $13 two weeks ago so, instead, let's spend $9.55 ($19,100) to buy back the short Jan $70 puts and, hopefully, we'll get a pullback that will allow us to replace them with better short puts on a pullback as well.

So what if there is no pullback? Well then we would sell, perhaps, the Jan $90 puts for $16.50 ($37,000) and use that money to roll the Jan 100 puts at $21.25 to the Jan $120 puts at $32.50, for net $11.25 ($22,500). That would leave us in a much higher put spread that's deeper in the money for net $4,600 out of pocket – an amount we can intantly make back on our next short put sale. In fact, I like our backup plan almost better than our main plan of catching a well-timed pullback with our naked long puts – we'll see how this plays out!

Have a great and well-hedged weekend,

– Phil