774,404 Global cases per day.

774,404 Global cases per day.

That's up 15% from the beginning of April and a new record for planet Earth, despite 1Bn shots being distributed around the World. With about 1/10th of the World's population having gotten at least their first shot – you would think cases would start declining but the virus is raging among the 7Bn people who have not been vaccinated and, unfortunately, easing restrictions still leads to trouble – but try telling that to your partially-vaccinated populations.

Public health experts say the number of global cases is most likely surging because more contagious virus variants are spreading just as people are starting to let their guards down.

83% of the shots that have gone into arms worldwide have been administered in high- and upper-middle-income countries. Only 0.2% of doses have been administered in low-income countries. Not only that but the wealthiest nations are privileged to get the most effective vaccines from Pfizer, Moderna, JNJ or Astra-Zeneca while the rest of the World are using vaccines that offer as little as 50% protection.

India is recording more than a third of all new global cases each day, averaging more than 260,000 new daily cases over the past week. The country’s sudden surge, driven by the spread of a newer variant, is casting increasing doubt on the official death toll of nearly 200,000, with more than 2,000 people dying every day. Experts say the official numbers, however staggering, represent just a part of the virus’s spread, with hospitals overwhelmed and lacking critical supplies like oxygen.

In Thailand, where cases were kept at bay for months with strict quarantines and lockdowns, the virus has spread rapidly, in part by unmasked people partying. Daily cases, still low by global standards, have increased from 26 on April 1st to more than 2,000 three weeks later. The rates of new coronavirus cases also remain high across much of South America. In Brazil, reported cases are starting to drop but remain high after a more contagious variant tore through the country and overwhelmed hospitals.

The rate of new cases in the United States is falling but remains alarmingly high — similar to last summer’s surge. “We have to start thinking on a global scale and do what we can to help these other countries otherwise we’re never going to put out the whole fire.” Said, Dr. Robert Murphy, the Director of the Institute for Global Health.

The rate of new cases in the United States is falling but remains alarmingly high — similar to last summer’s surge. “We have to start thinking on a global scale and do what we can to help these other countries otherwise we’re never going to put out the whole fire.” Said, Dr. Robert Murphy, the Director of the Institute for Global Health.

If you are vaccinated, you can get on a plane with 300 other people this Summer and head off to Europe, who will be allowing tourism. All 27 member states will accept, unconditionally, all those who are vaccinated with vaccines that are approved by E.M.A. “We’re at a tipping point,” said Dr. Blythe Adamson, an infectious disease epidemiologist and economist. “People are going out more, they have pandemic fatigue. They’re vaccinated, but people are still getting Covid with these new strains."

None of this is bothering the Global Markets, which are up and up and up some more recently. The Dow is up from 30,000 in early February to 34,000 at the moment – that's about 12% in two months and up about 20% from pre-pandemic levels. Trump is no longer President – so I guess the World is less likely to end suddenly and that's a market-booster but his tax cuts are going away so the other variable has to be the Stimulus – or 20% over-stimulus, according to the market.

None of this is bothering the Global Markets, which are up and up and up some more recently. The Dow is up from 30,000 in early February to 34,000 at the moment – that's about 12% in two months and up about 20% from pre-pandemic levels. Trump is no longer President – so I guess the World is less likely to end suddenly and that's a market-booster but his tax cuts are going away so the other variable has to be the Stimulus – or 20% over-stimulus, according to the market.

As long as it's not according to the Fed, we can party on a little longer. Earnings season is hot an heavy this week with all the Trillionaire Companies reporting and we know the rich have been getting much richer during this pandemic so it SHOULD be a good week for the markets – and watch out if it isn't. We've seen some signs of earnings fatigue, especially in the tech sector, where great earnings are not great enough to justify the already maxed-out valuations – watch out for more of that as we move forward:

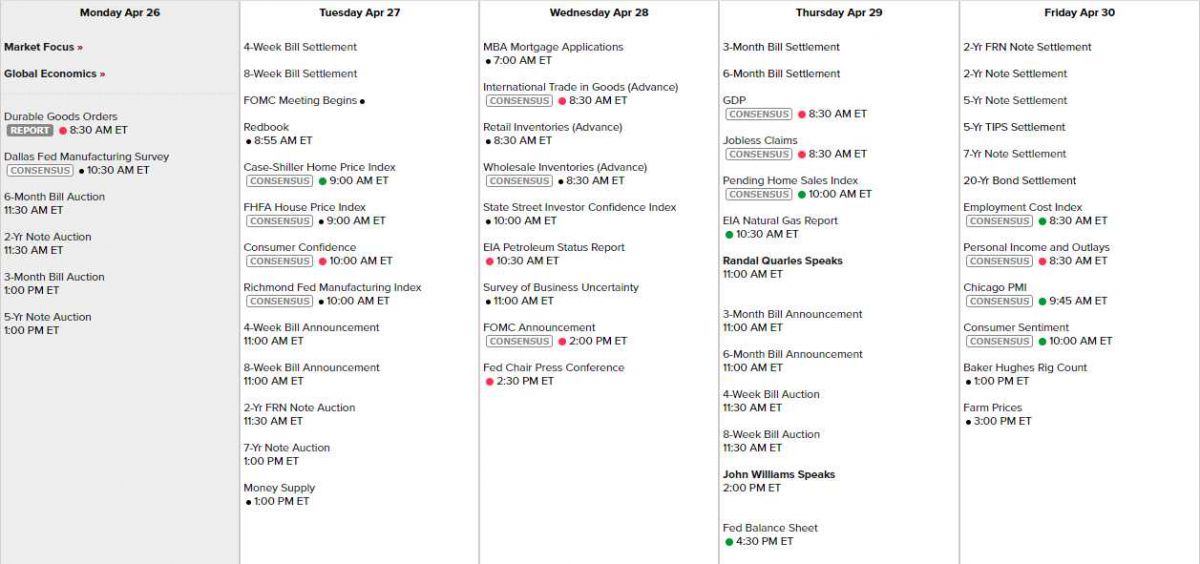

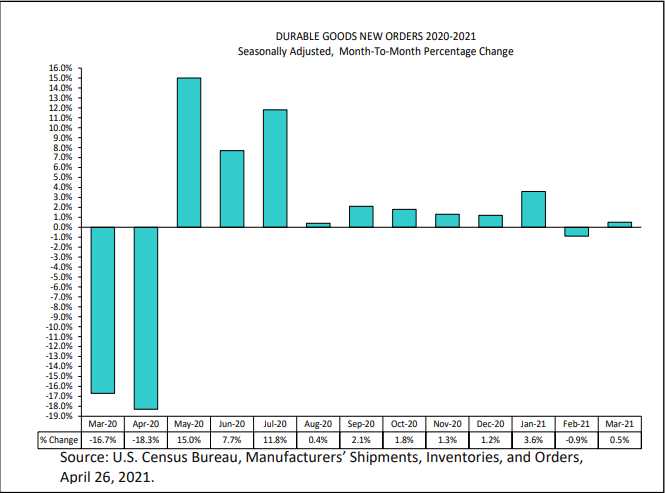

TSLA has earnings this evening and Elon Musk seems confident enough to go on Saturday Night Live on May 8th, so I imagine they will turn in a good report. It's a big data week with Q1 GDP on Thursday. We already had Durable Goods this morning and it was up an anemic 0.5% compared to a 2.2% increase anticipated by leading Economorons, who completely failed to take into account the supply shortages of chips and other critical items. Still, they will ask the same idiots for their opinions next month too.

That means Thursday's GDP Report is also likely to disappoint from the 6.5% growth expected. How will the markets take that? We also have the Dallas Fed this morning and lots of Housing Data this week and Consumer Confidence with the Richmond Fed tomorrow.

That means Thursday's GDP Report is also likely to disappoint from the 6.5% growth expected. How will the markets take that? We also have the Dallas Fed this morning and lots of Housing Data this week and Consumer Confidence with the Richmond Fed tomorrow.

Wednesday we get the latest Fed announcement and that's not at all likely to change and Powell will cheerlead the economy at 2:30 on Wednesday after we get a look at Retail and Wholesale Inventories and Consumer Confidence. That takes us into Thursday's GDP and, in case that's bad, Fed Governors Quarles (11am) and Williams (2pm) are ready to spin it for us following the Report.

Friday we have Pesonal Income and Outlays along with the Employment Cost Index, the Chicago PMI and Consumer Sentiment so busy, busy, busy this week and don't forget Farm Prices at 3pm Friday, to put the iciing on the inflationary cake.