What else could matter?

What else could matter?

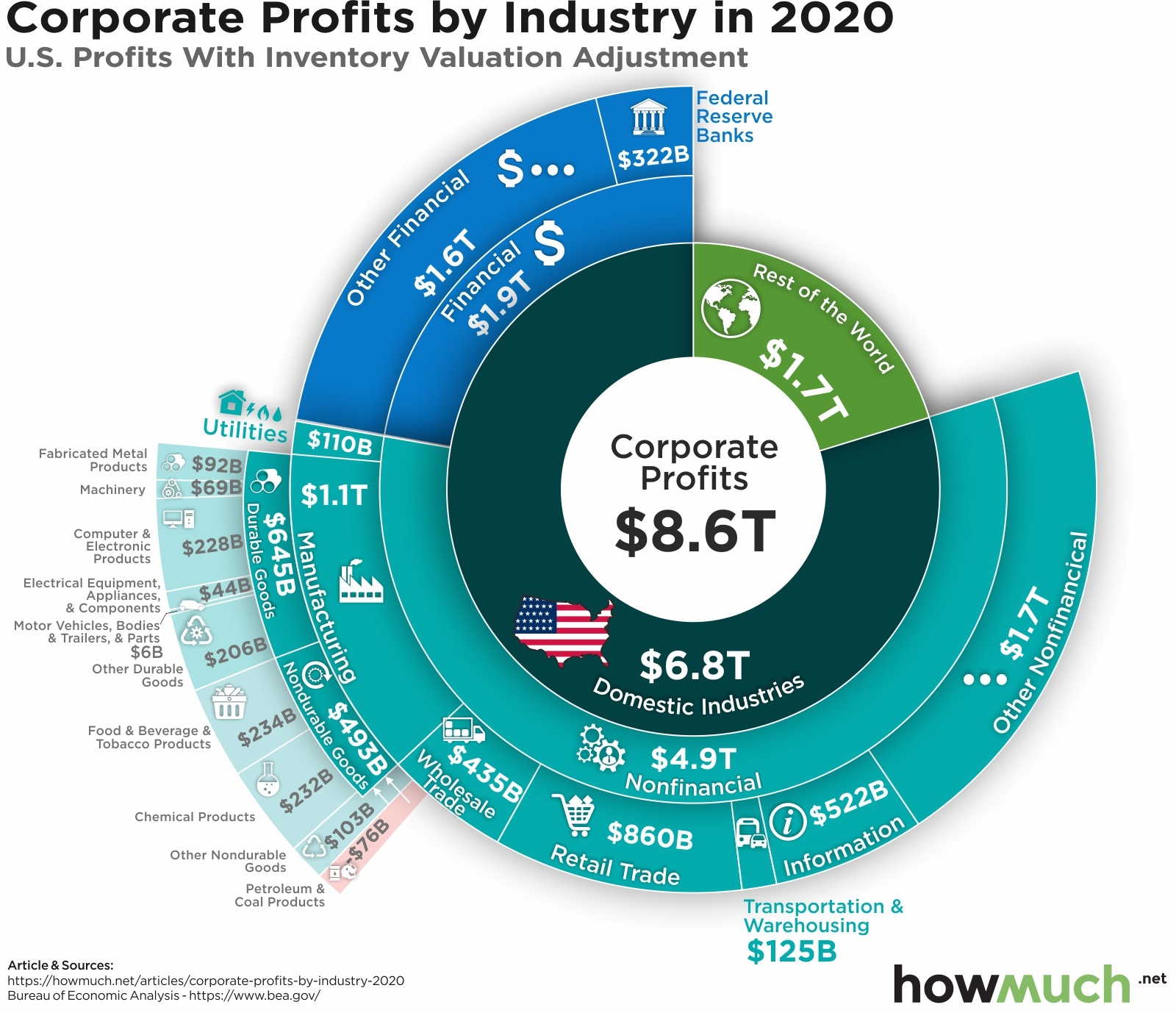

$1,000,000,000,000 is 20% of our quarterly GDP and, in Q1 and Q2 of this year, the Government went $2.5Tn into debt already (25% of the first half GDP) along with the Fed's $720Bn in the first hald and now it's Q3 so it's time for another Trillion, right? After all, US Comapnies only made $6.8Tn last year and they paid $212Bn in taxes so it's only fair that we give them at least $1Tn per quarter in assistance because, after all – who could possibly be more deserving?

In fact, thanks to the Fed-induced inflation (and notice on this chart that the Fed itself is a Corporation – NOT a Government entitiy, that made $322Bn in profits during last year's crisis), Corporate Profit Margins are at record-highs. Never before in history have Corporations made a larger profit selling things to people. In fact, 12.5% net profit margins for the S&P 500 are a fantastic 25% higher than the normal highs – no wonder those profits are so excellent!

America is truly unique, even among Capitalist Nations, as we pretty much let Big Business do whatever they want with pretty much no conserquences. We call it "Free Market Capitalism" but in college it was called an Corporatocracy, a term used to refer to an economic, political and judicial system controlled by corporations or corporate interests. In a Corporatocracy you would find "Bank Bailouts, Excessive Pay for CEOs along with the Exploitation of National Treasuries, People & Natural Resources." Sound like any countries you know?

Look at the burden that is placed on the people of the US to pay taxes compared to the rest of the developed world (and our inclusion in the average makes it look better than it is):

This is MADNESS people we pay almost double the Individual Taxes, more than double the Property Taxes while our Corporations pay about half the consumption taxes and far less than half of the taxes on their income which, as you can see from the first chart – is already 4 TIMES larger than the entire rest of the World combined!

The problem for Americans is our Corporate Citizens don't live in the rest of the World and they are not draining the money and resources away from 8Bn people – they are, in fact, laser-focused on ruining the lives of the 330M people in this country. That's our money they are spending and our debts we, the people, are taking on to support their very profitable "lifestyles". Those are our roads and bridges and electrical grids that they don't pay their fair share of and those 25% higher profit margins is money they suck out of our pockets in this "free market."

The problem for Americans is our Corporate Citizens don't live in the rest of the World and they are not draining the money and resources away from 8Bn people – they are, in fact, laser-focused on ruining the lives of the 330M people in this country. That's our money they are spending and our debts we, the people, are taking on to support their very profitable "lifestyles". Those are our roads and bridges and electrical grids that they don't pay their fair share of and those 25% higher profit margins is money they suck out of our pockets in this "free market."

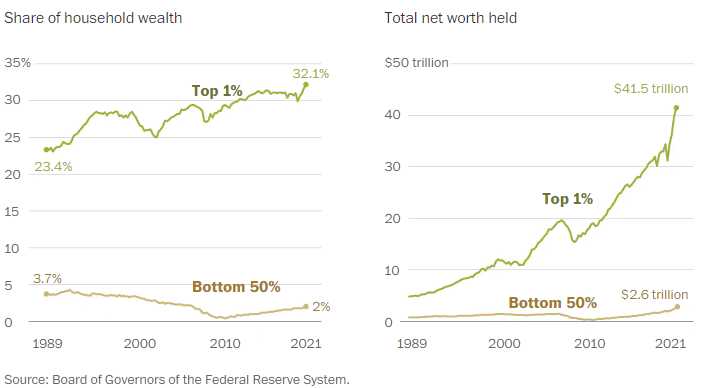

And, of course, even within our Corporate World, there are uneven distributions of profits. While the profit margins for S&P 500 companies jumped 25% in the past 4 quarters thanks to TRILLIONS of Dollars of bailout money (that you and I borrowed to give them), individual businesses, which used to make up 60% of the Corporate Sector by Revenues and employed 60% of the people – have been getting killed. Low interest rates for the Top 1% Individuals and Corporation and massive bailouts have engineered the greatest transfer of wealth from the poor to the rich in human history.

The combined wealth of all households in the United States added up to $129.5Tn in the first quarter of this year. The wealthiest 1% held 32.1% of that total, up from 23.4% in 1989. The top 10% of households owned $70 of every $100 in household wealth, up from $61 in 1989. The bottom half, whose share never exceeded 5 percent, now holds just 2 percent of household wealth in the United States.

The combined wealth of all households in the United States added up to $129.5Tn in the first quarter of this year. The wealthiest 1% held 32.1% of that total, up from 23.4% in 1989. The top 10% of households owned $70 of every $100 in household wealth, up from $61 in 1989. The bottom half, whose share never exceeded 5 percent, now holds just 2 percent of household wealth in the United States.

First they came for the minimum wage workers, and I did not speak out—because I was not a minimum wage worker.

Then they came for the Bottom 50%, and I did not speak out— because I was not in the Bottom 50%.

Then they came for the Middle Class, and I did not speak out—because I was not in the Middle Class.

Then they came for me—and there was no one left to speak for me.

Wake up people! How do you think the Top 1% will get richer? They have to take money from someone and now the bottom 50% and the Middle Class have been squeezed like the grapes they buy for $500 a bottle – where will the Top 1% turn to in order to extract their next $20Tn in the coming decade. Maybe they've got enough and will no longer attempt to make more money, right?

The Global GDP in 2010 was $66Tn and last year it was $87Tn. The wealth of the Top 1% in 2010 was $19Tn and now it's $41.5Tn so over 100% of the growth in the Global Economy went to the Top 1% but it's not just that they took ALL the money – the expansion of wealth still leads to an expansion of prices (sometimes called inflation if you are not a Government or Fed official) which means, even if the Top 1% didn't specifically confiscate your wealth – you still have 15% less buying power than you had in 2010.

The Global GDP in 2010 was $66Tn and last year it was $87Tn. The wealth of the Top 1% in 2010 was $19Tn and now it's $41.5Tn so over 100% of the growth in the Global Economy went to the Top 1% but it's not just that they took ALL the money – the expansion of wealth still leads to an expansion of prices (sometimes called inflation if you are not a Government or Fed official) which means, even if the Top 1% didn't specifically confiscate your wealth – you still have 15% less buying power than you had in 2010.

There are also 500M more people on the planet than there were in 2010, when we were just crossing 7Bn – that's another way your wealth is being diluted faster than you think as the Top 1% only has 5M more people (75M total) to share $20Tn additional dollars with while the other 7.5Bn of us have to make due with the same money 7Bn of us had 10 years ago.

Though wealth inequality has grown in other industrialized democracies too, the U.S. figures mark this country as an outlier. A 2018 study of 28 countries in the Organization of Economic Cooperation and Development found that, on average, the top 10 percent of households owns 52 percent of wealth, while the bottom 60 percent owns 12 percent. But in the United States the top 10 percent held 79.5 percent and the bottom 60 percent held 2.4 percent.

Our bottom 60% – 200M people, have 1/5th as much wealth as other countries and, again, we are included in the average – so it's even worse than that!

Despite what the US Corporate Media likes to tell you – economies cannot thrive with such levels of inequality.