$2,003,426!

$2,003,426!

That is JUST the net of our Long-Term Portfolio, up about $44,000 since our July 15th review and I'd love to take all the credit for it but July 15th just happened to be a dip in the S&P (and we're generally playing blue-chips in the LTP) and we have since recovered about 200 points (5%) – back to new all-time highs on the S&P 500 – again.

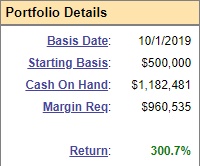

Still, it's a big milestone and the last time we hit $2M in the LTP was September of 2019 and we decided that was ridiculous and we cashed out and then we started the new LTP in October of that year, with a fresh $500,000 commitment. This was all very fortunate for us because, when the crash came in March of 2020, we still had very few positions (we were waiting for Q1 earnings reports) and we were able to jump in and pick up a lot of great stocks on sale.

Now I have very much the same feeling as I had in late 2019 – that the rally has been too much, too fast and we're long over-due for a correction. It may be the Delta varient or it may be something else that sets it off but we are simply paying far too much money for the average stock and there's bound to be a reckoning at some point.

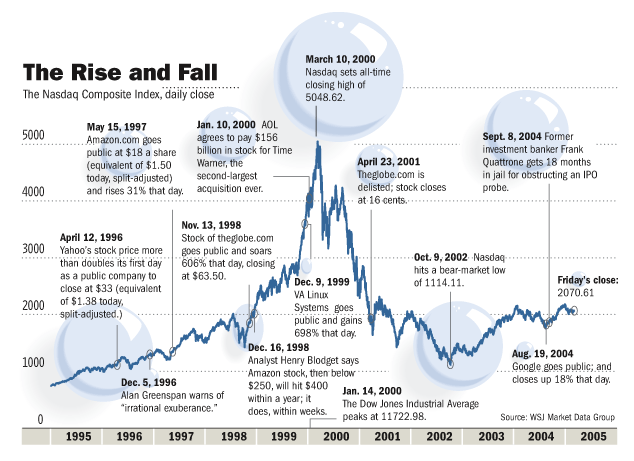

FOMO is, of course, the Fear of Missing Out and of course we'd hate to miss out on a 1999-like spike up but, on the other hand, it would be a real shame to get caught in another 2000-like spike down – or 2008 or 2020 – what is the plan for that BEFORE you decide to let it all ride.

FOMO is, of course, the Fear of Missing Out and of course we'd hate to miss out on a 1999-like spike up but, on the other hand, it would be a real shame to get caught in another 2000-like spike down – or 2008 or 2020 – what is the plan for that BEFORE you decide to let it all ride.

I will say again what I said last time we cashed out: If the rally continues, we will turn $500,000 into $2M again and it's not like we don't make any money on the $1.5M we move to the sidelines, we just put them into very well-hedged, long-term positions or blue-chip dividend stocks or invest in a businss or rental properties – something besides the open market. So we'll make a return there too.

Having $1.5M on the side allowed us to be very aggressive when our positions dropped 20-40% back in March of 2020 but had we remained fully invested with $2M and it dropped to $1.2M – we would have simply sat on our hands praying to get back to $2M, rather than making a fresh $1.5M, right?

That's something people don't take into account when deciding whether to cash in their positions – the flexibility it gives you to take advantage of the next opportunity. That's why Warren Buffet is always looking to raise more cash – you never know when it's going to come in handy!

We do have plenty of cash on the sidelines in the LTP – $1,182,481 is 59% of the portfolio's value and we're only using about 1/4 of our margin buying power but we have a lot of short put positions that can turn ugly on us in a sharp downturn. We do, of course, have very strong hedges in our Short-Term Portfolio (see that review on July 13th), which have about $585,000 worth of downside protection against a 20% drop in the indexes. Even that would still leave us with multiples in the mid-20s – but it's a start.

But it's not just about that. You have to think ahead psychologically as well as strategically and there's a big difference between the market dropping 20% and us staying about even or losing 20% (hedges don't 100% protect you) in our portfolios vs. the market dropping 20% when we are sitting in cash and ready to buy. It was only last year that we went through this very thing and we had a great time buying stock – BECAUSE we were mainly in cash and did not have legacy positions to worry about.

So you have to game (theory) this out and think about where we'll be better off. Many of our LTP positions are near their caps, so we won't double up, perhaps we'll make $1M more in a strong market (+20%) but we had only $1,102,871 in our LTP/STP combo last April and that's doubled in 16 months so if we go back to $500,000/$100,000 in our LTP/STP and that doubles, that's $600,000 more anyway so we're "risking" making $400,000 less in a best-case scenario.

In the worst-case, if we move $1.5M (the STPs money too) to the sidelines – even if we lose the entire $600,000, we are far better off. If the market is flat – I'd rather be more flexible and aggressive with cash than a lot of mature positions. So there's my thinking – I'm strongly leaning towards cashing out next week – let me know if you have a different opnion.