Big reversal.

Big reversal.

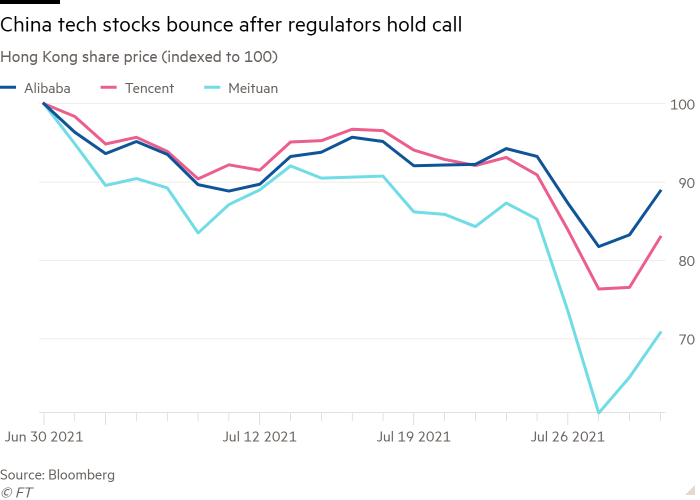

Regulators in Beijing held a call with executives from global investors, Wall Street banks and Chinese financial groups last night, according to the Financial Times. The call sought to reassure the groups after China issued an effective ban on the country’s $100Bn private tutoring industry at the weekend, which led to concerns of a broader regulatory crackdown on Chinese tech companies listed abroad.

During the call, CSRC vice-chair, Fang Xinghai, told the international groups China was committed to allowing companies to access capital markets and that the action on education technology businesses was an isolated situation. The ChiNext Index bounced 5% overnight with the CSI up 2%.

While it's very dangerous to take China at it's word, I'm liking DIDI, who have fallen below their IPO price of $14 to $8.87, which is a $10.5Bn market cap for a company with $30Bn in quickly growing sales (no profits so far but manageable losses). They are likely to be up 20% at the open, though. Amazon owns a piece of them and I think they are worth a toss down here so let's add them to our Future Is Now Portfolio as such (I'm estimating the opening prices):

- Sell 20 DIDI Feb $10 puts forr $2.50 ($5,000)

- Buy 50 DIDI Feb $10 calls for $3 ($15,000)

- Sell 50 DIDI Feb $15 calls for $2 ($10,000)

That's a net $0 cost on the $25,000 spread and our only obligation is owning 2,000 shares of DIDI for $10 so, as long as we REALLY want to invest in DIDI over the long-haul, the risk of assignment should not bother us. The upside potential is a clean $25,000 if they get back to $15 and, of course, we intend to roll the Feb $10 calls out to longer strikes when they are published.

There's an incorrect rumor in the Wall Street Journal that says "Didi Weighs Going Private to Placate China, Investors," that is not true and makes no stratgic sense and shame on the WSJ for publishing fake news. That may make DIDI very volatile but we have a value play, not a momentum play.

Meanwhile, the US GDP for Q2 is expected to come in at 8.4% after getting $2.2Tn worth of stimulus in March. One quarter of GDP is $5Tn so $2.2Tn is 44% of that so 8.4% growth means that, without stimulus, we'd have been down 32% – but let's not let the facts get in the way of good headline data, right? The reality is we have worker shortages, material shortages, natural disasters (mostly heat-related), supply shortages and a rapidly spreading virus (Disney is going back to requiring masks tomorrow). These GDP numbers could snap back fast if more places go on lock-down again.

Meanwhile, the US GDP for Q2 is expected to come in at 8.4% after getting $2.2Tn worth of stimulus in March. One quarter of GDP is $5Tn so $2.2Tn is 44% of that so 8.4% growth means that, without stimulus, we'd have been down 32% – but let's not let the facts get in the way of good headline data, right? The reality is we have worker shortages, material shortages, natural disasters (mostly heat-related), supply shortages and a rapidly spreading virus (Disney is going back to requiring masks tomorrow). These GDP numbers could snap back fast if more places go on lock-down again.

“I really don’t expect anything like we saw in the spring of last year,” said Ben Herzon, executive director at forecasting firm IHS Markit. “Going forward we’ll just see how high the case count gets and how nervous some people get.”

The challenges facing Hollywood are echoed throughout corporate America as a surge due in large part to the highly infectious Delta variant and current vaccination rates raise questions about the ideal timetable and practices for returns to workplaces.144 min read

Are investors taking these risks seriously enough? Well the Dow is up 150 points today so I'd have to say, no. Amazingly, last year taught us nothing but we'll be adjusting our Short-Term Portfolio to be a bit more bearish over the weekend.

8:30 Update: 6.5%! That's massive GDP growth but very disappointing as leading Economorons predicted a much bigger number. We have finally gotten the economy back to where it was before the pandemic but, again, that's after $8Tn worth of stimulus has been put into it – so let's hold off on the party hats. Nonetheless, we are paying 33% more for the average share of stock than we were pre-pandemic so hope does sping eternal – false or otherwise.

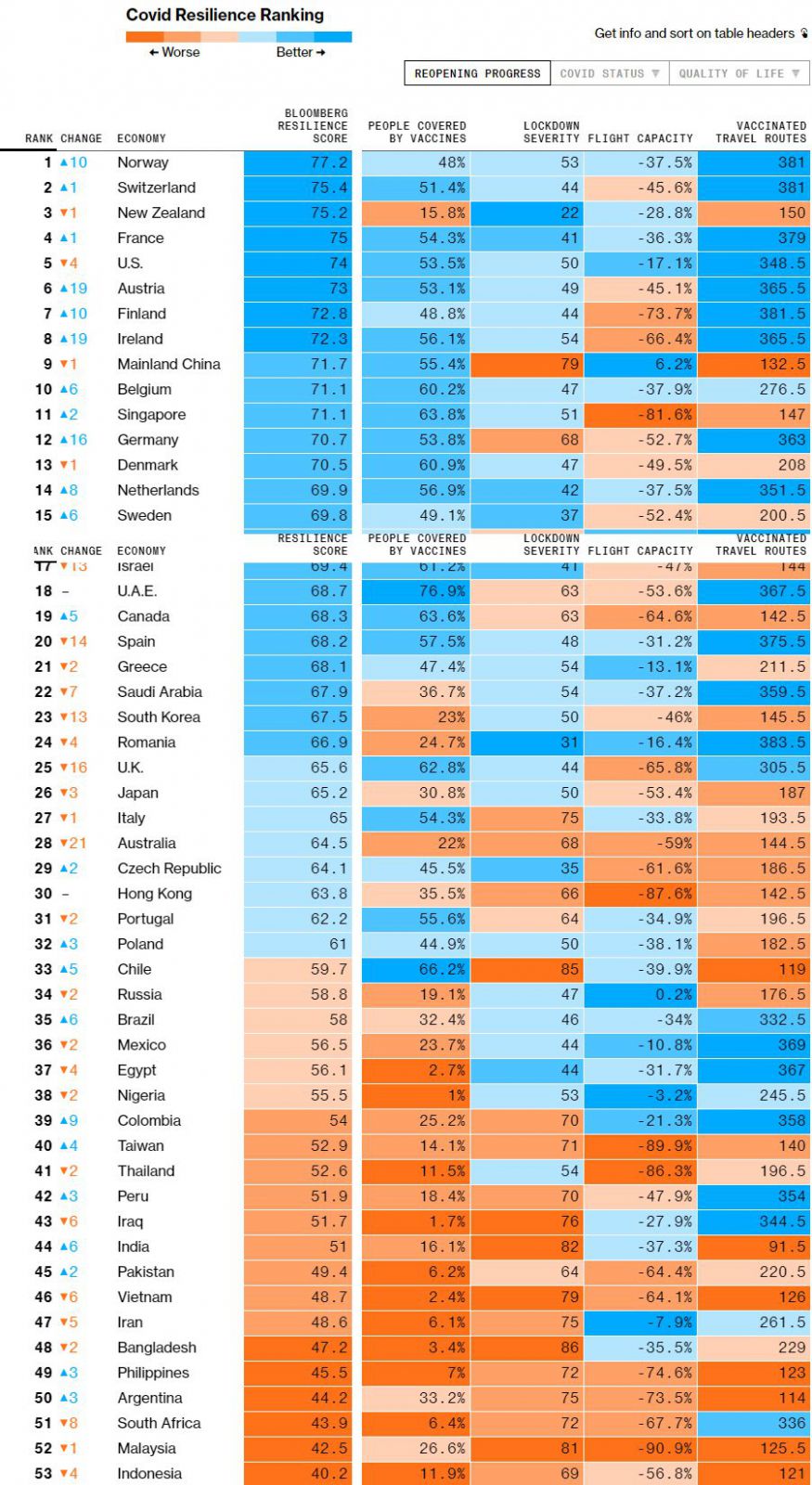

On the bright side, slower growth keeps the Fed on the table and Powell indicated no intention of slowing in yesterday's press conference anyway. India, however, is nearing a Recession and Thailand is already in one or, more accurately, year two of their contraction. According to the latest weighted average of 36 Economists surveyed by Bloomberg, GDP should grow 1.8% this year. That’s particularly weak considering it’s a comparison to last year, when Thailand’s economy contracted 6.1%, the most in more than two decades and that growth is now thretened by record numbers of infections and deaths this summer. Bangkok and 12 other provinces, which account for more than half of the Thai economy, have been under lockdown and curfew since last week as the delta variant threatens to overwhelm the country’s public health system.

On the bright side, slower growth keeps the Fed on the table and Powell indicated no intention of slowing in yesterday's press conference anyway. India, however, is nearing a Recession and Thailand is already in one or, more accurately, year two of their contraction. According to the latest weighted average of 36 Economists surveyed by Bloomberg, GDP should grow 1.8% this year. That’s particularly weak considering it’s a comparison to last year, when Thailand’s economy contracted 6.1%, the most in more than two decades and that growth is now thretened by record numbers of infections and deaths this summer. Bangkok and 12 other provinces, which account for more than half of the Thai economy, have been under lockdown and curfew since last week as the delta variant threatens to overwhelm the country’s public health system.

Here's how other countries are faring – in case you are planning your holidays (or investments):

India and Pakistan have 1/4 of the World's population- we should be a LOT more concerned than we are about what's going on there as well as in the UK where, DESPITE 2/3 of the population having been vaccinated and more lockdowns than the US, they are still having very serious spreads of the virus.

Needless to say – Be careful out there!