We're flying higher this morning.

We're flying higher this morning.

Not for any particular reason other than the post-holiday volume is very low and it's easy to manipulate the market so why not set a new high to open the new month? The Dow is almost at 35,000, S&P 4,225, Nasdaq 13,750 and Russell 2,300 and both the Russell and the Nasdaq are 50-points off their Spring highs still but it's a very impressive start nonetheless.

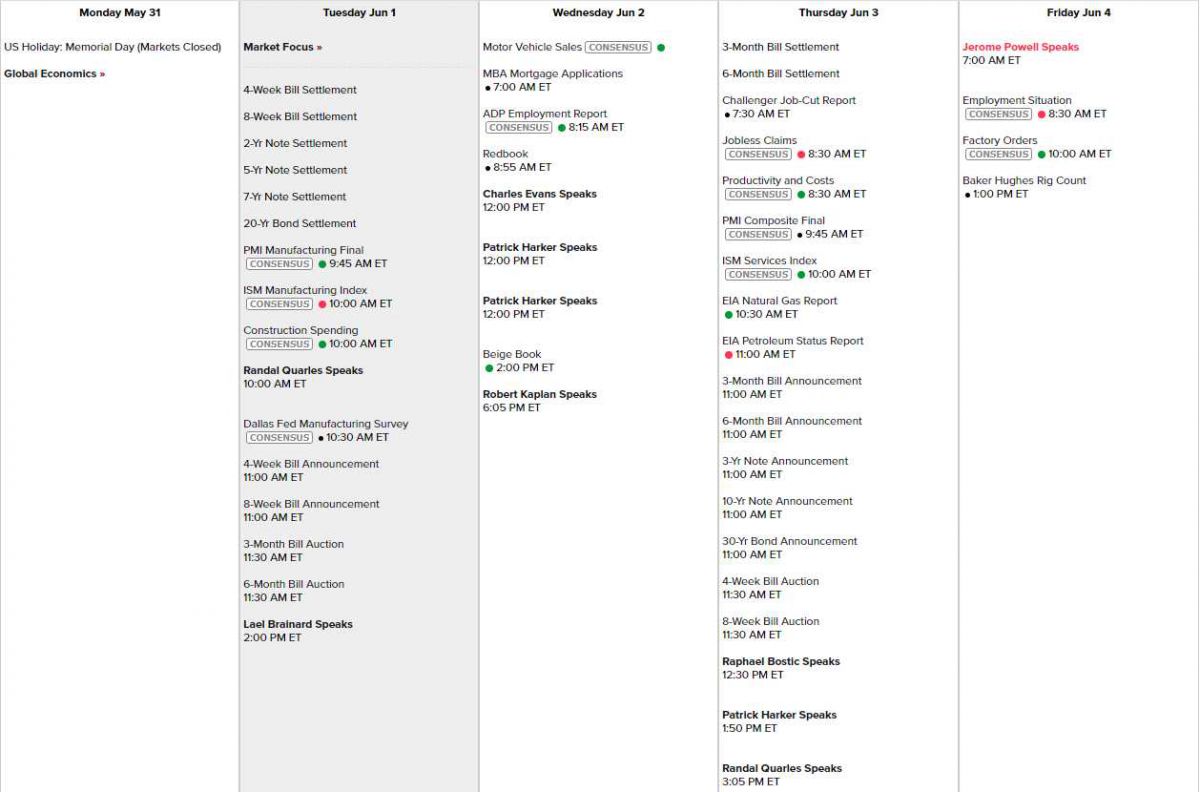

It's a short week and we have very little data, mostly PMI and ISM numbers with 9 Fed speakers plus Powell on Friday morning. We do have a look at the Beige Book tomorrow at 2pm but it's even going to be a slow earnings week – with very few major reports and nothing that's likely to move the market – one way or another:

Things are hardly back to normal at the beginning of month 6 of 2021 as evidenced by the weekend box office at the movies, which TOTALED $97M, $57M of which went to "A Quiet Place Part II" – that's about half of what a normal Memorial Day weekend brings in and part of that is because "Cruella", the other big show for the weekend, was also released on TV in this strange World we now live in – so it's hard to say the movies were a total disaster but I have ti imagine it's a harbinger for a disappointing weekend and that means I would like to take a poke at shorting Oil (/CL) Futures at the $68.50 mark – with tight stops above that line.

Things are hardly back to normal at the beginning of month 6 of 2021 as evidenced by the weekend box office at the movies, which TOTALED $97M, $57M of which went to "A Quiet Place Part II" – that's about half of what a normal Memorial Day weekend brings in and part of that is because "Cruella", the other big show for the weekend, was also released on TV in this strange World we now live in – so it's hard to say the movies were a total disaster but I have ti imagine it's a harbinger for a disappointing weekend and that means I would like to take a poke at shorting Oil (/CL) Futures at the $68.50 mark – with tight stops above that line.

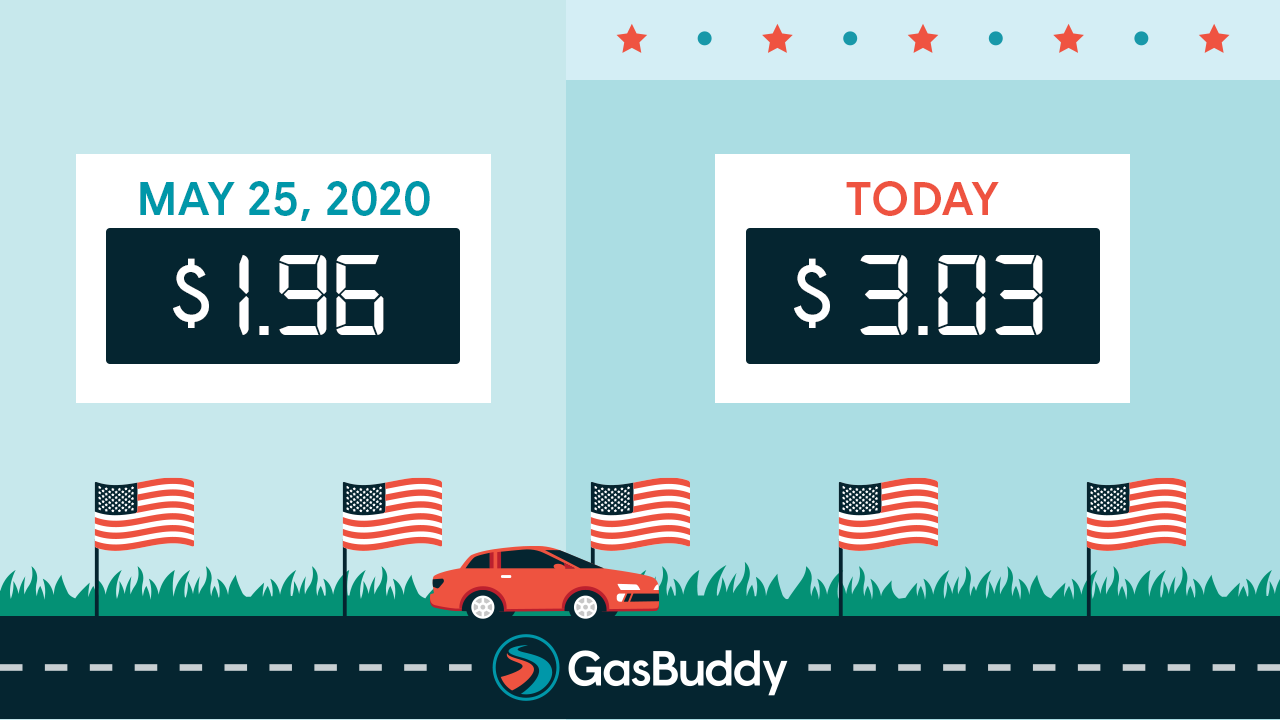

It looks to me that oil has gotten way ahead of itself though this week's Inventory Report, which is delayed until Thursday, will only show the pre-holiday levels – so we won't get a real indication of demand until next week – it could be a rough ride but I'd hate to miss the opportunity to catch a $2,000 per contract move down, back to $66.50. OPEC is also meeting today, so that's going to move things but it's most likely they reduce their production cuts – especially with the general consensus that demand will be back over the summer but, according to the tracking firm GasBuddy, demand is up 9.6% over the 4-year average which sounds impressive until you do the math.

Helping oil prices move higher was also the Dollar dropping back to 89.70 while we were trying to spend it this weekend. They haven't derailed Biden's $6Tn spending plan yet and that's keeping a lot of downward pressure on the Dollar as we'll have to run those printing presses 24/7 to keep up with the inflated demand for debt. In reality, 30% of the movie theaters (yes, back to that) aren't even open yet and the same is true for much of retail so the people who tell you the economy is back on track are simply idiots. Healthy economies don't have empty stores on Main Street – you KNOW that is true.

So it's the same old song and dance with Fiscal Stimulus propping up a slacking economy and everyone is pretending things are better than they really are – especially invesors but that's also because the market is the best of a lot of bad places to put your money at the moment since Bonds look like they are ready to collapse and housing is still scary and commodities have gotten expensive. BitCoin lost 43% of it's "value" in May and the same experts that told you that was the future are now telling you to buy stocks and lithium or whatever fad will bring them eyeballs instead so they can make ad revenues in exchange for lying to you. Enjoy.

Speaking of catching eyeballs, here's some news to start off the week:

Millions of Americans could face eviction as housing protection expires in June.

In Less Than Two Weeks, Millions Of Americans Will Lose Unemployment Benefits

U.S. Labor Market Recovery Plays Out Unevenly in States

The Worst-Kept Secret in America: High Inflation Is Back

Fed’s Taper Talk Is Pre-Emptive Strike Against Inflation Fears

ECB Spectrometer Suggests Ultra-Loose Policy Continuing

German Inflation Climbs to Highest Since 2018 as Lockdown Eases

Currency Wars Return: China Hikes FX Reserve Ratio For First Time In 14 Years In Bid To Weaken Yuan

Rabobank: The US And China Can No Longer Both Blow Bubbles At The Same Time

China Takes Its Most Visible Measure Yet to Curb Yuan’s Gain

Why China Is Struggling to Boost Its Birthrate

India Posts Record Fiscal Gap Amid Spending to Cushion Economy

U.S. Cases Drop by Half in May; India Passes Peak: Virus Update

Iran and World Powers Begin ‘Final Round’ of Nuclear Talks.

Oil Exceeds $67 as Demand Outweighs Prospect of More OPEC+ Oil

OPEC+ Talks to Offer Clues on Next Phase of Oil Supply Revival

Hedge Funds Keep Cutting Their Bullish Wagers on Commodities

Surging prices may only be beginning; where you're going to feel the squeeze

For DoorDash and Uber Eats, the Future Is Everything in an Hour

Intel CEO Pat Gelsinger Says Semi Shortage Could Last "A Couple Years"

CLOs Join The Everything Bubble

Apple’s massive success with CarPlay paves the way for automotive ambitions