15% over the 200-day moving average is a rare thing.

15% over the 200-day moving average is a rare thing.

That's where we are now on the Dow, which is over 34,000 again. Are things really 15% better than they were in November, when we last tested the 200 DMA? Well Trump is no longer President and the virus is diminishing (in the US, in the rest of the World it's still a disaster) – those are good things.

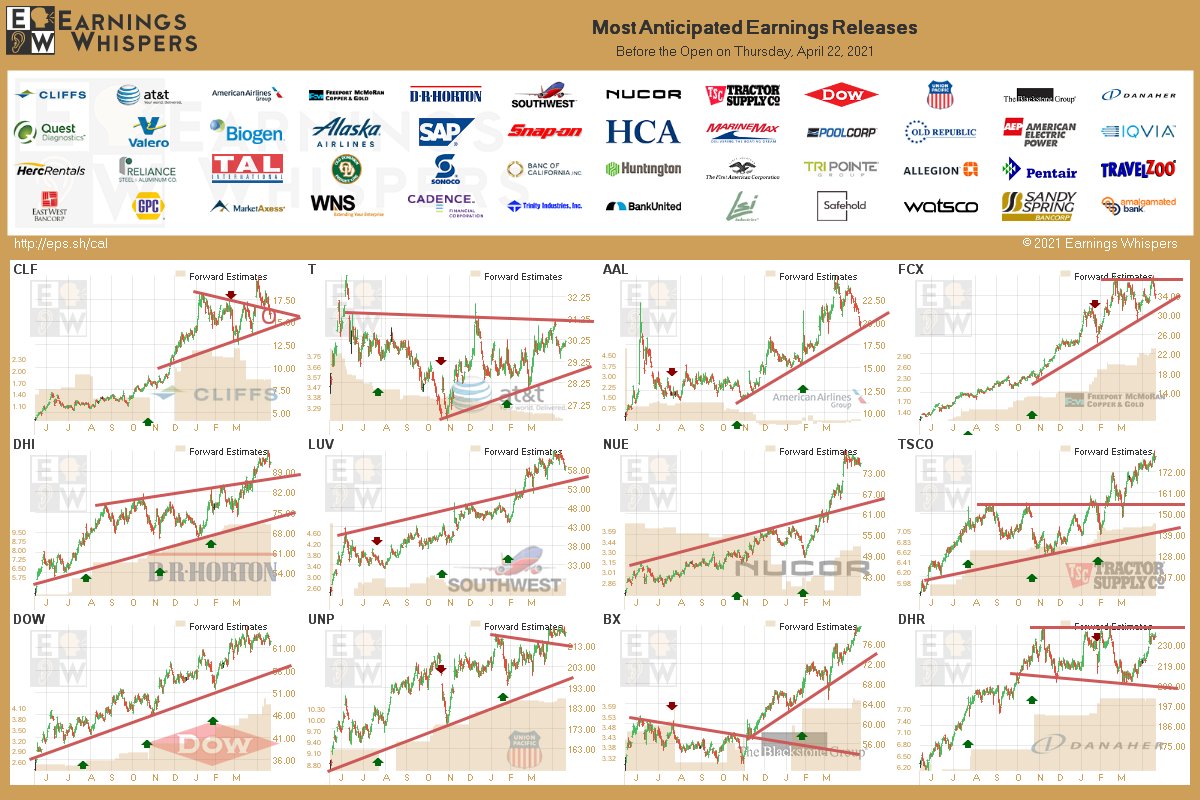

However, it's already the end of April and Q1 has not been generally better than Q1 of last year, when we entered lockdown. Chipotle (CMG) beat expectations last night, as did Kinder Morgan (KMI) and Whirlpool (WHR) but Las Vegas Sands (LVS) is still in very bad shape and this morning American Airlines (AAL) took a massive $4.32 loss per $20 share while our favorite airline, Alaska (ALK) "only" lost $3.51 per $70 share.

T beat, CLF beat by a mile, BIIB out of the ballpark, DHI massive beat, Valero (VLO) massive miss – the stimulus is having a very uneven effect on industry but clearly Mass Transportation and Hospitality are suffering the most still. Tonight we hear from our Stock of the Year, Intel (INTC) but they have already gone to the moon since we picked them in November. Boston Beer (SAM), Mattel (MAT), Seagate (STX) and Sketchers (SKT) also report this evening with American Express (AXP), Honeywell (HON) and Schlumberger (SLB) reporting tomorrow.

Nothing seems to matter to the market as it only goes in one direction these days. That's why we made an aggressive play on AT&T into earnings yesterday in our Live Member Chat Room ahead of their report:

T/Rick – Still underpriced at $30.05 so I'd just buy the 2023 $30 calls for $2.50 and, if T goes up, you can either take a quick profit or sell $35 calls (now $1.15) and turn it into a cheap spread. If it goes up a lot, that's all there is to do but if it's flat or down, then you can also sell puts like the $27 puts, which are now $2.70 and then you have a free set of $30 calls or a credit if you do the bull call spread or you can spend the credit and have the $25/35 spread with the short puts for about even.

That should pay off very nicely this morning as T is popping about $1 (3%) off the report. The 2023 $30 calls hav an 0.55 delta, so they should be a bit over $3 for a quick 20% gain and we can take that off the table, wait for it to go higher or sell the $35 calls for $1.50, leaving us with a net $1 entry on the $30/35 bull call spread and we can pay for 15 of those by selling 5 of the $30 puts for $3.70 ($1,850) and still have a net credit. Then the worst case is you end up owning T at net $31 (where we are now) or, over $35, you make $5,350 in profit.

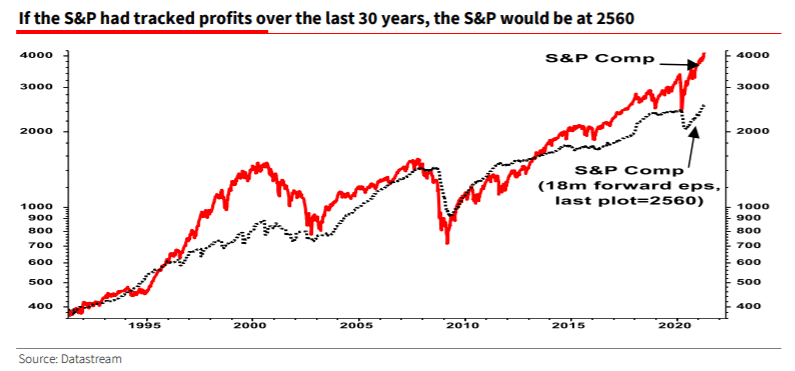

We've been discussing overall earnings this week and Societe General's Albert Edwards decided he agrees with me that we're heading for a correction bases on runaway valuations, as evidenced by this chart:

We didn't collaborate but we both came up with the same base valuation for the S&P – which I discussed with our Members in yesterday's Live Trading Webinar (replay here). Edwards also notes that while people may say valuations don't matter, in the long run "profits do (sort of). "Taking analysts’ typically overoptimistic 18-month forward earnings and rebasing them to the same level of the S&P 30 years ago, we can see that a huge gap has opened up," he said. Earlier this week, BofA outlined three indicators to watch for a "tactical correction."

Be careful out there,

– Phil