Efforts are, of course, being made, to end the quarter on a good note but it's only June 7th, so three more weeks of this ahead. We still have earnings trickling in but the bulk of them have been put to bed and, although GameStop (GME) will be interesting on Wednesday – there's nothing here that's likely to move the market very much.

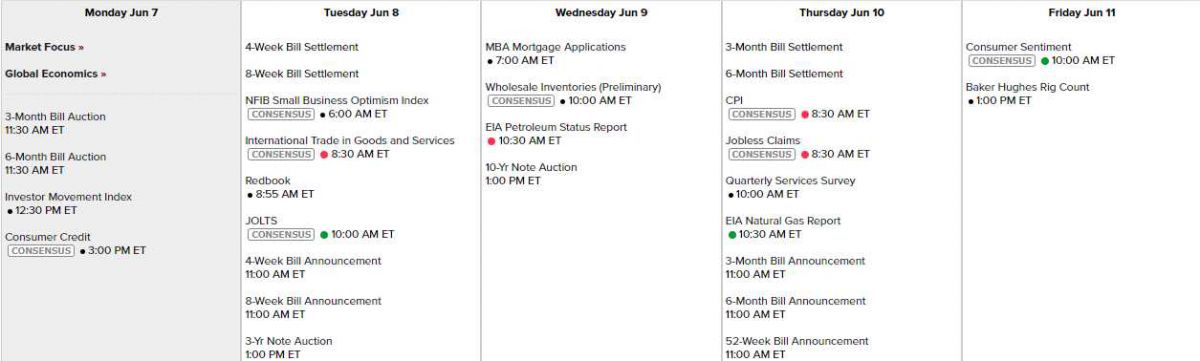

That leaves us with Data and there's not much of that this week either with Consumer Credit this afternoon (yawn), Small Business Optimism tomorrow, a 10-Year Note Auction on Wednesday (that might go badly), CPI Thursday and Consumer Sentiment Friday so, other than signs of inflation near the week's end – there's nothing likely to derail this market train, which is on a very bullish track at the moment.

Unfortunately, Biden is still talking to Republicans about Infrarstructure – despite Friday's deadline coming and going. He's leaving for a foreign road trip on Wedndesday so this will likely be the last chance for Republicans to have a say but I'm surprised he's giving them more time as there's been no progress on that side.

Half of Biden's Infrastructure Bill has already morphed into an Industrial Policy Bill that will promote US Manufacturing and that has the support of Republicans as it's being packaged as a way to compete with China – which they love to talk about. Also, it's a fantastic way to shovel more money to the Top 1%, which is something else the Republicans love to do.

What is most striking about the legislation is the degree to which the projects that the bill funds closely parallel those in China’s “Made in China 2025” program, which funnels huge government spending into technologies where the country is seeking to be independent of outside suppliers. The Chinese government announced its initiative six years ago. Senator John Cornyn, a Conservative Texas Republican who has been critical in the past of government funding of Industry, said of the semiconductor funding, “Frankly, I think China has left us no option but to make these investments.”

The G7 has backed a Global Minimum Tax Rate of 15%, which is more than the average US company pays (12%) and will hopefully stop all this nonsense of companies shuffling their books to keep earnings from being taxes. Over the weekend, Janet Yellen once again called inflation "transitory" but what else can she do when Central Banks added $7Tn to their balance sheets last year and simply don't have any firepower left to fight with? If inflation comes along, the central bank governor is in a pickle. Raise rates, and the government screams. Keep them low, and you prove that your independence (and credibility to fight inflation) has gone.

We'll see how the week progresses but we're off to a good start with the indexes looking green this morning, on a low-volume Monday.