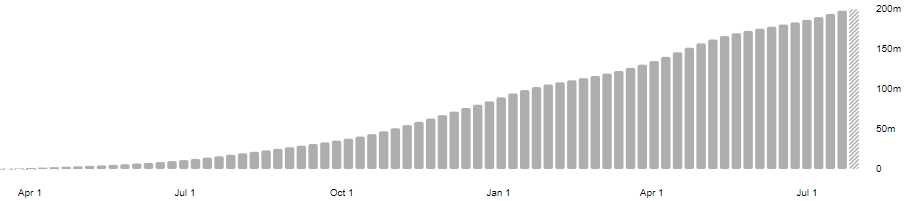

200,370,643 infections!

200,370,643 infections!

That is more than double the 89,586,548 we had as of January 4th so the total amount of Global Covid cases is accelerating, not declining at all. Note the huge bump we had in the spring as country after country rushed to re-open – declaring victory as soon as the first people got thier shots. 1,997,597M people had died as of January 4th, now it's 4,259,874 and, as we discussed in yesterday's Live Trading Webinar, India may be undercounting their deaths by another 4M – according to NPR as Modi, like his friend Donald Trump, likes to underplay the data in order to pretend the virus isn't a threat.

Of course, as we discussed yesterday, this Summer is squarely on Biden's shoulders as 13M new cases (out of 35M) and 233,000 deaths (out of 609,000) since January 4th are on his watch and Biden did not "follow the data" and keep things closed – he let things open up chosing business over 233,000 American lives – not to mention the debilitating long-term damage that 13M infections can bring. 10% of our population have gotten Covid at this point – many of those people still have diminished capacity – long after the initial infection is gone.

"Eradication of Covid Is a Dangerous and Expensive Fantasy," says the fact-free Wall Street Journal, who are calling the lockdowns which do save people's lives "ruinous and oppressive". I guess a person who valued human life over commerce might call them necessary but those kind of people don't write for the Wall Street Journal and, unfortunately, it takes a fairly united front to get people to do things that are necessary and Mr. Murdoch's (is he still alive?) papers and TV stations have made very sure this World has not done what is necessary to stop the spread of Covid-19 – even in 21….

"Eradication of Covid Is a Dangerous and Expensive Fantasy," says the fact-free Wall Street Journal, who are calling the lockdowns which do save people's lives "ruinous and oppressive". I guess a person who valued human life over commerce might call them necessary but those kind of people don't write for the Wall Street Journal and, unfortunately, it takes a fairly united front to get people to do things that are necessary and Mr. Murdoch's (is he still alive?) papers and TV stations have made very sure this World has not done what is necessary to stop the spread of Covid-19 – even in 21….

We live with countless hazards, each of which we could but sensibly choose not to eradicate. Automobile fatalities could be eradicated by outlawing motor vehicles. Drowning could be eradicated by outlawing swimming and bathing. Electrocution could be eradicated by outlawing electricity. We live with these risks not because we’re indifferent to suffering but because we understand that the costs of zero-drowning or zero-electrocution would be far too great. The same is true of zero-Covid.

We have vaccines, says the Journal, we have hospitals – so let's use them. That's nice except we don't have Universal Health Care so essentially this logic translates to the good old "Kill the Poor" platform that is at the heart of most Conservative thinking these days. So far, 2Bn people in the World have been vaccinated – the Top 20% of most countries with 70% of the people in rich countries like the US having the vaccine vs 250M of India's 1.4Bn people (18%).

We have vaccines, says the Journal, we have hospitals – so let's use them. That's nice except we don't have Universal Health Care so essentially this logic translates to the good old "Kill the Poor" platform that is at the heart of most Conservative thinking these days. So far, 2Bn people in the World have been vaccinated – the Top 20% of most countries with 70% of the people in rich countries like the US having the vaccine vs 250M of India's 1.4Bn people (18%).

"Living with Covid" means vaccination expenses forever more – another burden on the health-care system and, as we're seeing with the virus' resurgence in the US – even vaccinating 70% of the population doesn't get us there. That's about how many people get flu shots now and we still have 65M cases of the flu each year (20% of the population). Are we going to lean to live with a more fatal, long-term debilitating disease that hits 20% of the population each year? Is that really the plan for America?

Just like with Climate Change, which Murdoch and company worked hard to prevent us from addressing until it's pretty much too late – the longer we put off eradicating a virus, the more entrenched it becomes. That should be obvious even to the people who think Science is some modern form of witchcraft.