Best week since April!

Best week since April!

We're up 2.5% this week and sure, it's a low-volume rally based on Powell's promises that inflation isn't real and there's plenty of free money backed by Biden saying the Government will print even more money and nobody seems to think debt matters anymore so PARTY!!! “That also reassures the market that the Fed will not be overly hawkish in their tightening policy,” said Peter van der Welle, a strategist at Robeco. At the same time, “the infrastructure deal also portrays that the fiscal thrust is still very much with us,” he added.

Of course, the Dow still isn't back to the May/June highs but an optimist would say that means we have 1,000 points more to climb and who isn't a market optimist these days? The S&P 500 is at new highs (4,260) and the Nasdaq is testing 14,400 and the Russell is almost back to 2,375, where it was in March, when we were being promised $2.2Tn in Infrastrucuture. So now we're getting $1Tn – that's just as good, right?

Any excuse for a low-volume rally and Gasoline (/RB) is back at decade highs – even though we're using substantially less of it. What differecne does that make? Consumers have money and our Corporate Masters have all the data they need to figure out the best way to squeeze it out of you. They know what buttons to push and when to push them, don't they?

Any excuse for a low-volume rally and Gasoline (/RB) is back at decade highs – even though we're using substantially less of it. What differecne does that make? Consumers have money and our Corporate Masters have all the data they need to figure out the best way to squeeze it out of you. They know what buttons to push and when to push them, don't they?

And what could possibly go wrong, just check out the headlines from the Corporate Media (WSJ front page):

- Stock Futures Point to Best Week Since April for S&P 500

- Consumers Are Back Out Spending, Driving the Recovery

- Biden, Senators Agree to $1 Trillion Infrastructure Plan

- Fed Gives Big Banks Clean Bill of Health in Latest Stress Test

- The Economic Recovery Is Here. It’s Unlike Anything You’ve Seen.Unlike Anything You’ve Seen.

Wow, all this great news makes me want to run out and buy stocks before the Nasdaq hits 30,000!

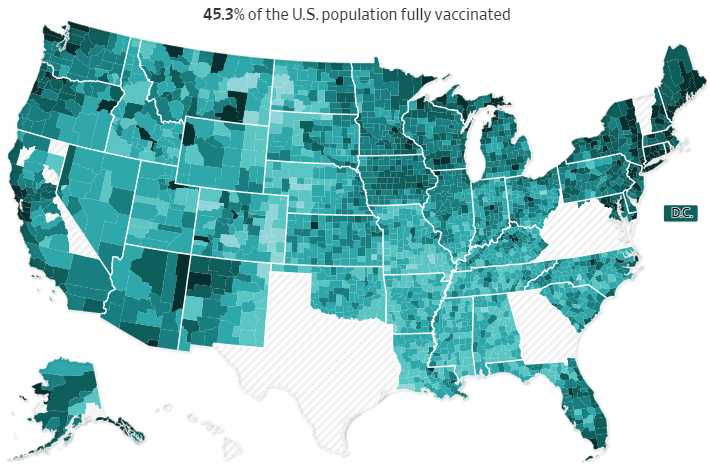

Oops, forgot about that, didn't we? Well, it's only Sydney – they are on the other side of the World. When did a virus on the other side of the World have anything to do with us, right? They say those that forget the past are condemned to repeat is but is this even the past? Aren't we still kind of in the same crisis? I don't know, it's hard to remember with all the bullishness. After all, ONLY 12,436 people in the US caught Covid YESTERDAY and ONLY 375 people died of the disease YESTERDAY – it's not like it's a problem or anything, right?

Oops, forgot about that, didn't we? Well, it's only Sydney – they are on the other side of the World. When did a virus on the other side of the World have anything to do with us, right? They say those that forget the past are condemned to repeat is but is this even the past? Aren't we still kind of in the same crisis? I don't know, it's hard to remember with all the bullishness. After all, ONLY 12,436 people in the US caught Covid YESTERDAY and ONLY 375 people died of the disease YESTERDAY – it's not like it's a problem or anything, right?

Cruise ships are starting to sail agin – that's a GREAT idea, right? Even better – some cruise lines don't require you to be vaccinated to sail. They don't even require their workers to be vaccinated. That is f'ing unbelievable! Even more unbelievable is that Florida Governor, Ron DeSantis, has banned the concept of vaccine passports in the state.

What do unvaccinated people do on cruises? They spend a week together in a very tight space taking occasional breaks to walk around other countries, insuring maximum exposure to every possible variant. Then, before an infection is likely to show up in a test – they head straight back to the airport and get in close proximity to another 200 people plus thousands more at airports all over the country. What could possibly go wrong? Oh yes, and their kids go back to school, of course – all such great ideas!

In Texas (another state cruise ships leave from), 59% of Republicans surveyed said they are either reluctant to be vaccinated or refuse to take it outright. But the trend among Republicans is nationwide. A Civiqs poll updated in March indicated that white Republicans make up the largest demographic of people in the U.S. who remain vaccine hesitant with 53% saying they were either unsure about or not getting the vaccine.

Most hesitancy among Republicans stems from a distrust of scientists and an unfounded concern about how new the vaccine is, said Timothy Callaghan, an assistant professor of health policy management at the Texas A&M School of Public Health. “What you do find is that over time conservatives have been more vaccine hesitant than liberals, which you can largely attribute to higher levels of distrust in the scientific establishment among conservatives,” Callaghan said.

Gosh, I wonder where all these crazy ideas came from?

Have a great weekend,

– Phil