Apple (AAPL) beat estimates by 30% and the stock is down.

That should tell you something. How stretched does this market have to be that a company that sold $81.4Bn worth of product in Q2 and made $20Bn in 3 months LOSES share price on a 30% beat? Revenue from iPhone sales came in at $39.6Bn, up nearly 50%, and well ahead of the Street consensus forecast of $34.2 billion as well and, more importantly, less than 1/2 the company's total revenues – it's what investors always wanted!

In fact, the company exceeded estimates in every product category. Mac revenues were $8.2Bn, up 16%, while iPad revenues were 12% higher at $7.4Bn. Revenue from wearables, home, and accessories was $8.8Bn, up 36%. Services revenue was $17.5Bn, up 33%. The company said it finished the quarter with more than 700M paid subscribers across its services portfolio, up more than 150M from a year ago. Revenues in the Americas were $35.9Bn, up 33%, while Europe came in at $18.9Bn, up 34%, and Greater China revenue was $14.8Bn, up 58%. Revenues in Japan were $5.5Bn, up 30%, and the rest of Asia was $5.4Bn, up 28%.

CFO Luca Maestri said in a statement that the company set revenue records in each geographic region, with double-digit growth in each product category. He said the company returned nearly $29 billion to shareholders in the quarter in dividends and stock buybacks. He also said (and this is why they are selling off) that the company sees strong double-digit revenue growth in the September quarter, but at a smaller level than in June, for three reasons.

- One – Foreign exchange issues will be 3 percentage points less favorable.

- Two – Services growth will be lower, after the June quarter benefited from an easy comparison in the year ago quarter, when advertising and Apple Care revenues were impacted by the pandemic.

- Three – Supply constraints will be higher than they were in the June quarter, with a particular impact on iPhone and iPad sales.

Apple may be the greatest company on the planet but, at 27 time forward earnings, they can't afford to make a misstep, or have supply constraints. Companies that are this good have to worry about their suppliers, as well as their own business.

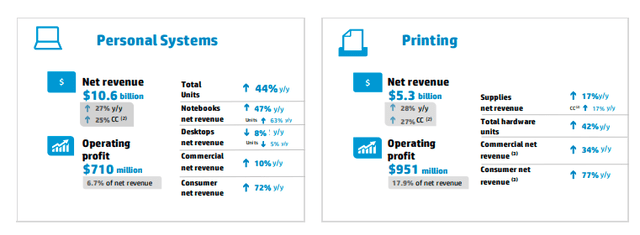

Meanwhile, rather than stressing over whether AAPL or MSFT can justify 30x earnings, how about investing in a pedigreed tech company that "only" has a $34Bn market cap but makes $4Bn in profits on $63Bn in sales? HPQ does not have AAPL's growth but they are steady performers and even made $2.8Bn last year, during the lockdown.

I love their new, trendy logo but it's the same old HP, making so many things that businesses depend on every day along with a thriving service division. Windows 11 requires better hardware so I think PC sales will pick up this year – especailly considering companies did little or no upgrading last year. HPQ still has 42.4% of the global printing market and I still think that, if you want to pick an ultimate winner in 3D printing – it will be HPQ.

HPQ pays a respectable 2.72% dividend but, initially, for the LTP, we'll just promise to buy it if it gets cheaper:

- Sell 15 HPQ 2023 $25 puts for $3 ($4,500)

- Buy 25 HPQ 2023 $22 calls for $7.50 ($18,750)

- Sell 25 HPQ 2023 $30 calls for $3 ($7,500)

That's net $6,750 on the $20,000 spread so we have $13,250 (196%) profit potential if HPQ can finish over $30 in Jan 2023. Not a big ask and our worst case is being assgined 1,500 shares at $25 and losing our $6,750, which would be another $4.50/share so we'd be at net $29.50, which is more than HPQ is now so it's an aggressive play but we're very happy to double down on this one if it sells off.

We will see this afternoon (2pm) what the Fed has to say but no one expects them to actually DO anything – just a minor tweak to the language of the statement and, of course, Powell's press conference comes after.

China State Media Seeks to Calm Investor Nerves After Stock Rout

China’s Escalating Property Curbs Underline Xi’s New Priority

The China Model: What the Country’s Tech Crackdown Is Really About

Asian Stocks Track U.S. Decline Amid China Risk: Markets Wrap

Sydney Lockdown Extended Four Weeks as Delta Surge Worsens.

Oil Resumes Gains as Report Points to Shrinking U.S. Stockpiles

U.S. Copper Buyers Face World’s Highest Prices as Demand Booms

White House Orders Staff to Again Wear Masks Amid New Danger.

NY, LA Among Big Cities Joining Rural Areas in CDC Mask Zone.

Visa Card Spending Buoyed by Return of Travel, Stimulus Checks

No Crabs, No Scallops: Seafood Is Vanishing From Menus in U.S.

Landlords Sue U.S. for Rent Unpaid Under Eviction Moratorium

Lawmakers Say Infrastructure Deal Within Reach

Google advertising revenue rises 69% from last year

Microsoft posts big earnings beat and gives optimistic revenue forecast

Starbucks earnings beat, fueled by U.S. cold drink sales, but stock drops on weak China outlook

Orange Juice Futures Soar Amid 'Frost Threats' In Brazil

Inflation Shock: Are You Ready To Start Paying "$40 Or $50" For A Hamburger?