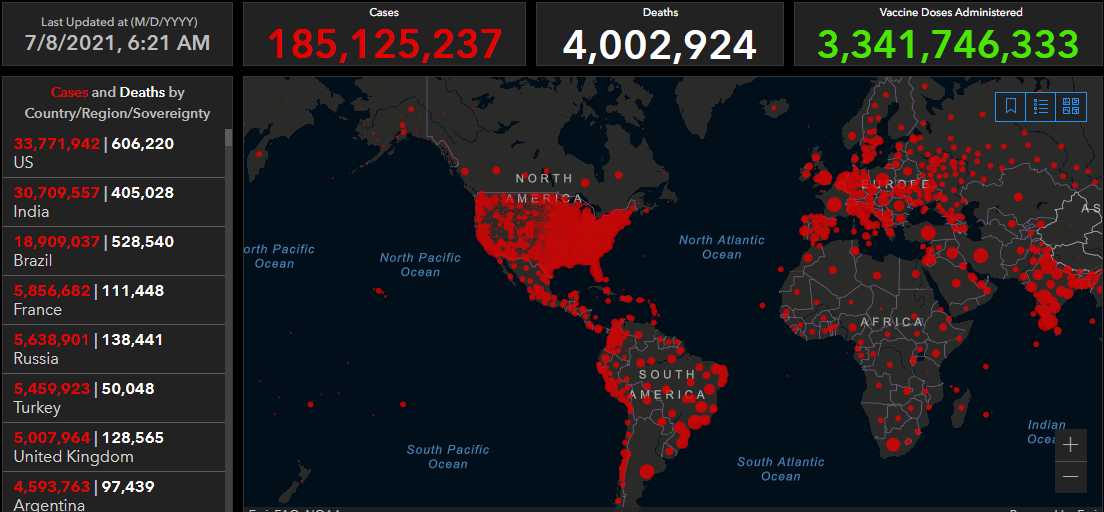

4,002,924.

4,002,924.

That is how many Global Citizens have died from Corona Virus in the past 18 months. Despite all the improvements made under Biden in the last 6 months, the US is still leading the World in both infections and deaths though, with almost 70% of our population now vaccinated – it does liik like India and Brazil will catch up to us.

India has 1.4Bn people so it's understandable they might have as many infections and deaths as the US, with our 330M people (less than 1/4) but Brazil only has 211M people, just 2/3 the size of the US so their deaths per capita have already surpassed ours.

This is not a chart of something that is over, no matter how much we wish it to be. Less than 15% of the World population has been vaccinated and that means 85% of the people are still exposed – including an alarming 32% of the US population, though that is mostly Conservatives who don't wish to be vaccinated.

This is not a chart of something that is over, no matter how much we wish it to be. Less than 15% of the World population has been vaccinated and that means 85% of the people are still exposed – including an alarming 32% of the US population, though that is mostly Conservatives who don't wish to be vaccinated.

While you may think it's fine and dandy for people to choose not to be vaccinated for whatever crazy reason – those people, in turn, breed variants of the virus in their unvaccinated population and, eventually/inevitably, some of those variants end up being vaccine-resistant strains and then the 70% of us who are vaccinated are right back in danger anyway.

Look what has already happened in the UK, India and Nepal – the Delta Variant has become dominant as our current vaccines are far less effective against it and you can see how quickly UK Covid cases are ramping back up despite 68% of their population having had at least one dose of the vaccine (51% fully vaccinated).

Look what has already happened in the UK, India and Nepal – the Delta Variant has become dominant as our current vaccines are far less effective against it and you can see how quickly UK Covid cases are ramping back up despite 68% of their population having had at least one dose of the vaccine (51% fully vaccinated).

"Trump Lite", Boris Johnson, said on Monday that the "continuing effectiveness" of the vaccine rollout allows England to consider loosening restrictions, rather than tightening them, as cases rise."I want to stress from the outset that this pandemic is far from over," Johnson told a news conference. "It certainly won't be over by [July] the 19th," he said.

"We're seeing cases rise fairly rapidly," Johnson added. "There could be 50,000 cases detected per day by the 19th, and again as we predicted we're seeing rising hospital admissions, and we must reconcile ourselves sadly to more deaths from Covid."

Must we? Why must we? Why can't we learn from the countries that actually beat Covid, like China, who used very strict lockdowns and kept them in place until the virus was so low that they switched to testing and, to this day, only allow uninfected people to mix with the general public. Amazingly, that plan seems to work, in country after country. Setting arbitrary openings and sticking with them becuase you don't want to upset the business community, on the other hand, has generally led to failure.

Case in point, Japan (the world's 3rd largest economy, by the way) has now moved back to restrictions and there will be no spectators at the Olympics. Bars are closed, the people have been asked to go out only if absolutely necessary, larger stores have been requested to be shut down – even travel is being strongly discouraged and, worst of all Karaoke has been suspended! You know it's serious if you can't even get drunk and hear strangers sing badly…

So that has investors concerned this morning and, even though US Investors are generally trained to ignore the rest of the World – I still like to check things out globally once in a while. Meanwhile, on the home front, though the Fed signalled no actual signs of raising rates or tapering any time soon, the underlying reason for that was that the real economy still SUCKS and is not likely to be able to function without constant stimulus. That's not the kind of sentiment that makes you think RECORD HIGH MARKETS – is it?

So that has investors concerned this morning and, even though US Investors are generally trained to ignore the rest of the World – I still like to check things out globally once in a while. Meanwhile, on the home front, though the Fed signalled no actual signs of raising rates or tapering any time soon, the underlying reason for that was that the real economy still SUCKS and is not likely to be able to function without constant stimulus. That's not the kind of sentiment that makes you think RECORD HIGH MARKETS – is it?

Later today, the ECB will announce their 18-month strategy review, followed by a news conference by Christine LaGarde – so we'll see what page those guys are on but with the UK (6th largest economy) and Japan (3rd largest) on lockdown and India (5th largest) in deep trouble along with France (7th largest) – I would at least suggest some prudent hedges – if you don't already have them in place.

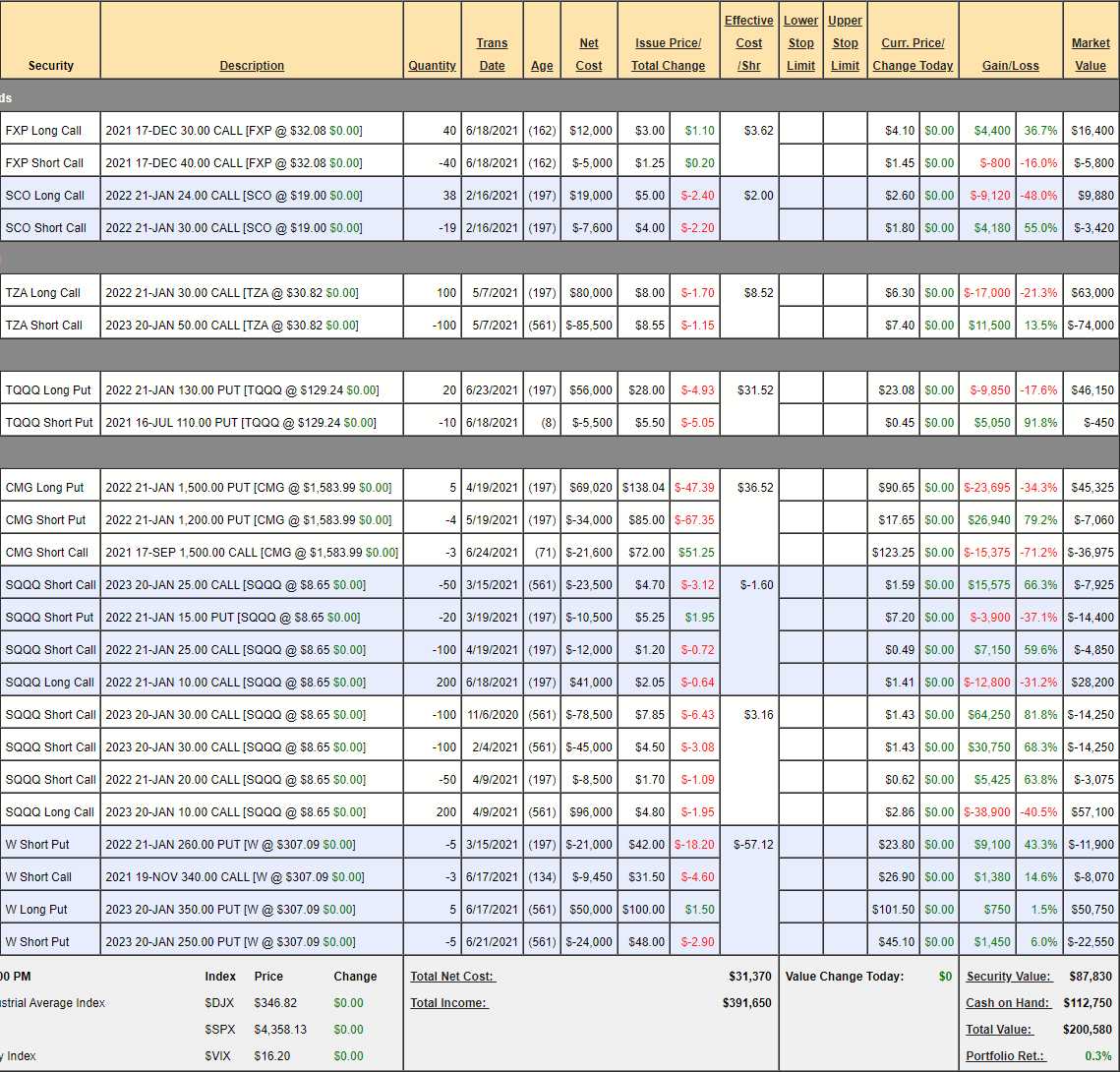

In yesterday's live trading Webinar we discussed our Short-Term Portfolio (STP) and its hedges and the STP has lost 20% ($41,508) since our June 15th review as of yesterday's close but these are good hedges and can make that money back very quickly if the market actually sells off – just a little bit: