Lots of earnings this week.

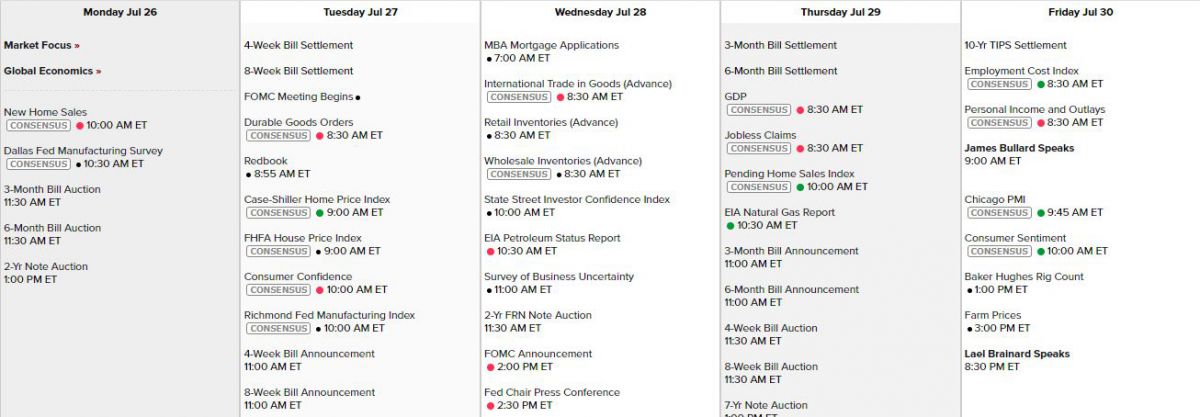

We have no Fed speak until Friday as they are having their meeting this week and Powell will speak Wednesday afternoon, after their announcement and it's doubtful they do anything but fears are they will push up their timetable to combat the raging inflation they still won't admit is happening. We also have our GDP Q2 Estimate on Thursday and leading Economorons are predicting 8% growth to keep up with our 10% Inflation – as with most things in this economy – it's an illusion.

I'm in Orlando this week and, though there are plenty of people out and about, it's not summer-crowded and there are still plenty of empty store-fronts. Also plenty of help wanted sings and prices everywhere are out of control so it's clearly an economy in transition. Over at Disney (DIS), there are a lot of pissed off "cast members" because, during the pandemic, Disney laid off almost all the food service workers but kept the customer service, show and costume types – since they were harder to find. Then, when restrictions eased, they moved those workers to food jobs and now they can't find food workers so they still haven't moved the customer service types back to their old jobs.

What they thought was pitching in and helping out the company they loved has led to a career they never wanted (or thought they had escaped). Depressing! People come to Disney from all over the World and they stand together in huge lines etc. and no one is wearing a mask! I was very surprised at Sea World and Disney there are no mask rules at all and nowhere in Orlando were there mask requirements – unless you want to take an Uber, which still requires them to ride.

On the whole, however, I'm not too worried as peple are watching Orlando closely to see if it's a "super-spreader" zone and, so far – it hasn't happened. Most Americans are vaccinated and probably most park visitors – though it would be nice to see an actual study. Disney will, in fact, restart their cruise line on August 9th, after considering the park re-opening a success.

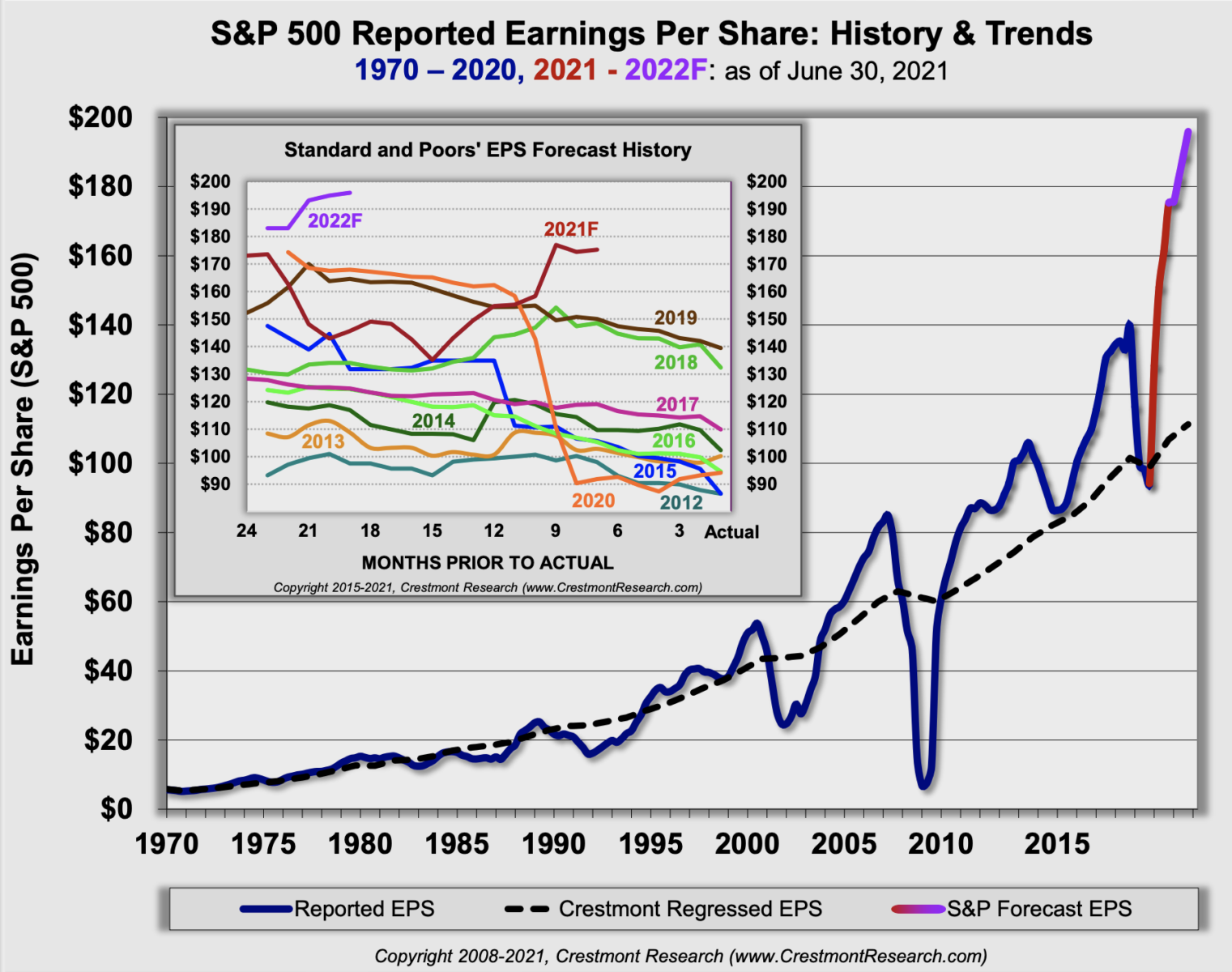

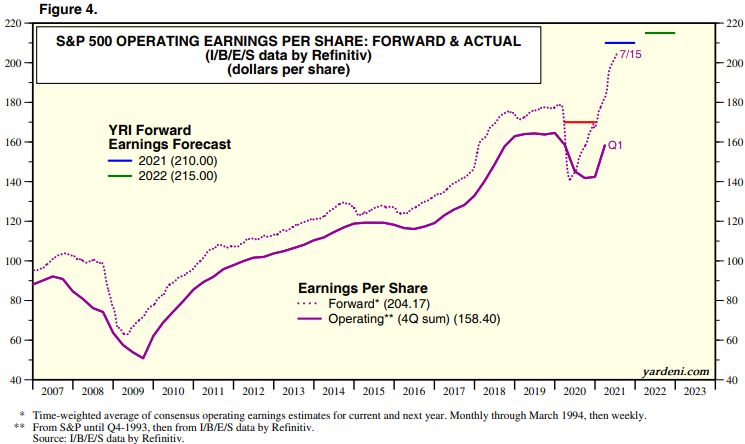

Hope springs eternal among most of the S&P 500 and earnings forecasts are through the roof but ACTUAL earnings are about 50% below forward forecasts so far. Since the ACTUAL earnings are based on Trillions of Dolars in stimulus – it's very hard to imagine how we're going achieve that doubling of forward earnings without Trillions of additional Dollars being spent.

Hope springs eternal among most of the S&P 500 and earnings forecasts are through the roof but ACTUAL earnings are about 50% below forward forecasts so far. Since the ACTUAL earnings are based on Trillions of Dolars in stimulus – it's very hard to imagine how we're going achieve that doubling of forward earnings without Trillions of additional Dollars being spent.

The problem is we're being asked to pay for those forward earnings NOW, with the S&P at 4,400, which is 100% over our March 2020 lows, the ACTUAL earnings per share in Q1 were trending at $160 per S&P share, so a P/E of 27.5 but anticipation is for $200/share or a P/E of 22, which is still 50% over the normal 15 but not too outrageous so the trick will be to see if the actual earnings justify the hype BUT STILL, this is all being done WITH Trillions of Dollars in stimulus – it's no indication at all of what the economy will look like once the free money stops flowing.

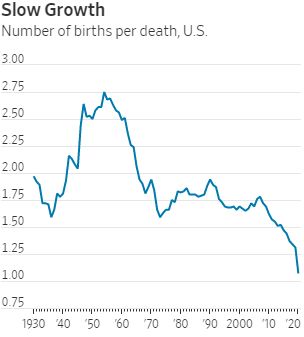

One indicator of slowing real economic growth is the slow or, more accuratately, NO Birthrate in the US. On the whole, in 2020, we barely replaced the dying population and, in half the states in the country, MORE people died than were born. In a normal year, American women give birth to 2.4M baby consumers and that contributes to our normal 2% GDP growth. If we aren't popping out new consumers (and we don't let them immigate anymore) – then it's up to all of us already here to consumer more.

One indicator of slowing real economic growth is the slow or, more accuratately, NO Birthrate in the US. On the whole, in 2020, we barely replaced the dying population and, in half the states in the country, MORE people died than were born. In a normal year, American women give birth to 2.4M baby consumers and that contributes to our normal 2% GDP growth. If we aren't popping out new consumers (and we don't let them immigate anymore) – then it's up to all of us already here to consumer more.

If we fail to consume more, can we really blame our Corporate Masters for raising the prices on what we do consume? Profits are holy – they must be made – one way or the other…

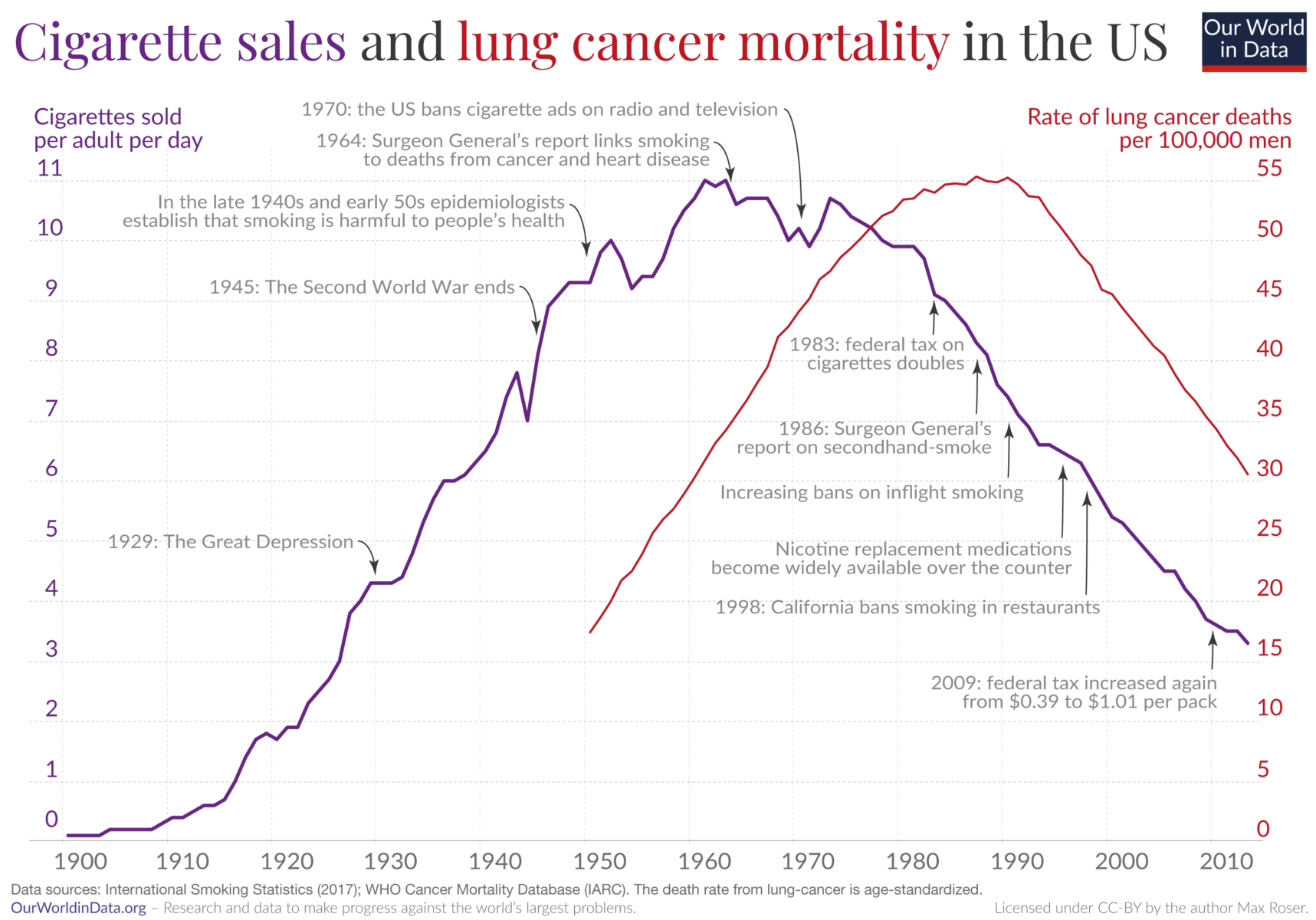

Speaking of killing your customers, how's this chart for clear correlation? Turns out Cigarette Consumption is down 66% in the past 50 years and deaths from Lung Caner is down 45% in the past 30 years (it takes about 20 years to kill you). So congrats to all the quitters and let's hope, in the future, we can be as wise about controlling these viruses as we have been about controlling cigarettes.