It's payroll time again.

It's payroll time again.

We added 916,000 jobs in March (adjustments pending) and under 1M added will actually be a disappointment for April but I think the pace of hiring may have slowed somewhat. Normal job growth is roughly 300,000 but we're adding back the 22M people who were laid off during the shutdown and, so far, we're still about 4M short and that's not including the normal growth we should have had.

I know the ever-rising market makes us think the economy must be fantastic but it's not really. Even with the endless stimulus, a lot of sectors are hurting and they are sectors that employ a lot of people like restaurants, movies, clubs. We're getting back to normal but we're not normal yet and half the year has already gone by. Fortunately, we've had $6Tn in stimulus measures in the first 4 months which is pretty much our entire GDP for 4 months – so who's going to notice a few holes in our economic ship?

In fact, labor shortages now threaten to restrain what is otherwise shaping up to be a robust post-pandemic economic recovery. Some businesses are forgoing work, such as not bidding on a project, delivering parts more slowly or keeping a section of the restaurant closed. That reduces the pace of the economy’s expansion. Other companies are raising wages to attract employees, which could inflate prices for customers or reduce profit margins for owners. Analysts say the labor shortages should ease over time as more potential workers are vaccinated, schools fully reopen and federal benefits expire, though the process could take months and the impacts are already being felt.

In fact, labor shortages now threaten to restrain what is otherwise shaping up to be a robust post-pandemic economic recovery. Some businesses are forgoing work, such as not bidding on a project, delivering parts more slowly or keeping a section of the restaurant closed. That reduces the pace of the economy’s expansion. Other companies are raising wages to attract employees, which could inflate prices for customers or reduce profit margins for owners. Analysts say the labor shortages should ease over time as more potential workers are vaccinated, schools fully reopen and federal benefits expire, though the process could take months and the impacts are already being felt.

Companies are scrambling for workers. Notice this McDonalds is offering a $500 sign-on bonus but still sells value menu items for $1. Even if they make a 20% profit on those items, a new hire has to serve 2,500 of them before the restaurant just makes back the signing bonus and those of us who have worked in McDonalds know know that's about a month's worth of french fries or coffee as serving over just over 100 per shift is as good as it gets.

8:30 Update: Oopsie! Looks like I was right and the Economorons were wrong as we only added 266,000 jobs in April – 75% less than expected AND it turns out March was actually +770,000, 146,000 (16%) less than they said it was last month. That's not necessarily bad news for the market because it means… yes, you guessed it: MORE FREE MONEY!!! That's right, more free money fixes everything that ails your economy. Remember, when you aren't happy with an economic number – just throw money at it until it looks better! What are consequences – we have no idea?

Less jobs also means less need for money to pay workers and less money being spent by less workers so the Dollar will drop and that will give us a boost in stocks and commodities this morning – making us think all is well when it's clearly not. Keep in mind we all got big, fat stimulus checks in March and if you're telling me Biden's $2.1Tn March stimulus package wasn't enough to give our $20Tn economy a 2-month boost – then I'd have to say those holes in our boat are a lot bigger than we thought!

In fact, the Unemployment Rate is back to 6.1% and that's not good either.

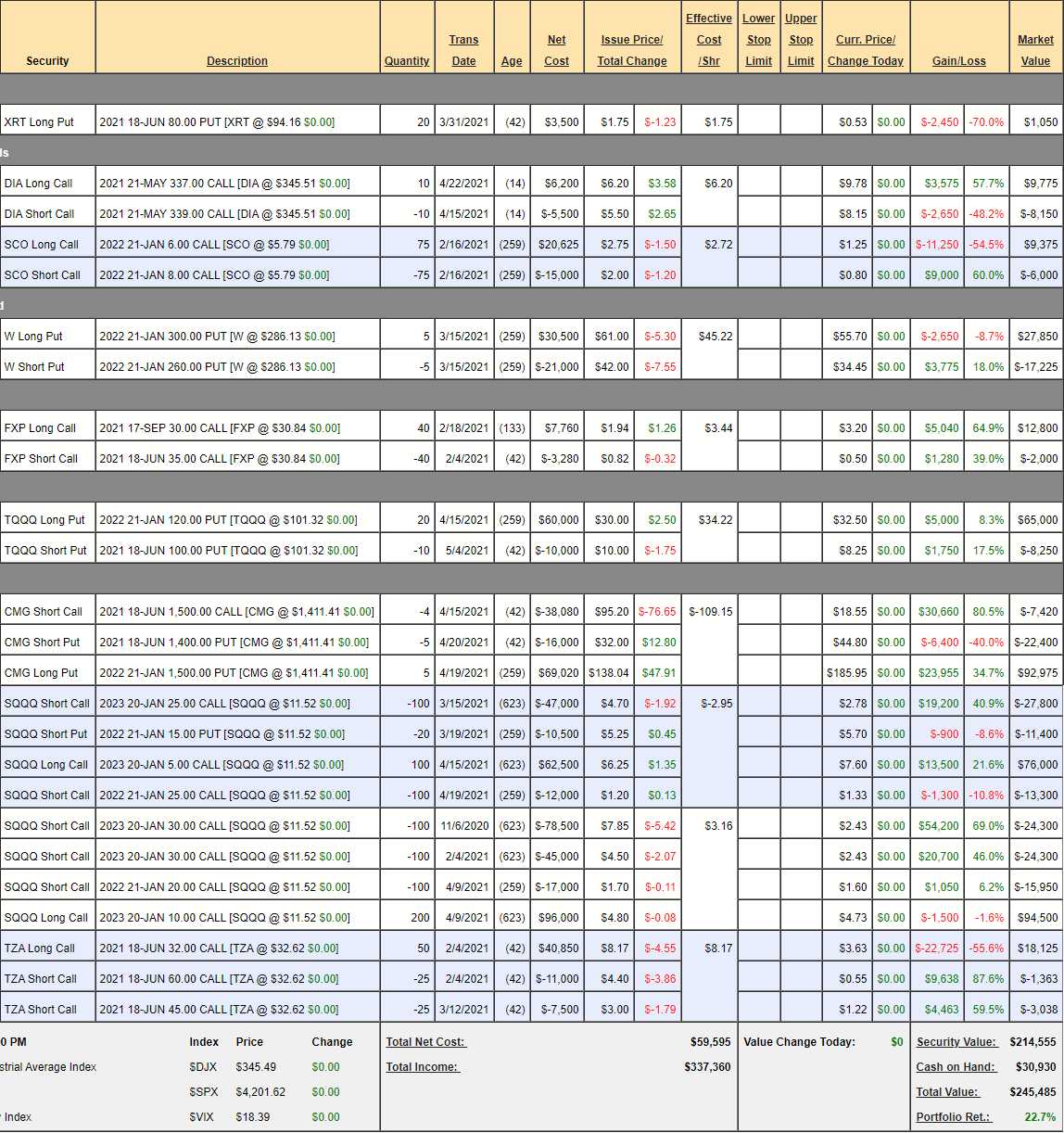

On the whole, it's a good time to check our Short-Term Portfolio (STP) and see how our protection is holding up. Our last review was on 4/15 and we were at $177,376 and now we've bounced back to $245,485 for a nice $68,109 gain in 3 weeks, benefitting largely from our side bets on CMG and W as well as our primary SQQQ hedges coming back a bit on the recent Nasdaq dip:

- XRT – Retail is stronger than we expected but the weakness in Non-Farm Payrolls makes me think earnings for smaller retailers won't be that great. Let's imagine XRT falls back $5 – that would make the June $80 puts, now 0.53, worth about what the $85s are ($1). So we can double our money on a $5 drop so we can put $2,500 to work on 50 more puts and give it two weeks. I doubt we lose more than 1/2 so risking $1,250 more to make $2,500 or much more if there's a real catastrophe – it's a good additional hedge for now.

- DIA – This was kind of a joke bet as I was exasperated with the market never going down and I said we could double our money every month with spreads like this. Well, the spread was net $700 and now it's net $1,625 so let's take it off the table and next month we'll see if we can turn $1,400 into $2,800 (notice I'm keeping the bonus $225 in my pocket so now we're only in for net $475).

- SCO – We're betting oil is below $60 in January. I'm still good with that.

- W – Took a nice dive for us an now net $10,625 but the short April $320s expired near worthless already and made us about $7,500 on what was originally a net $1,400 spread. It's potentially a $20,000 spread at $260 and they already reported earnings so I think we're just on track and, of course, if it does spike higher – we get to sell short calls again.

- FXP – China is taking longer to collapse than we thought but it's progressing and we have a few more months to go.

- TQQQ – I love shorting the ultra-bullish ETF because it gets so stupidly high and then it decays over time as well – two ways to win! We're at our June target already and worst case is we'll have to roll the short puts. If TQQQ goes higher, the short puts expire worthless and we make $8,250. Don't you just love options?

- CMG – Another one with earnings as we expected. This is where most of our profit came from this month and that's why we carry a variety of hedges in the STP – it gives us more ways to win. In this case, it was simply a fundamental short so, even if the market went higher (it did) I still didn't think CMG could justify $1,500. We still have $7,420 left to gain on the short $1,500 calls and we're right in the sweet spot for the short puts too – a perfect spread!

- SQQQ #1 – We sold another set of $25 calls to pay to roll to the $5 calls on the long side and we're double-exposed but SQQQ is a 3x ETF at $11.52 so $25 is more than 120% up and the Nasdaq would have to fall 40% for us to hit that and, even if it did, our $5 calls would be $200,000 in the money at $25 before we had to pay back a dime and we'd adjust long before then.

- SQQQ #2 – We left these calls at $10 and they are 50% over-covered but also with unreachable calls. So, by the time SQQQ hits $20, we have $350,000 from our longs to make adjustments with and the net of the two positions is currently $53,450 so 7x protection on the spreads.

- TZA – Much more straightforward. We paid net $4.50(ish) for the spread and we can salvage $3.60 from the short calls so let's do that and roll the 50 June $32 calls ($18,000) to 100 Jan 2022 $30 ($9)/2023 $50 ($9.25) bull call spread for an 0.25 credit. TZA also decays over time and we're much lower in strike so I think we have great protection for the rest of the year and decay should take care of the rest (the Jan $50s are $5).

So we have plenty of protection and we've taken almost $20,000 off the table while improving our positions. Great adjustments into the weekend's uncertainty.

Have a great weekend,

– Phil