$1.8 Billion!

$1.8 Billion!

That's right, it's been more than a month since we got our last $1.9Tn in stimulus so tonight President Biden will propose another $1,800,000,000,000 in spending on things like Child Care, Education and Family Leave as part of the American Families plan. Biden is also proposing another $300,000,000,000 for the IRS, so they can go around collecting unpaid taxes to pay for all this fun stuff. There are also likely to be some tax increases for wealthy Americans. Now I remember how Repblicans end up getting elected…

All of these are good things but you don't have to fix all the wrongs overnight though maybe you do as we've seen that the party in power has just 4 years before the next President comes in and tries to undo everything they did so team Biden has had a very busy first 100 days in office. This one is a bit less of a market-booster as we don't have a lot of public companies that take care of children or educate them – that's not the kind of behavior that Capitalism rewards, is it?

The American Rescue Plan of March did not provide money for guns or bombs or tax breaks for the wealthy either. This could be a disturbing trend for white, privileged Amerca, who are being left behind in the Biden bills:

This is coming right on the heels of the President's infrastructure proposal, known as the American Jobs Plan, which calls for improving the nation's roads, bridges, broadband, railways and schools. It would also provide a boost to manufacturing and funnel $400 Billion into augmenting home and community-based care for the elderly and disabled and raising the wages of care workers. It would be paid for by hiking Corporate Taxes. The tax increases contained in the two economic recovery packages would fully pay for the investments over the next 15 years, according to the White House.

I don't have to tell you how evil all this is, that's what Fox News is for. Today's headline is, of course: "Biden to unveil massive new spending plan that critics rip as 'redistribution' disguised as relief" The top income tax bracket for those households earning beyond $400,000 will revert to 39.6%. That had been the top rate before the 2017 GOP tax overhaul approved by Donald Trump that brought the percentage down to 37%. The administration pointed to a recent study that showed the country’s top one percent failed to report 20% of their income. Biden hopes to increase investment in the IRS and require financial institutions to report "account flows" as they would regular wages. Biden also aims to end loopholes that benefit the country’s wealthiest, including the tax rate on capital gains. Or: KUDLOW: BIDEN IS GOING TO WEAPONIZE THE IRS.

Of course, the entire concept of Government is based on the idea of redistributing wealth. If we didn't want to redistribute wealth for the public good, we could stick with Monarchies (who still tax you) or Dictatorships (who still tax you) or, best of all, Anarchy – where it's every man for himself and we haven't really given that a good shot since the Stone Age but it's certainly a solid platform for the GOP in the next election, isn't it?

Of course, the entire concept of Government is based on the idea of redistributing wealth. If we didn't want to redistribute wealth for the public good, we could stick with Monarchies (who still tax you) or Dictatorships (who still tax you) or, best of all, Anarchy – where it's every man for himself and we haven't really given that a good shot since the Stone Age but it's certainly a solid platform for the GOP in the next election, isn't it?

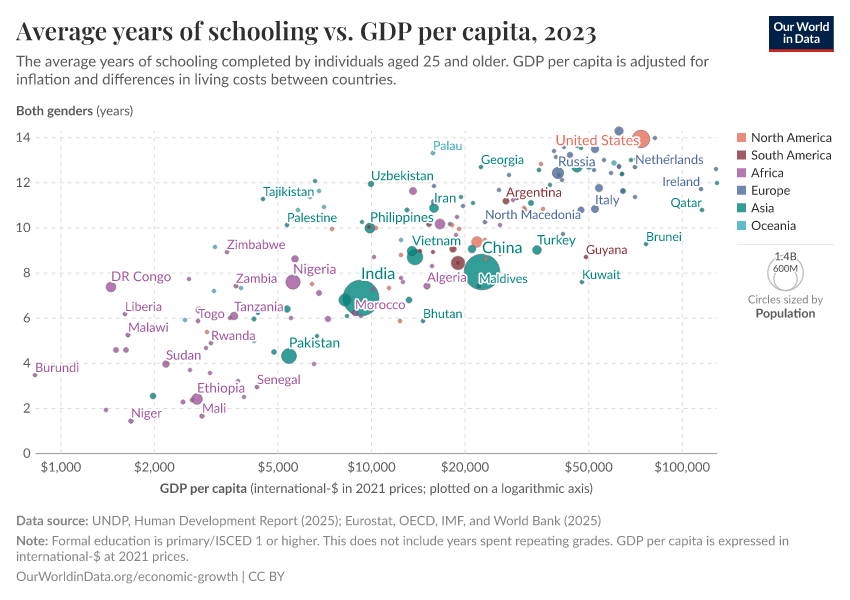

As repulsive as the idea of caring for and education our nation's children may be to Conservatives, as you can see from this chart, there is an extremely strong correlation between educating our population and GDP growth and, with a country that is 150% of their GDP in debt, growing the GDP has to be our top priority and, if a better-educated work-force can add 10% to our $20Tn GDP, that's a $2Tn ANNUAL benefit from $1.8Tn spent over 10 years – that's called INVESTING in your people.

But, to do that, we have to recognize that the children of others – ALL children, in fact, have the right to a good education and good nutrition and a safe, clean environment to learn in. As we have clearly seen demonstrated in the pandemic, 90% of the economic growth goes to the Top 1% anyway so the tax increases will pay for themselves as we invest in America's future and strengthen our greatest natural resource, which is our own future work-force.

I know it sound crazy but maybe we should give it a try. We haven't done much for Education since the Kennedy Administration – just before Joe Biden was elected Councilman in Delaware (1970). By 1972 Joe was elected Senator and here we are, 50 years later and he'll be addressing Congress as President for the first time. I'm going to watch it on Fox – I'm too much of a liberal and I'm worried I might miss how wrong for our country it is to care about its future in deeds, rather than words.