"Transitory" Inflation is still here – month 5.

"Transitory" Inflation is still here – month 5.

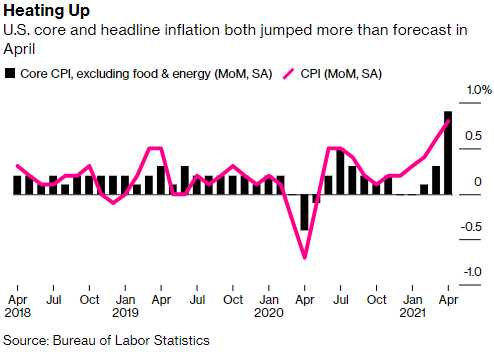

While the Fed tries to convince us it won't last, inflation is soaring higher and higher and bonds are dropping as that market doesn't believe a word the Fed is saying – especially after yesterday's decade-high 0.8% jump in Consumer Prices – double the projections by the usual crew of leading Economorons. How long inflation readings persist on the high side has implications for when the Fed decides to start withdrawing monetary stimulus by paring back bond-buying and raising interest rates from near zero.

“Transient does not mean one month. As supply shortages run up against aftershocks from fiscal stimulus, and the base for comparison remains low, the CPI will continue to run hot into the summer. The impact of the Colonial pipeline shutdown on fuel prices will also have to be monitored closely.” — Andrew Husby and Yelena Shulyatyeva, U.S. economists

“Transitory pandemic influences clearly contributed to the surprise but there’s residual firmness in core inflation that’s hard to ignore,” said Michael Gapen, chief U.S. economist at Barclays Plc. Aside from the reopening effect, “there was still some residual firmness that suggests risks around inflation in the near term are still skewed to the upside.” Wages have shown signs of picking up, and supply chain challenges have elongated delivery times and driven materials prices higher.

“Transitory pandemic influences clearly contributed to the surprise but there’s residual firmness in core inflation that’s hard to ignore,” said Michael Gapen, chief U.S. economist at Barclays Plc. Aside from the reopening effect, “there was still some residual firmness that suggests risks around inflation in the near term are still skewed to the upside.” Wages have shown signs of picking up, and supply chain challenges have elongated delivery times and driven materials prices higher.

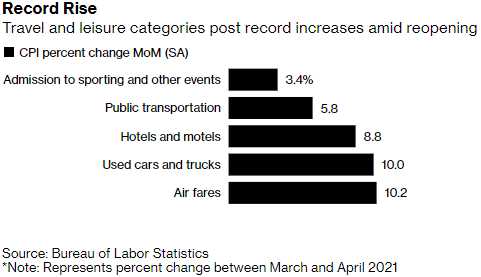

Tranportation Services have not jumped 5.8% since 1975, when the Fed Funds Rate was at 7%. More Federal Spending means more inflation, not even Powell can pretend that it doesn't and Biden still has proposals to spend $4Tn more on Infrastructure along with the Fed's ongoing $2Tn giveaway program and, of course, 0% borrowing rates. If either the stimulus bill is dropped or the Fed allows rates to rise to contain inflation – the blowback on the market could be tremendous.

It's not just the $28Tn National Debt we need to be concerned about but the $10.5Tn of Corporate debt that is 100% higher than the last time the market crashed – as companies have been on a low-rate binge ever since. And what is the main thing corporations spend all that borrowed money on? Buying back their own stocks to make their static earnings look like they are making more money per share – by reducing the share count it's divided by.

Corp

Corporate debt is a bomb that is ready to explode. Companies borrowed $1Tn in the past 12 months, boosting apparent Corporate Profits by 20% and padding their available cash. 5-year Bond Yeilds are currently 1.33% but they went from 3% in 2003 to 8% in 2008 and the market collapsed – that's like going from 1.33% to 2.5%, which would still be a mile below the historical lows. While we long for a return to "normal" – we certainly can't afford it!

Meanwhile, the Nasdaq faces a critical test of the 13,000 line and, after falling from 14,000, a weak bounce is at 13,200 and a strong one at 13,400. Finishing the week below 13,400 indicates we're likely to fail 13,000 next week – continuing the downtrend. In an early sign of a bursting bubble, tech stocks that don't actually make money yet (the kinds I keep telling you to stay away from) have fallen almost 20% this year.

Meanwhile, the Nasdaq faces a critical test of the 13,000 line and, after falling from 14,000, a weak bounce is at 13,200 and a strong one at 13,400. Finishing the week below 13,400 indicates we're likely to fail 13,000 next week – continuing the downtrend. In an early sign of a bursting bubble, tech stocks that don't actually make money yet (the kinds I keep telling you to stay away from) have fallen almost 20% this year.

According to Leuthold Group, the S&P 500 Index is at risk of falling 37% should its multiples to sales and earnings return to their mean levels since 1995. The FAAMG premium over the market could shrink by another 24% if they go back to the mean over the seven years before the 2020 pandemic. It’s a reason Leuthold’s core portfolio this week trimmed its equity holdings by 3 percentage points to 55%.

Tech megacaps such as Microsoft (MSFT) and Apple (AAPL) are examples of how sentiment may be shifting. Both saw mediocre share reactions to strong earnings reports. While the FAAMG group has seen its price-earnings multiple shrink from its peak, it still fetches a 24% premium relative to the rest of the S&P 500. That compared with a P/E spread of just 7.3% five years ago, according to data compiled by Bloomberg Intelligence.

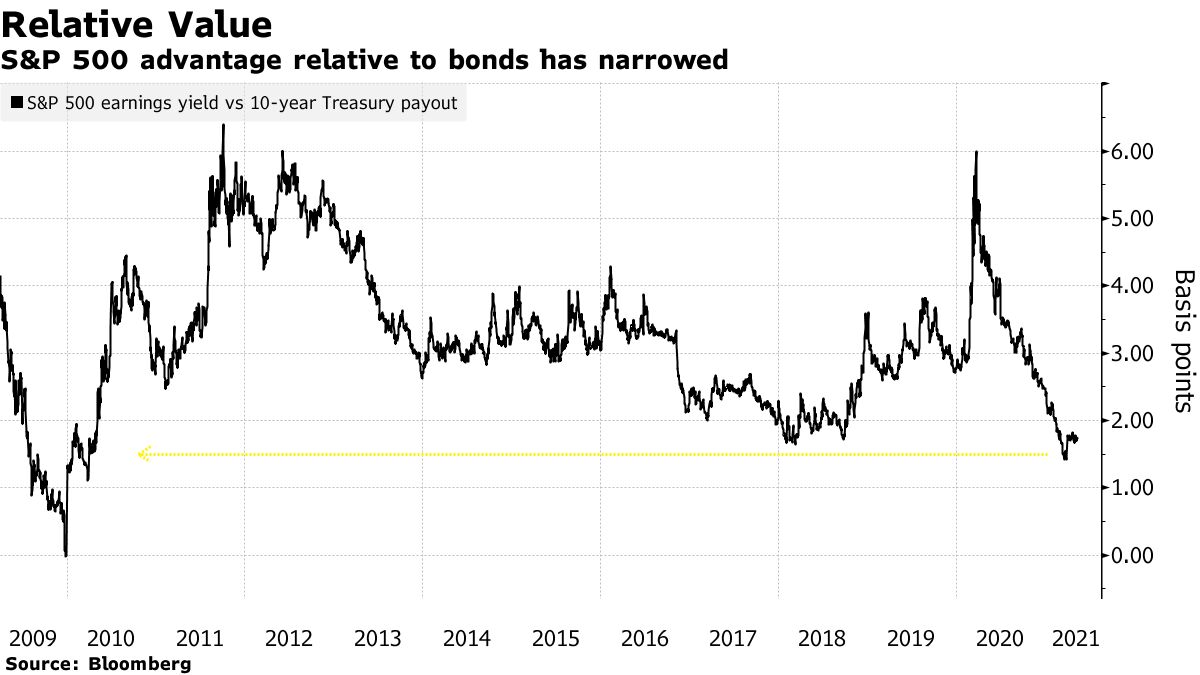

“The FAAMG bubble is deflating and should continue to do so as risk-tolerance heals and investors position for sustainable recovery,” said Martin Adams at Bloomberg Intelligence. “Valuations have dropped, but there is room for the group’s premium to fall.” For years, one pillar of support for equity valuations has been the rock-bottom interest rates that the Fed put in place to spur growth. Now, as the economy reopens, many investors see the only path for rates is up. That’s a problem, because relative to bonds, stocks are already less attractive than any time in a decade.

Based on a methodology sometimes called the Fed model, the S&P 500’s earnings yield — how much profits you get relative to share prices — is about 1.7 percentage points above the yield on the 10-year Treasuries. That’s close to the smallest advantage since 2010. Should 10-year yield climb to 2%, the S&P 500 would have to fall by 8% to keep the equilibrium, all else equal. The 10-year yield recently sat near 1.7%.

Be very careful out there!