Things are looking good.

Things are looking good.

The markets are holding up and Brett Kavanaugh sided with the Liberal judges on the Supreme Court and gave 4.2M homeowners another month before they are evicted from their homes. In a hot real estate market, it was the National Association of Realtors that brought the suit to the Supreme Court, trying to evict all the people who are behind on their mortgages so they can collect commissions selling and renting the houses – what could be more American than that? Justice Kavanaugh issued a one-paragraph concurrence explaining his views, saying he believed the moratorium was unlawful but was willing to leave it in place for July.

After that, it's open season on distressed families and we can happily add about 10M people to the ranks of the homeless. But how about those open houses! "One man's suffering is another man's commissions" – as Jesus used to say… The four other Conservative justices – Clarence Thomas, Samuel Alito, Neil Gorsuch and Amy Coney Barrett – indicated they would have lifted the moratorium. They also insisted that women in those poor familes be forced to have babies, so that they too could be thrown out onto the streets. "Love them until the day they are born – and then let them suffer their whole lives" – as Jesus used to say….

The moratorium is based on public-health concerns. The CDC found that mass evictions could accelerate the spread of Covid-19 because displaced tenants would likely move in with friends and family if not into shelters or settings in proximity with others. The moratorium was originally set to expire Dec. 31, 2020, but Congress extended it until late January, and the CDC has extended the order three times. .

The moratorium is based on public-health concerns. The CDC found that mass evictions could accelerate the spread of Covid-19 because displaced tenants would likely move in with friends and family if not into shelters or settings in proximity with others. The moratorium was originally set to expire Dec. 31, 2020, but Congress extended it until late January, and the CDC has extended the order three times. .

Local governments across the U.S. have struggled to quickly distribute approximately $47 Billion of rental assistance authorized by Congress, with some complaining that their staffs are being deluged by a flood of aid requests. Numerous renters are being disqualified for failing to correctly complete their applications, local officials say.

The problem is, of course, that $47Bn won't do anything but catch people up on their back rent – it doesn't help with their current rent so the tenant still has to go and they don't have money to put down on a new home or apartment either. Also, moving is expensive. This isn't just about Covid – a 23% rise in housing prices since the crisis started along with 10% inflation has, logically, made 4.2M out of 110M us homes unaffordable. Probably more than that as lots of people are struggling to pay their rents but haven't yet fallen far enough behind to get evicted.

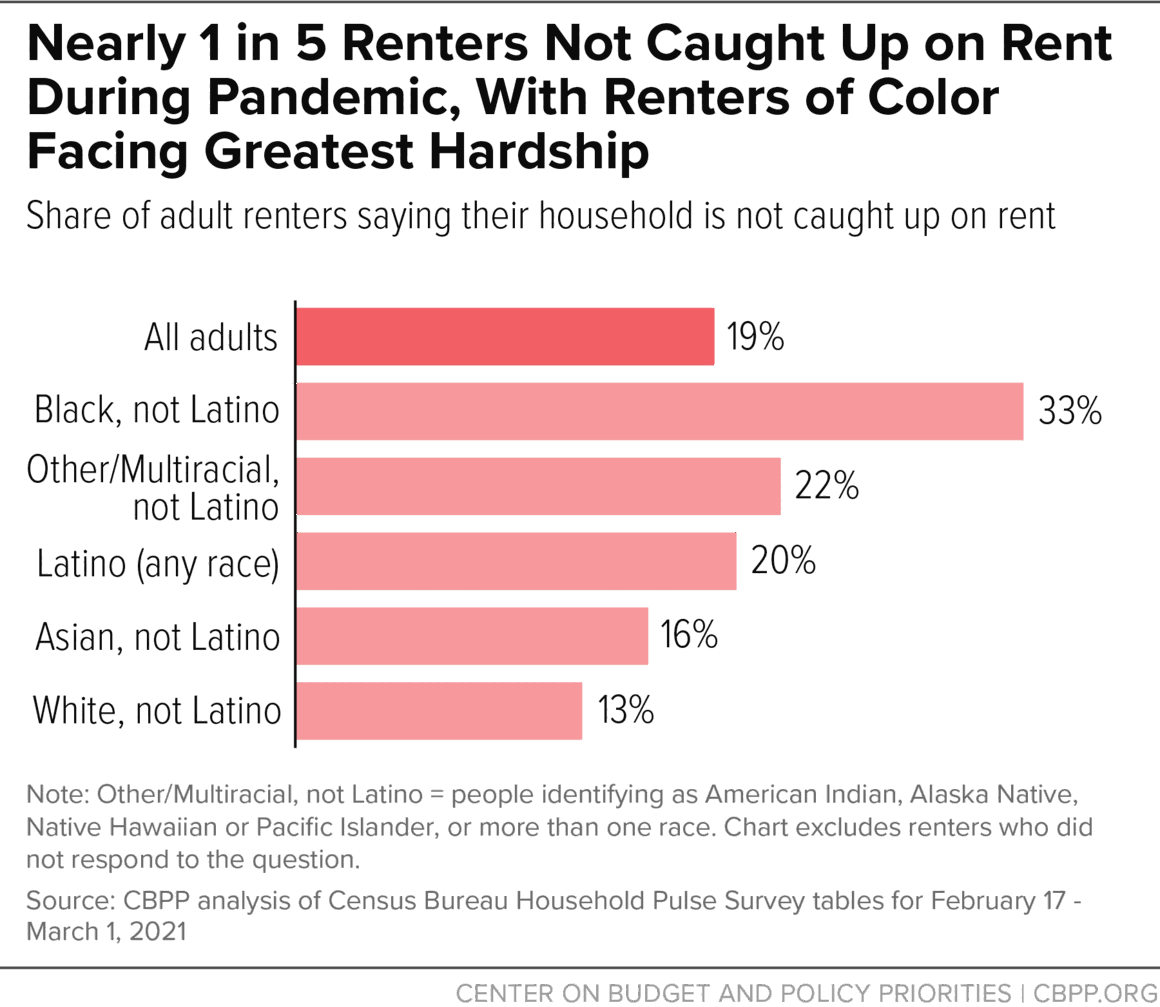

As of March, 1 in 5 renters in the US, 13.5M families, were behind on their rents. 4 out of 10 children in rental housing in the United States of America are exeperiencing either housing or food hardship as families are forced to choose between the two. These are the early VICTIMS of inflation and it's inflation caused by Government policy that has kept property prices unnaturally high, driven by low-rate mortgages that are never offered to the kind of people we are looking to evict.

As of March, 1 in 5 renters in the US, 13.5M families, were behind on their rents. 4 out of 10 children in rental housing in the United States of America are exeperiencing either housing or food hardship as families are forced to choose between the two. These are the early VICTIMS of inflation and it's inflation caused by Government policy that has kept property prices unnaturally high, driven by low-rate mortgages that are never offered to the kind of people we are looking to evict.

Another factor making housing much more expensive – especially on the rental side – is the influx of Investment Capital. The Corporate takeover of the rental market has driven rents relentlessly higher in search of more and more profits:

"This is one of the biggest sectors of the economy and it’s so remarkably inefficient. Real-estate agents are great people, but can they run a big data algorithm to figure out how much you should charge for your house? The principle behind all the investments we’ve made is in the future you’re going to be buying and selling your house from a company." – Andreessen Horowitz's Alex Rampell

Yes, God forbid we don't charge people as much as they can possibly pay for their homes. Who leaves that kind of money on the table? Certainly not Jesus, right? What's another 10M more or less homeless people going to do, you might wonder? Well, actually the homeless "crisis" we now have is being caused by 552,830 people who are homeless in the US, not 10M so allowing 10M people to fall through the cracks on July 31st is going to be everyone's problem.

Yes, God forbid we don't charge people as much as they can possibly pay for their homes. Who leaves that kind of money on the table? Certainly not Jesus, right? What's another 10M more or less homeless people going to do, you might wonder? Well, actually the homeless "crisis" we now have is being caused by 552,830 people who are homeless in the US, not 10M so allowing 10M people to fall through the cracks on July 31st is going to be everyone's problem.

The shelters are full now and that's with 358,363 total residents – and those people are "used to" being homeless – what happens when they are joined by your unlucky neighbor and the their family, who load up the car with what they can carry and show up for the first night needing assistance? If you live in California, you know what it looks like as 1/2 of all Americans living on the streets live in CA (why not, at least the weather is great).

Just another problem to sweep under the rug but what happens to the real estate market when 4.2M homes are added to the inventory? It's not like 4.2M people are lined up waiting for them. Many of those homes will remain unaffordably empty and landlords/banks will have to stop pretending those homes are still worth their last appraised value (based on the rents/mortgages they've been collecting) and MARK THEM TO MARKET. Remember what happened the last time banks were forced to mark homes to market? That was not pretty at all.

So, while it may seem "unfair" that people who are less fortunate qualify for housing assistance (sorry Rick Santelli), it's very necessary – we need the landlords and even the banks, who acted in good faith to be made whole and we need the people who face displacement to be given a solution – not an extension…

What rich assholes on Wall Street don't understand is that we are all connected and, sadly, 13 years after the last crash, they still don't get it. So let's be a bit cautious with our Banking and Housing investments until we see how this situation plays out. 4.2M homeowners and their families behind on their payments is a ticking time bomb and the Republicans just forced the Democrats to drop additional housing assistance from the proposed Infrastructure Bill so it will continue to tick along in the heart of America – until Brett Kavanaugh changes his mind.

So far, he's given us 30 days – have a great July!