49,343,700.

49,343,700.

That's all the trading on SPY yesterday. The average volume is 100M, but we only hit that one time in the whole month of June and, in those big (relatively) volume days of June 16th, 17th and 18th, SPY fell 5% – what is going to happen to this market if people really try to sell their holdings en masse?

There's a very strong correlation in this market, and any toppy market, between volume and direction. When the volume is low, the automatic buying done by ETFs (there are very few short ETFs) floats the market higher as they simply buy at market prices at the day's end. That's why you have all those late-day rallies. If there are not a lot of people selling (complacency), the market drifts higher. And who is putting in this "dumb money" every day? Well you are – it's your 401K, your IRA, your 529 plan that is doing this. That's where most of the ETF money comes from…

| Date | Open | High | Low | Close* | Adj Close** | Volume |

|---|---|---|---|---|---|---|

| Jun 23, 2021 | 423.19 | 424.05 | 422.51 | 422.60 | 422.60 | 49,343,700 |

| Jun 22, 2021 | 420.85 | 424.00 | 420.08 | 423.11 | 423.11 | 57,700,300 |

| Jun 21, 2021 | 416.80 | 421.06 | 415.93 | 420.86 | 420.86 | 72,822,000 |

| Jun 18, 2021 | 417.09 | 417.83 | 414.70 | 414.92 | 414.92 | 118,573,500 |

| Jun 17, 2021 | 421.67 | 423.02 | 419.32 | 421.97 | 421.97 | 90,949,700 |

| Jun 16, 2021 | 424.63 | 424.87 | 419.92 | 422.11 | 422.11 | 80,386,100 |

| Jun 15, 2021 | 425.42 | 425.46 | 423.54 | 424.48 | 424.48 | 51,508,500 |

| Jun 14, 2021 | 424.43 | 425.37 | 423.10 | 425.26 | 425.26 | 42,358,500 |

| Jun 11, 2021 | 424.20 | 424.43 | 422.82 | 424.31 | 424.31 | 45,570,800 |

| Jun 10, 2021 | 422.96 | 424.63 | 421.55 | 423.61 | 423.61 | 51,020,100 |

| Jun 09, 2021 | 423.18 | 423.26 | 421.41 | 421.65 | 421.65 | 48,436,300 |

| Jun 08, 2021 | 423.11 | 423.21 | 420.32 | 422.28 | 422.28 | 47,134,300 |

| Jun 07, 2021 | 422.59 | 422.78 | 421.19 | 422.19 | 422.19 | 51,555,000 |

| Jun 04, 2021 | 420.75 | 422.92 | 418.84 | 422.60 | 422.60 | 55,938,800 |

| Jun 03, 2021 | 417.85 | 419.99 | 416.28 | 418.77 | 418.77 | 58,138,800 |

| Jun 02, 2021 | 420.37 | 421.23 | 419.29 | 420.33 | 420.33 | 49,097,100 |

| Jun 01, 2021 | 422.57 | 422.72 | 419.20 | 419.67 | 419.67 | 54,216,600 |

And what else do ETFs do? They rebalance – which is to say they tend to reallocate capital to match the index they are tracking which means they effectively chase the high-flying stocks. So who are the idiots who buy stocks when they hit new highs – that's you too! Now, when sentiment changes, that's a different problem as the ETFs begin to engage in program selling but, since they were the primary buyers on the way up – they find no one to buy their stocks on the way down but they sell at market anyway – and prices plumet.

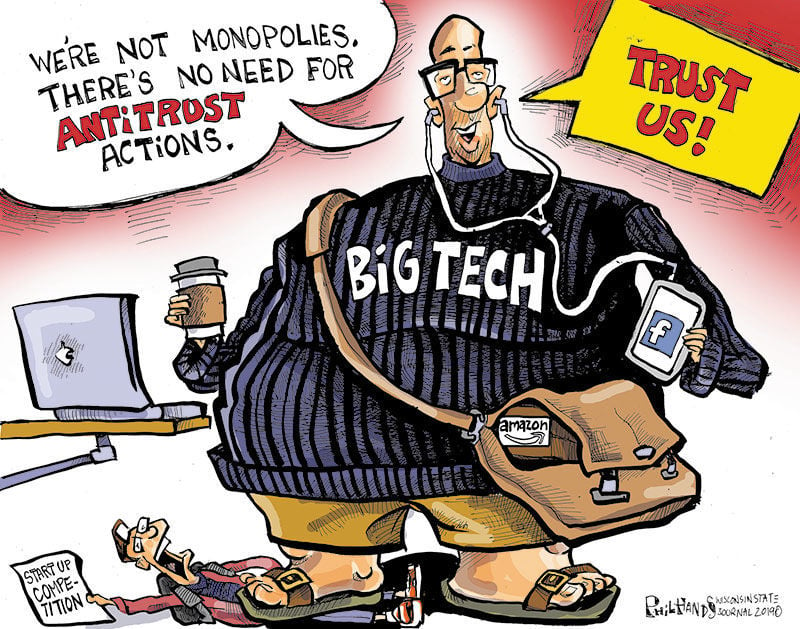

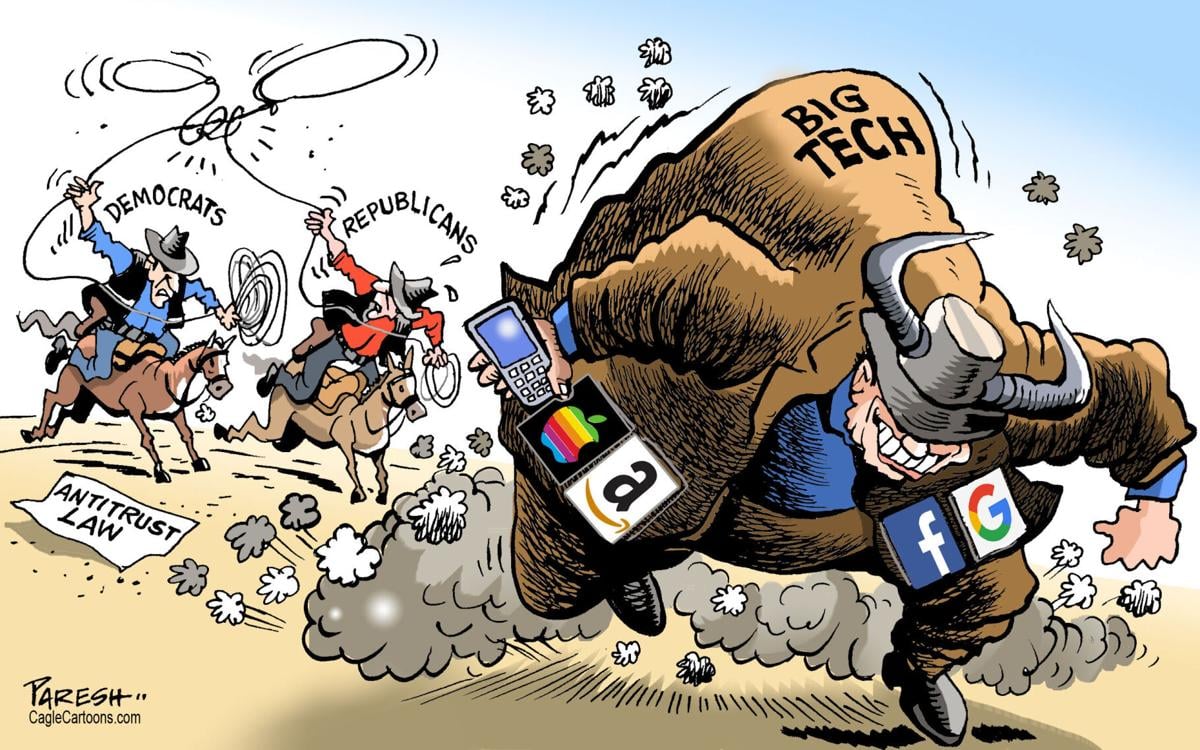

That's why I want you to be especially careful with the Nasdaq (our primary short) as a House Committee just approved far-reaching legisltation to CURB THE MARKET DOMINANCE OF TECH GIANTS. The centerpiece of the six-bill package, a measure to bar big tech companies from favoring their own products in a range of circumstances on their platforms, was approved early Thursday by a vote of 24 to 20.

That's why I want you to be especially careful with the Nasdaq (our primary short) as a House Committee just approved far-reaching legisltation to CURB THE MARKET DOMINANCE OF TECH GIANTS. The centerpiece of the six-bill package, a measure to bar big tech companies from favoring their own products in a range of circumstances on their platforms, was approved early Thursday by a vote of 24 to 20.

Known as the American Choice and Innovation Online Act, the legislation would prohibit big platforms from engaging in conduct that advantages their own products or services, or disadvantages other business users, or discriminates among similarly situated business users – which is pretty much their entire business model!

The package was the culmination of a lengthy investigation by a House antitrust subcommittee. It found that the big tech companies have leveraged their dominance to stamp out competition and stifle innovation, adding that Congress should consider forcing them to separate their platforms from other business lines.

Taken together, the bills represent the beginnings of an effort by many in Congress to reinvigorate antitrust enforcement among high-tech companies by updating laws they say have fallen behind. Rep. David Cicilline (D., R.I.) said the unchecked power of the biggest tech companies threatens economic fairness and even American democracy itself. “At its core, this issue is fundamentally about whether or not we have an economy where businesses fighting for economic survival can actually succeed,” Mr. Cicilline said.

It's not just the US that is looking to reign in Big Tech. The last 5 years of US politics has warned Governments around the World that Social Media can raise up and bring down Governments and I wouldn't be surprised to see a major "News" campaigns shortly that will tell you how Congress is attacking your freedom to be a drone in the matrix. Your life, or at least the Data about your Life, is a product that is bought and sold by Big Tech and those pesky Democrats, like Keanu Reeves, are concerned about that being a bad thing.

It's not just the US that is looking to reign in Big Tech. The last 5 years of US politics has warned Governments around the World that Social Media can raise up and bring down Governments and I wouldn't be surprised to see a major "News" campaigns shortly that will tell you how Congress is attacking your freedom to be a drone in the matrix. Your life, or at least the Data about your Life, is a product that is bought and sold by Big Tech and those pesky Democrats, like Keanu Reeves, are concerned about that being a bad thing.

Three years ago, the Supreme Court issued a ruling that appeared to reaffirm Americans’ right to privacy in the digital age. It turns out that all the government really needs is cash and a data broker. Government agencies – as several publications have reported – have discovered ways around what seemed to be robust constitutional protections for sensitive location information. They are engaging in creative legal interpretations and secretly exploiting gaps in the law to buy Americans’ personal information from intermediaries. This practice of buying Americans’ data has become routine, effectively hollowing out both Carpenter vs United States and privacy safeguards enacted by Congress.

Key to this activity is the proliferation of entities that collect, package and sell Americans’ information. The government no longer needs to compel the production of location data from Verizon or T-Mobile, because there are innumerable cellphone apps that gather and track precise geolocation coordinates (along with a wealth of other personal data). I personally saw a demo of a package from one of the Credit Reporting Agencies that is available to any mortgage broker with a reason to verify your data and it told me where you work, where you shop, who you associate with (and who they associate with), what you own, what cars you drive (data comse from Toll Cameras that Face ID you driving whatever license plate) and all sorts of other things that you would think are private.

Of course, most of us are in the "so what, I have nothing to hide camp" but don't you get junk mail from people who seem to know way too much about you? How do you think identities are stolen? In fact, here's something fun you can do today. Go on social media like Facebook or Twitter and mention a vacation place or a hobby and then pay attention to what adds you see popping up all over the place wherever you connect to the net – it is kind of disturbing once you start paying attention.

Advances in technology have eroded Fourth Amendment protections as well as created major gaps in our privacy laws. The Supreme Court has made clear, however, that we don’t forfeit our constitutional privacy rights simply because so much of our personal information lies in the hands of companies. To prevent the government from buying its away around those rights, we need to rewrite privacy rules for the age of apps.

As more and more Governments look to reign in the madness and politicians start popping those red pills, it's going to be a bumpy ride for big tech and, with Big Tech accounting for about 20% of the market cap in the US these days – a bumpy ride for them is going to be very contagious. About $300Bn worth shares are traded on the S&P 500 each day and they are bought and sold in near-balance but what happens if AAPL ($2.2Tn) falls 10% and you need to find $220Bn worth of buyers? Add another $500Bn from the other Trillion-Dollar companies and you can see where unwinding just big tech could swamp the indexes for a week or more.

Be careful out there!