"Well, we know where we're goin'

But we don't know where we've been

And we know what we're knowin'

But we can't say what we've seenWe're on a road to nowhere

Come on inside

Takin' that ride to nowhere

We'll take that ride" – Talking Heads

Here we are again.

Two weeks ago (14th), it was "Record-High Wednesday – Dow 33,600, S&P 4,140, Nasdaq 14,000" and this morning we're at Dow 33,783, S&P 4,178 and Nasdaq 13,846. Keep in mind that's AFTER another $2Tn in stimulus has been announced and AFTER the Fed pledged to keep the money flowing, AFTER all these "terrific" earnings reports and AFTER we got a GDP Report showing 6.4% growth. What's wrong with this picture?

Certainly it's SOMETHING, right? Perhaps my concerns about a slow Global recovery, massive debt, rising inflation and ridiculous market multiples might be valid? Nah… As long as the money keeps flowing, the markets should keep going higher – or at least maintain these highs. In a "normal" year, the Market goes up 8% – that's the average, historic gains. In a normal year, the Fed doesn't put $80Bn per month into the bond market and another $40Bn a month into banks (buying up their mortgages) and, in a normal year, the Government doesn't drop $2Tn per quarter into the economy and Biden has just proposed $4.2Tn in new spending over 5 years so $800Bn/12 = $66.6Bn/month from Uncle Joe going forward.

That's a lot of money! Of course, coming off last year's $6Tn in stimulus, this year's $2Tn in Q1 + maybe 6 months of $66.6Bn = $400Bn – we're only going to be at $3.8Tn in stimulus this year – including the Fed's $1.44Tn. So, how will the economy do on "just" $3.8Tn in stimulus and, keep in mind, the big pop came already – the rest is a trickle. They are trying to take the economy off life support and soon we'll start to see how it stands up on its own.

That's a lot of money! Of course, coming off last year's $6Tn in stimulus, this year's $2Tn in Q1 + maybe 6 months of $66.6Bn = $400Bn – we're only going to be at $3.8Tn in stimulus this year – including the Fed's $1.44Tn. So, how will the economy do on "just" $3.8Tn in stimulus and, keep in mind, the big pop came already – the rest is a trickle. They are trying to take the economy off life support and soon we'll start to see how it stands up on its own.

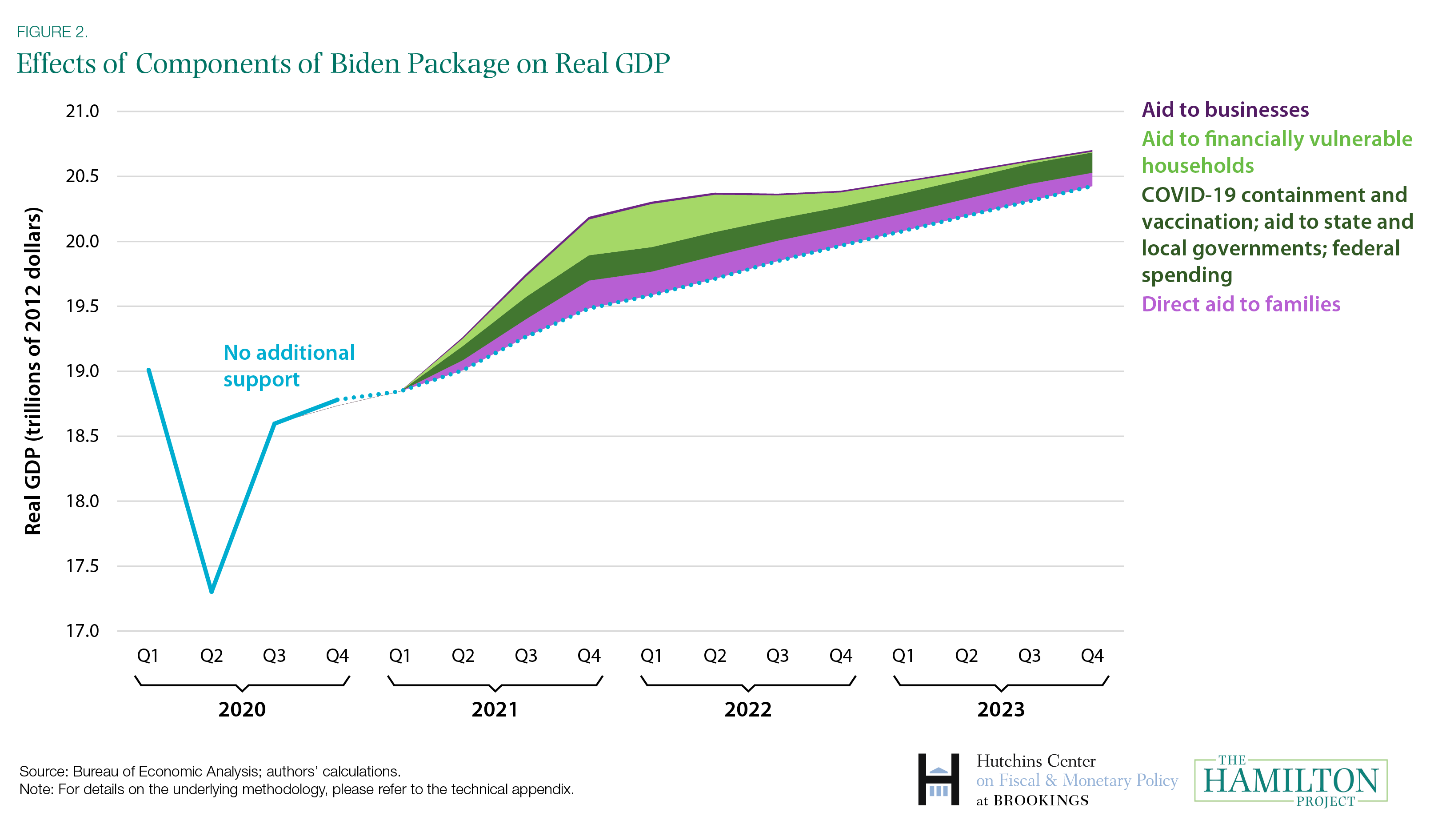

As you can see from the chart on the left, Biden's stimulus plan is set to deliver maximum impact this year and next, planning to boost our GDP by about $1Tn (5%) for 2021. Clearly, without the support, we'd have negative GDP compared to 2019, though still better than last year, which was a total disaster.

This isn't real folks, this is a propped-up Hollywood movie-set of an econmy and you only have to walk around the other side of the wall to see it's not a real house at all but just a board that's been painted to look like a wall in a house yet all the "actors" in the media are "oohing and ahing" like it's the greatest thing they've ever seen in their lives. It's just silly! We'll keep playing but just remember this is a rigged game and, as soon as the stage hands stop holding up the walls – they are going to come tumbling down hard and fast.

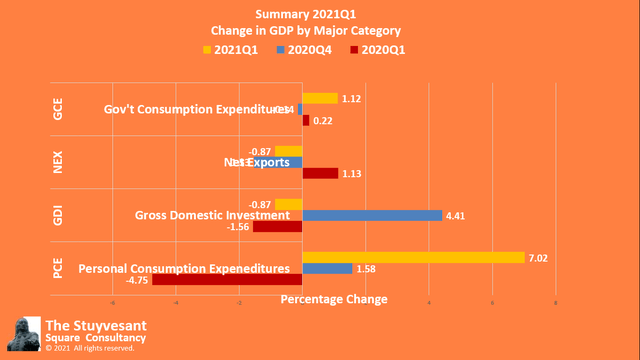

If we break down yesterday's Q1 GDP report, we can see that 7% out of 6.4% total growth (so the rest was -0.6%) came from a Massive pop in Personal Consumption or, very simply, people spending their stimulus checks. Not only that but 3% of the 7% spent by consumers went to durable goods, cars and RVs or things that are 90% borrowed money – that is not a long-term stimulus to the economy as that money has to be paid back at some point and detracts from future spending.

If we break down yesterday's Q1 GDP report, we can see that 7% out of 6.4% total growth (so the rest was -0.6%) came from a Massive pop in Personal Consumption or, very simply, people spending their stimulus checks. Not only that but 3% of the 7% spent by consumers went to durable goods, cars and RVs or things that are 90% borrowed money – that is not a long-term stimulus to the economy as that money has to be paid back at some point and detracts from future spending.

The Government itself added 1.1% with it's own spending. So where would be be if the Government wasn't handing out free money and using their own open checkbook to boost the economy? We'd be -1.6% at least but take away the lending and it's more like -4.6% or about $1Tn and the Administration knows this – that's why they quckly added two programs that will add $1Tn to the economy this year – we can't afford to look like we're backsliding economically, can we?

No, we can't because don't forget that all this stimulus already has us at $28,230,850,000 in the hole already this year and our Federal Budget Deficit through June 30th is $3.255Tn. In Wednesday's Webinar we discussed Government Spending vs Revenues with a cool chart and what I was pointing out was that very little of the Government's spending is discretionary – down to about $800Bn and the Interest on Debt is $400Bn at 2% so if interest on debt runs up to 6% – we'd have to cut EVERYTHING just to stay even and even is runnning $1Tn annual deficits, at least.

In reality (I've heard of the place but I can't find it anywhere), we NEED to spend $4Tn on Infrastructure this decade and we NEED to spend $10Tn on Climate Change so that's really a $2Tn annual deficit we need to face up to for the rest of this decade and the Government only collects $3.5Tn now in taxes so how are they going to cover $2Tn? Raising taxes 50% is not enough!

So, they don't raise taxes and, in 2030, we're about $45Tn in debt and, if the interest rates are just 4%, that's $1.8Tn per year in interest alone and that's $1.4Tn more than we pay now so we HAVE to raise taxes 20% just to cover the interest on our debt (or we turn into Greece).

Think about it and have a great weekend,

– Phil