Only down 5% (since April).

Only down 5% (since April).

The Dollar may have found a floor but probably not as it's down 5% in 50 days so up 1% (90.50) would be a weak bounce and 91.50 is the strong bounce line, which we already failed on the way down in early May. The bouncing Dollar is giving the commodity rally a rest since commodities are priced in Dollars (so they go down when it goes up) but gold is just under $1,900 and it looks like we'll see $2,000 and, if BitCoin goes out of fashion – gold may be the next thing that blasts off as the World's favorite collectable non-currency.

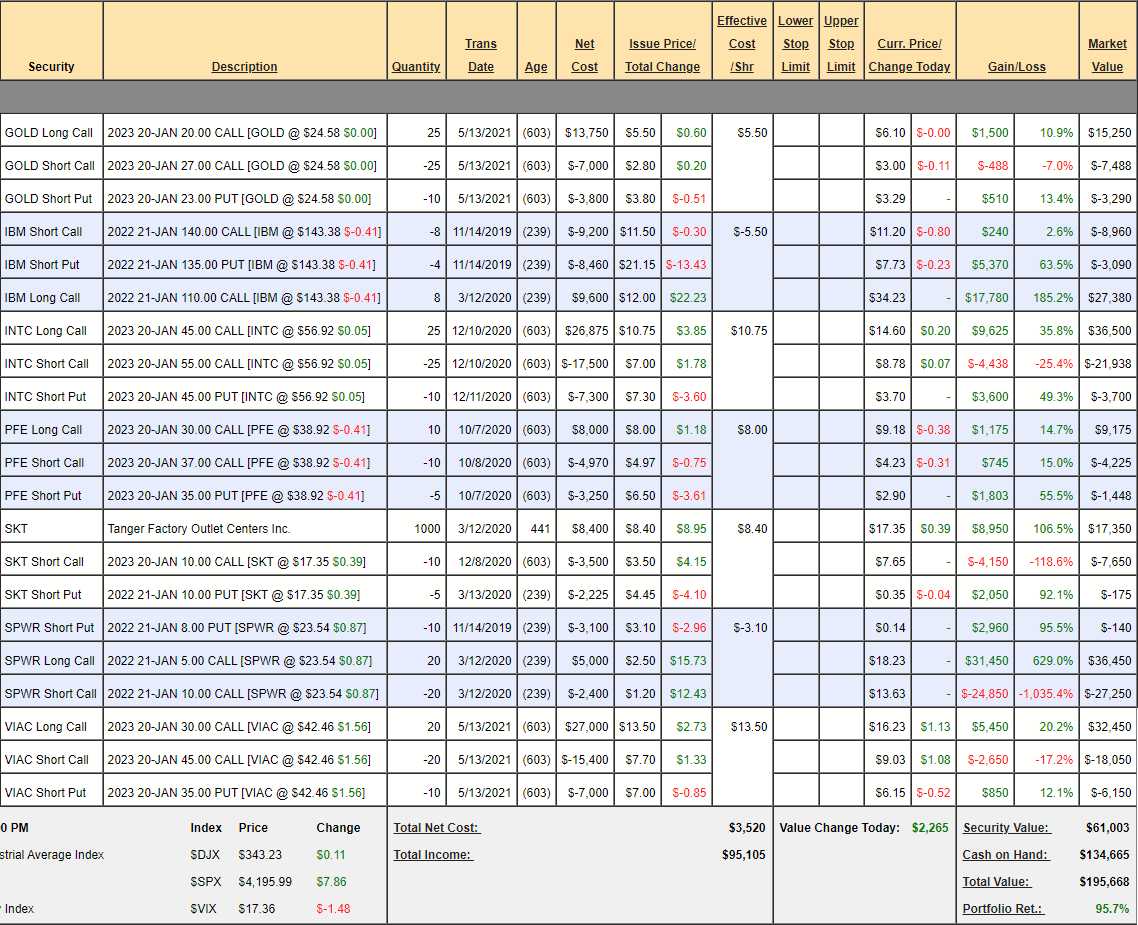

We added Barrick Gold (GOLD) back to our Money Talk Portfolio in our last review and it's already up $1,500 in two weeks but still only net $4,472 on the $17,500 spread so there's $13,028 (291%) left to gain – even if you did miss out on the first 50% gain. Remember, I can only tell you what's likely to happen in the markets and how to profit from it – the rest is up to you. Our Money Talk Portfolio now looks like this:

$195,688 is up $8,415 (4.4%) since our last review and that's fantastic since we're still 2/3 in CASH!!! The cash is our saftey net in this portfolio – we don't have any hedges and we can only adjust it when we do the Money Talk show, usually once per quarter. There were $77,978 worth of gains to be had from the above positions and now there's about $69,500 left to gain if all our positions work out. Since we're only using $61,003 for our positions – that's a very nice 18-month return on cash.

My other comments from that interview are worth a look too.

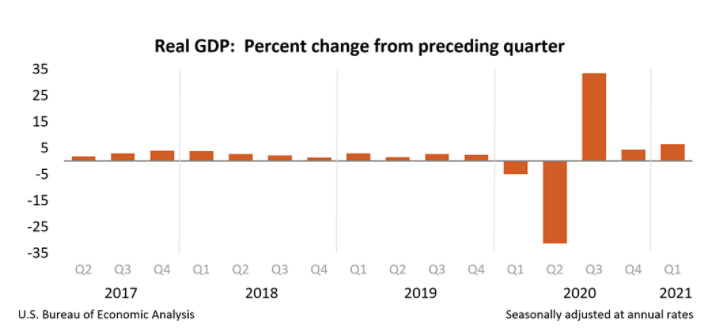

8:30 Update: GDP came in at 6.4% in the 2nd estimate of Q1, that's 0.1% lower than expected while the PCE is at 3.7% vs 3.5% expected and flying up from 1.7% in Q4. Core PCE was also up 0.2% at 2.5% and double 1.3% in Q4. Domestic Income is up 19.4%, mostly for the Top 0.000001% but yay for them! "Only" 406,000 people lost their jobs last week so that's getting better but Durable Goods for April were a disaster, going NEGATIVE 1.3% vs 0.7% expected by leading Economorons though, to be fair, it was really the very volatile Transportation numbers that took things down.

What does this mean? Nothing, there was $2.1Tn in stimulus in March so how can you draw any conclusions from what happened in Q1 or what happened in April after that distortion. What we can be sure of is $2.1Tn is more than 10% of our total GDP and the GDP growth for Q1 was 1.6% (6.4% is annualized), so, without the 10% boost, we'd be down about 8.4% for the quarter and that's down 25.6% annualized – how do you think that would play out in the media? That's why we pass these massive stimulus bills – to make things look good.

The poor Durable Goods number is actually good for the market as it keeps the Fed in play – giving them an excuse to keep the QE going for another quarter. The US is now $28.3Tn in debt (up $5.6Tn since the end of 2019) and running a $3.2Tn deficit (so far) this year and the Fed's Balance Sheet is at $10.3Tn – up from $4Tn pre-crisis so it's cost us $11.9Bn to buy this beautiful chart (so far):

Might as well enjoy it!