No progress since February.

No progress since February.

That's where the Russell is (or isn't) after the first half of 2021 has come to a close. That's OK because, before that, the Russell had gone nowhere since 2018 but then it dropped 600 (37.5%) and now it's 700 (43.75%) points higher than where it had been steady before.

With 2020 earnings being negative, the CAPE (earnings over 10 years) of the Russell 2000 is still well below the 2018 high of 130, hovering around 120 but we're paying 43% more than we did then, when the P/E ratio for the Russell was 83.05. The means the current P/E for the Russell is around 100 times earnings and we KNOW, for a FACT, that the Government and the Fed have spent over $10Tn (50% of our GDP) in the past 18 months – just to give us that 43%. We don't know, for a fact, that they will ever stop spending and average of $600Bn/month to prop up the economy and, if so, then maybe paying 100x earnings isn't so crazy but, if they do ever stop….

| Date | Russell 2000 Index Value | Dividend Yield (TTM) | P/E (TTM) | CAPE Ratio |

|---|---|---|---|---|

| 12/31/2020 | 1,974.86 | 1.21% | Negative | 112.98 |

| 6/30/2020 | 1,441.37 | 1.58% | 46.89 | 84.51 |

| 12/31/2019 | 1,668.47 | 1.45% | 38.00 | 106.29 |

| 6/30/2019 | 1,566.57 | 1.49% | 36.86 | 113.28 |

| 12/31/2018 | 1,348.56 | 1.74% | 40.17 | 105.69 |

| 6/30/2018 | 1,643.07 | 1.26% | 83.05 | 130.62 |

| 12/31/2017 | 1,535.51 | 1.33% | 131.96 | 120.24 |

| 6/30/2017 | 1,415.36 | 1.46% | 82.78 | 107.19 |

| 12/31/2016 | 1,357.13 | 1.46% | Negative | 99.15 |

Fortunately, so far, there are no signs of stopping and no one I spoke to this weekend thinks the Government will or CAN stop stimulating the economy, so I guess we'll just keep betting with the bulls but it's very important to know what a farce this is – especially when we haven't even built anything of lasting value for $10Tn – these "benefits" vanish as soon as the Government stops spending.

That's the great difference between Capitalism and Socialism – when a Socialist Government spends money, they build transit systems and bridges and schools and power plants – things that will benefit their people for decades to come. When a Capitalist Government spends money, they buy some of those things but mostly they just funnel money to our Corporate Masters and we hope some of it trickles down to benefit the citizens who paid for it.

Since trickle down is really a fairy tale Conservatives tell to their logic-challenged base, the Russell stocks are starting to feel the pain as they tend to be smaller companies that actually need Consumers to have money to spend. While we do hear about an uptick in Consumer Savings – it's drastically skewed towards the wealthy and we still have 6% Unemployment and 10M people who live in homes that are facing foreclosure (extended through the end of July). We are down to kicking these cans down the road 30 days at a time now.

Since trickle down is really a fairy tale Conservatives tell to their logic-challenged base, the Russell stocks are starting to feel the pain as they tend to be smaller companies that actually need Consumers to have money to spend. While we do hear about an uptick in Consumer Savings – it's drastically skewed towards the wealthy and we still have 6% Unemployment and 10M people who live in homes that are facing foreclosure (extended through the end of July). We are down to kicking these cans down the road 30 days at a time now.

Of course the Personal Savings Rate is also distorted by the stimulus, as distributing several Trillion Dollars is wont to do. It's also distorted because the PSR is the RATIO of Personal Savings to Income and, when Income drops, the money you give people in stimulus checks tends to read as a greater portion of their Incomes. As you can see from the chart, DESPITE the $10Tn money shower, we're only doing as good as we did in the 70s – and that was an inflationary/recessionary period for the US.

Are those who forget the past condemned to repeat it? We'll have to wait and see what happens to women who go out for drinks with Bill Cosby, won't we?

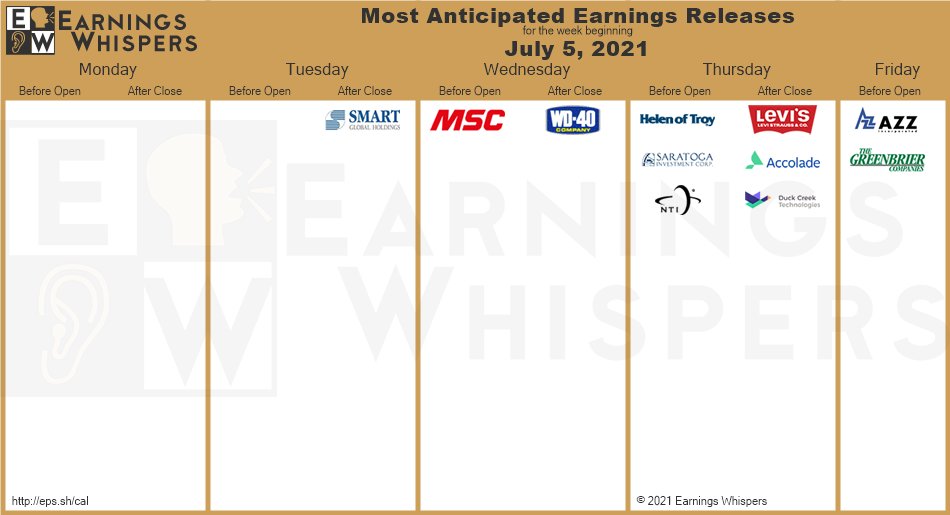

It's going to be a slow market week as we've only got 4 post-holiday days to play with. PMI and ISM today, Fed Minutes tomorrow and that's about it for data.

Nobody's reporting earnings either – just a very dull week ahead:

Oil topped out at $77 early this morning and NOW we can short it but it's already down to $76 on /CL but below that line (with tight stops above) is fun as we should calm down to $75 this week or next and that would be good for +$1,000 per contract but, longer-term, there should be a slump between holidays that takes us to $70 – and that's worth playing for!

And I don't want to be all negative to start the week so I'm not going to talk about China's Debt Bomb (again) but tick, tick, tick it goes….

- The Ticking Debt Bomb in China’s $18.1 Trillion Bond Market

- China Defaults Threaten an Eerily Calm $12 Trillion Bond Market

- China On Verge Of Contraction After Sudden Plunge In Services PMI

- China Widens Probe Beyond Didi, Roiling Global Investors.

- A Stunned Wall Street Responds To China's Droconian Didi Crackdown

- Tesla’s Fall From Grace in China Shows Perils of Betting on Beijing

- Plastic Makers Reel on Soaring Oil Costs, Rising Competition

- OPEC+ Deal Fails, Leaving Oil Market Tighter as Prices Surge.

- In OPEC Deadlock, U.A.E. Steps Out of Saudi Shadow

- U.K. Plans to End Distancing; Biden Celebrates: Virus Update

- Economic Sentiment Rises to Record in Canada on Vaccine Rollout

- Investors Don’t See End to Record-Breaking Equity Rally Just Yet

- Retail Investors Power the Trading Wave With Record Cash Inflows

- Bitcoin Resumes Losing Streak After Weekend Strength Evaporates

- Wages are finally going up and that’s going to have to continue to get people back to work

- Zoltan Sees Reverse Repo Hitting $2 Trillion In Weeks: What Happens Then