Wheee, this is fun!

Wheee, this is fun!

We've been shorting Oil (/CL) Futures at the $69.50 line since last week and we featured that play during last week's Live Trading Webinar. On Friday morning, in our PSW Report, I made the following call for our Members:

With all the heaving and hoing the market has done this week, we haven't actually gone anywhere – even with this morning's pop. We're clearly consolidating at S&P 4,200 but whether it's for a move up or down remains to be seen. Oil (/CL) is popping to $69.50 into the weekend and we are going to short into the weekend. We started shorting (again) at $68.50, so another round here will give us an average of $69 and then we take 1/2 off when we get back to $69 and we're left with our original short at a higher strike over the weekend – so that's the plan.

So at $68.50, we are happy with $1,000 gains per contract and we take 1/2 (2 in this case) off the table and set a stop at $69 on the last two (trailing 0.25 once we get below $68.50) to lock in at least $750 per contract as an average gain – which is still pretty good for a couple of days' "work." We don't want to play with oil shorts for too long as the July 4th weekend is coming and that should be another excuse to jack up prices and THEN we will go back to shorting.

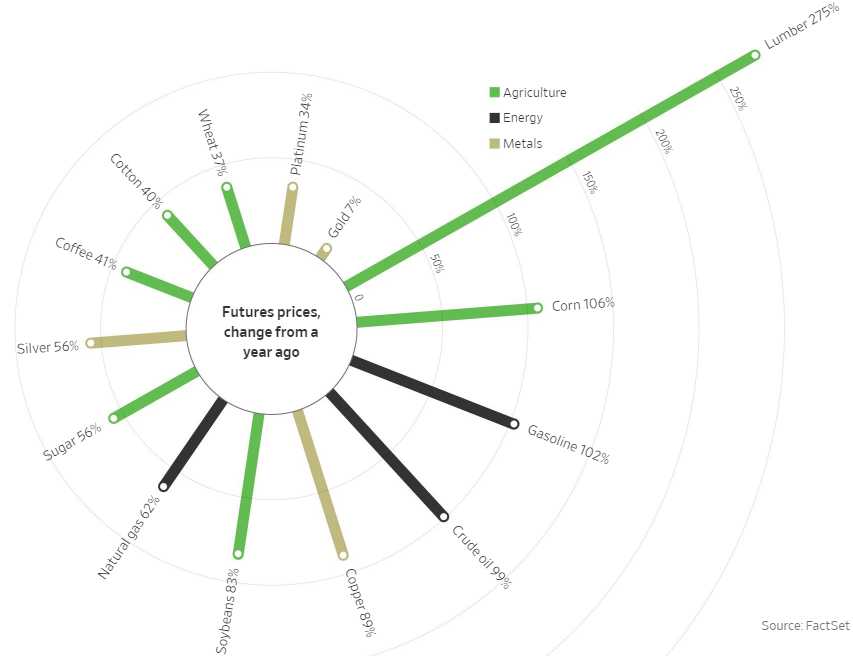

Oil is not the only commodity that's been flying higher: Lumber, iron ore and copper have hit records. Corn, soybeans and wheat have jumped to their highest levels in eight years. Oil, for it's part, just reached a two-year high. China’s producer-price index, a gauge of factory-gate prices, could climb to its highest level since August, 2008 on Wednesday amid rising commodity prices. All these commodities are competing for the same money – that's why we don't see oil particularly taking off. More likely, these high prices will lead to a slowdown of activity in the near future.

Oil is not the only commodity that's been flying higher: Lumber, iron ore and copper have hit records. Corn, soybeans and wheat have jumped to their highest levels in eight years. Oil, for it's part, just reached a two-year high. China’s producer-price index, a gauge of factory-gate prices, could climb to its highest level since August, 2008 on Wednesday amid rising commodity prices. All these commodities are competing for the same money – that's why we don't see oil particularly taking off. More likely, these high prices will lead to a slowdown of activity in the near future.

Manufacturers’ profit margins are shrinking because of higher costs for raw materials. Households are paying more for gas, groceries and some restaurant bills, curbing their ability to spend elsewhere. In poorer countries, some are going without basic needs entirely.

“We are being hit from every possible angle,” said Franz Hofmeister, chief executive of Quaker Bakery Brands Inc. in Appleton, Wis. He says his costs for items including wheat, energy and new aluminum equipment have shot up at least 25% to 35% this year. Customers protested when his firm lifted prices for pizza crusts, burger buns and other goods by as much as 8%, but more increases might be needed. “The scary thing is, we don’t really see an end in sight to these cost pressures,” he said.

And prices are not climbing for no reason – there are actual shortages of materials. Languishing commodity prices led producers to slash capital spending on major resources by nearly half over the last decade, shrinking stocks of industrial metals to two-decade lows and reducing supplies across commodities. The crunch is now converging with a buying spree in key markets via Infrastructure Spending aimed at stimulating economies and that is supercharging prices – there is no quick fix for this.

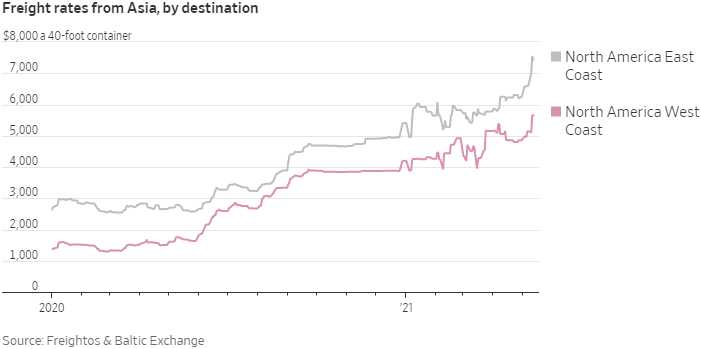

Bottlenecks in the shipping industry are giving some commodity prices a leg up. The pandemic, and the surge in demand for goods sparked by stay-at-home orders, threw supply chains into disarray. In the container shipping industry, the disruption remains acute. Traders face weeks-long delays to move materials from Asia to the U.S. and Europe. The result is localized shortages in the West, just as demand is climbing. Plus, traders are paying several times more for a berth on container ships than on the eve of the pandemic. They pass that cost on to customers in the form of higher commodity prices.

Bottlenecks in the shipping industry are giving some commodity prices a leg up. The pandemic, and the surge in demand for goods sparked by stay-at-home orders, threw supply chains into disarray. In the container shipping industry, the disruption remains acute. Traders face weeks-long delays to move materials from Asia to the U.S. and Europe. The result is localized shortages in the West, just as demand is climbing. Plus, traders are paying several times more for a berth on container ships than on the eve of the pandemic. They pass that cost on to customers in the form of higher commodity prices.

The consequences of underdeveloped global resources now stoke worries among regulators and companies that producer price inflation—buoyed by demand projections that in key materials stretch decades ahead—is becoming sufficiently broad and prolonged that it spills onto consumer prices. Raw-material shortages sometimes morph into broader market dysfunction that force companies to cut or shut production, as some car makers have done in recent months because of limited semiconductor supply.

As our NAK players know, it can take years to get a new mine up and running and the Fed and others calling these spikes "transitory" scare off long-term investors so it can be a long time or never before supply imbalances are corrected. That means prices will keep going higher until we hit the point of unaffordability, which causes demand to drop. BUT, if the Government is printing money and greenlighting projects which require them to buy commodities AT ANY PRICE – when will it all end and how much damage will consumers suffer on the sidelines?