Here we are again.

Here we are again.

After testing 33,900 last night, the Dow is back to 34,100 pre-market and we did spend April building a base at 34,000 so it should, at least, be bouncy. If we look at this as being rejected at 35,000, it's a 1,000-point run so the weak bounce takes us to 34,200 and the strong bounce would be 34,400 – nothing less than that is going to impress us today and I don't think we'll even get to the weak bounce as sentiment seems to be shifting a little.

Like Bitcoin or Dogecoin, it doesn't take much of a dip for the bullish investors to start to wonder if maybe they overpaid for their positions after stupidly chasing the price up 35% from the November lows. Were the people who valued stocks in November all crazy? Did none of them understand how awesome the earnings potential of these companies are?

Well, we're in the middle of earnings season now and it's not that stocks are not hitting their estimates – it's more like they are disappointing the bulls who have bought into fantasies that are impossible to realize. We are re-opening this year but it's already mid-May and things are certainly not "normal" by any stretch of the imagination so why would the market be worth 30% more than the 2019 average of 26,500 on the Dow?

Did the economy grow 30%? No, it did not. Then where would these magic beans have come from that made this valuation beanstalk grow up to the clouds? We all know the answer – it's stimulus. There are not 30% more people in the World spending 30% more money with 30% more jobs – the opposite is closer to the truth after losing 3.3M people – roughly the population of Los Angeles. Another 160M people in the World have been infected and the jury is still out on the long-term effects of covid and the long-term drain on our our heath system for people with chronic conditions.

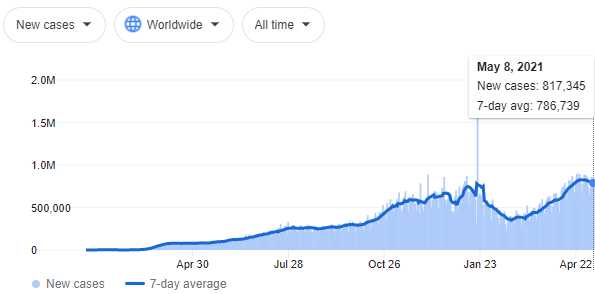

Out of 160M cases in the World, 64M of them are actively infected. The World has never had more active cases at one time. 817,345 people caught covid Saturday and we are partying like it's 1999. Ignoring reality is fun, we did it all the time when we were kids, so we have a lot of practice at it but ignoring reality when we're investing is foolish and we have to be careful of the narrative the Corporate Media and the Corporate Government are feeding us and try to look at things as they really are.

Out of 160M cases in the World, 64M of them are actively infected. The World has never had more active cases at one time. 817,345 people caught covid Saturday and we are partying like it's 1999. Ignoring reality is fun, we did it all the time when we were kids, so we have a lot of practice at it but ignoring reality when we're investing is foolish and we have to be careful of the narrative the Corporate Media and the Corporate Government are feeding us and try to look at things as they really are.

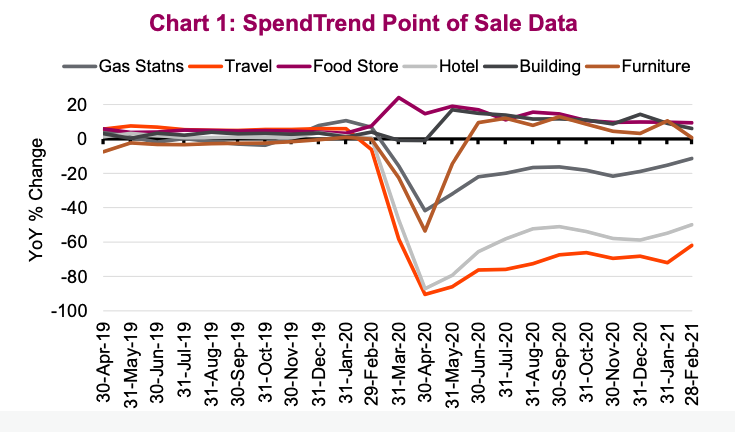

How great can things be for Airlines, Restaurants, Hotels, Retail, Energy… if most of the population is still at home, if office buildings are empty? Here's a chart of ACTUAL credit card spending in various sectors and you can see – even with Trillions of Dollars being handed out – that the drop in spending is nothing short of catastrophic. Of course Trillions of Dollars are also being given to these industries to make up for the shortfall and they are calling that money EARNINGS – because it does not need to be paid back and technically they are earnings – they earned their bailout – I guess….

So you, the investor, are paying inflated multiples for inflated earnings based on money you gave them because their business sucks. In REALITY (a place we've heard of but never visit anymore) the organic business is down and earnings are way off where they were in 2019 but the comps we are doing are against 2020 and everyone is oohing and ahing over how much better things are getting. It's like when Grandpa is able to open one eye at the hospital and he smiles and nods and everyone says what a "good day" he's having…

Notice these are "year over year" so, if you are down 50%, like Furniture was last April, it's not made up for by being up 10% now, is it? If your baseline is $10Bn in furniture and you are down 50% to $5Bn, being 10% up from $5Bn is $5.5Bn – not only have you done nothing to make up the 5Bn you lost last year but you're STILL operating 45% where you were in 2019. People don't understand how these charts work and make very poor decisions when reading them.

This is why we still love Wayfair (W) for a short. W has very much benefitted from Covid as people have been ordering furniture on-line but, based on 86% of reviews being negative, I don't see that this is a trend that will continue post-covid. Q1 Earnings were strong and revenues are running 50% ahead of 2019 but only 10% ahead of 2020 so the "growth" is slowing already and W made $185M last year and projected almost $500M this year but that's still no reason to pay $34Bn for the company (68x earnings) at $326. This is where we came in last time and, in our Short-Term Portfolio, we still have:

| W Long Put | 2022 21-JAN 300.00 PUT [W @ $325.94 $0.00] | 5 | 3/15/2021 | (254) | $30,500 | $61.00 | $-18.25 | $45.22 | $42.75 | $0.00 | $-9,125 | -29.9% | $21,375 | ||

| W Short Put | 2022 21-JAN 260.00 PUT [W @ $325.94 $0.00] | -5 | 3/15/2021 | (254) | $-21,000 | $42.00 | $-16.00 | $26.00 | $0.00 | $8,000 | 38.1% | $-13,000 |

We had originally sold the April $320 calls for $28 and those expired worthless for an $8,000 profit (we bougth them back a bit early) and the next earnings are early August so now we can sell 3 June $320 calls for $26 ($7,800) knowing that the August calls will be easy to roll to as they will have plenty of earnings premium. In fact, the Aug $360 calls are $36 – so that's where we'd roll to if W pops higher but what would the catalyst be now that earnings are past and they already jumped 20%?

We'll be looking at some other over-priced retailers today. Seeing the air come out of TSLA this Q makes me think there's a lot more to come.