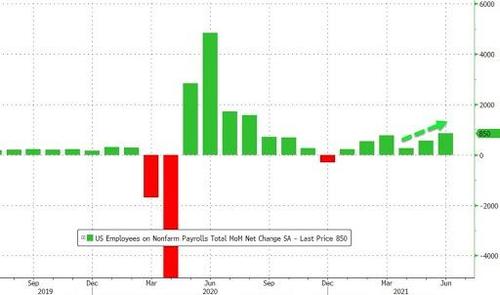

700,000 jobs.

700,000 jobs.

That's how many they expect to have created last month. That would be up a bit from 559,000 in May (if it isn't revised – these numbers are wildly inaccurate) and that would leave our Unemployment Rate at 5.6% – still kind of high, actually. According to the Congressional Budget Office, we are on track to recover all of the jobs lost during the pandemic in about 12 months – but what about the jobs that should have been created during those two years? Usually we create 3M jobs per year to keep up with population growth – we are still woefully behind the curve.

The forecasters expect economic growth to continue at a strong pace in 2022, hitting 5% in real terms. But they see it declining quickly in the years to follow, as the labor force grows more slowly than is typical. Budget office officials said that reflected, in part, the effects of more restrictive immigration policies adopted under Trump. By 2023, the office predicts, growth will slow to 1.1%.

After already running a $3Tn deficit in FY 2021 (15% of our GDP), Biden is currently pushing Congress to approve as much as $4Tn in spending and tax cuts meant to create jobs and aid growth by improving the productivity of workers and the broader economy, like repairing bridges and subsidizing child care costs to help more parents, particularly women, work additional hours. Biden’s rescue plan included direct payments of $1,400 each to low- and middle-income Americans, $350 Billion to help states and municipalities patch what were expected to be budget shortfalls and hundreds of Billions of dollars to accelerate vaccines and more widespread coronavirus testing. It also extended supplemental federal payments of $300 a week to unemployed workers through September, a benefit that Republican governors across the country have ended early as business owners complain of difficulties finding workers.

After already running a $3Tn deficit in FY 2021 (15% of our GDP), Biden is currently pushing Congress to approve as much as $4Tn in spending and tax cuts meant to create jobs and aid growth by improving the productivity of workers and the broader economy, like repairing bridges and subsidizing child care costs to help more parents, particularly women, work additional hours. Biden’s rescue plan included direct payments of $1,400 each to low- and middle-income Americans, $350 Billion to help states and municipalities patch what were expected to be budget shortfalls and hundreds of Billions of dollars to accelerate vaccines and more widespread coronavirus testing. It also extended supplemental federal payments of $300 a week to unemployed workers through September, a benefit that Republican governors across the country have ended early as business owners complain of difficulties finding workers.

That's where our 5% "growth" is coming from – not because the economy is actually doing great.

For instance, 370,000 restaurants applied for $75Bn in funding from the Restaurant Revitalization Fund, nearly three times what the program had available. Around 105,000 businesses were approved for grants, which averaged just over $272,000. The Small Business Administration, which runs the Restaurant Revitalization Fund, told unsuccessful applicants in an email that it was unable to fund all qualified applications because of “overwhelming demand.” Not because the money wasn't needed – just because there wasn't enough of it.

Too little or too slow aid is why 18.7% of all office space in Manhattan is unleased (as well as people still working from home – so this might not go away). In downtown Manhattan, 21% of the offices have no tenants. In the East Village, 30.4% of the the available commercial space is emply – and you can really feel it walking around there – with 1 out of 3 business closed. Asking prices have come down almost 10% since last year but, at $74.06 average per square foot – it's still shockingly high to most of the world.

8:30 Update: 850,000 jobs were added in June but the unemployment rate ticked up to 5.9% as some people who were "not in the workforce" decided to look for work too. 9.5M people are still out of work, about 5M more than when the crisis began last March. At 146M people working, we're still way down from 154M people pre-pandemic and, again, that's without expecting any growth. Labor Force Participation Rate is 61.6% and that's why unemployment doesn't look so bad – a lot of people aren't bothering (hence the labor shortage).

8:30 Update: 850,000 jobs were added in June but the unemployment rate ticked up to 5.9% as some people who were "not in the workforce" decided to look for work too. 9.5M people are still out of work, about 5M more than when the crisis began last March. At 146M people working, we're still way down from 154M people pre-pandemic and, again, that's without expecting any growth. Labor Force Participation Rate is 61.6% and that's why unemployment doesn't look so bad – a lot of people aren't bothering (hence the labor shortage).

4.6M people are Employed Part-Time for Economic Reasons (not by choice) – they don't count as unemployed but they are not in jobs that pay them enough money. Overall, the Employment/Population Ratio stands at 58%, 3% lower than last March out of 330M people is – 9M people – that's what they call a check-sum.

In June, 6.2M people reported that they had been unable to work because their employer closed or lost business due to the pandemic- that is, they did not work at all or worked fewer hours at some point in the last 4 weeks due to the pandemic. This measure is down from 7.9M in May. Among those who reported in June that they were unable to work because of pandemic-related closures or lost business, 10.0% received at least some pay from their employer for the hours not worked, little changed from the previous month. Among those not in the labor force in June, 1.6M people were prevented from looking for work due to the pandemic.

9M less people working and earning the US median salary of $50,000 ($100,000 is AVERAGE but above-average workers aren't the ones who can't find jobs) is $450Bn worth of lost wages so there's where that stimulus goes. Given a money multipler of 3, those lost wages ding out GDP for $1.5Tn(ish) – that's pretty catastrophic if not for the $3Tn in stimulus (so far) this year, right?

Still, we don't worry about deficits – that's our children's problem! Make sure you tell them that this weekend at the family barbeque…

Have a happy holiday weekend,

– Phil