America doesn't lose wars – we "withdraw" from them. It was Sept 11th, 2001 when George Bush started to blame Afghanistan for hijackings of 4 American planes by 19 (out of 21) Saudi nationals and it was Al-Queda that took credit for it, not the Taliban but we attacked Afghanistan anyway and found no chemical weapons but we did kill 71,000 civilians and injured over 500,000 more (and triple that including soldiers)in a country of 40M – so every single Afghani person pretty much has someone they know who's been killed or injured by Americans over the past 20 years – and we wonder why they don't like us….

We invaded Afghanistan in December of 2001 and, by 2004, we had displaced the Taliban and installed a corrupt, puppet Government that lasted for 10 years while the war with the Taliban raged on. But the Taliban found lots of recruits and we never got rid of them – no matter how many weddings we bombed – go figure…

Trump initiated peace talks last November and we were supposed to be out by May 1st but it's been a little delayed, Biden re-set the deadline to Sept 11th (20 year anniversary) but then changed it to August 31st – so less than 20 years. The Taliban, however, stuck to the original timeline and started taking over Afghan provinces again in May, starting with Helmand, where all the good poppies are grown.

Trump initiated peace talks last November and we were supposed to be out by May 1st but it's been a little delayed, Biden re-set the deadline to Sept 11th (20 year anniversary) but then changed it to August 31st – so less than 20 years. The Taliban, however, stuck to the original timeline and started taking over Afghan provinces again in May, starting with Helmand, where all the good poppies are grown.

As of yesterday, they took over the capital and now Biden is sending in 5,000 troops as 30,000 US civilians still need to be evacuated. But don't count this as a loss – America doesn't lose wars…

This isn't Trump's loss, this isn't Biden's loss, this is America's loss as we went into this war for all the wrong reasons and we never had a real plan to fix anything. This war was about oil and massive military contracts for Dick Cheney's Haliburton (HAL) and other military contractors who made a fortune on it and had no desire to see it end. The left didn't want to end it badly enough and the right didn't want to win it badly enough so we half-assed a war for 20 years and now Afghanistan is run by the Taliban and our problems are just beginning.

Does this matter to the markets? In a normal World it would matter a lot. This war was all we had back in 2001 and the markets were tanking as America began spending roughly $500Bn per year bulking up the military. Now we think our $1Tn annual military budget is "normal" – even though the US spends more (and $778Bn is only the hard costs) than the entire rest of the World COMBINED – including our "allies"!

Does this matter to the markets? In a normal World it would matter a lot. This war was all we had back in 2001 and the markets were tanking as America began spending roughly $500Bn per year bulking up the military. Now we think our $1Tn annual military budget is "normal" – even though the US spends more (and $778Bn is only the hard costs) than the entire rest of the World COMBINED – including our "allies"!

Also, keep in mind that the only reason China feels compelled to spend $252Bn (1/3 of our total) on their military is BECAUSE we spend $778Bn on ours. Russia spends less than 1/10th what we spend and the Taliban do it for free – all volunteers or, as President Regan used to say "They are like our Founding Fathers!"

Wars also consume a lot of oil (tanks get terrible mileage in the city) and that puts more money into the pockets of the people we're figthing – as does the heroin and then the morphine we use to get people off heroin is also made from poppies – and the beat goes on.

Speaking of oil, as we expected, oil is taking its mid-August dive. I said to our Members last Wednesday, after the API Inventory Report:

Oil was net 0 and we're drifting around $67.50 but I think we'll break below $65 in the near future. Biden is asking OPEC to increase supply and, if they don't, he might us the SPR to dump oil on the market and reduce prices. We have 621M barrels in the SPR and we import 3.8Mb/d of oil so it's enough to last us about 6 months and, of course, 70% of that oil comes from Canada and Mexico so the amount of supply OPEC can control would take a year to affect us. We also have 1.2Bn barrels in commercial storage.

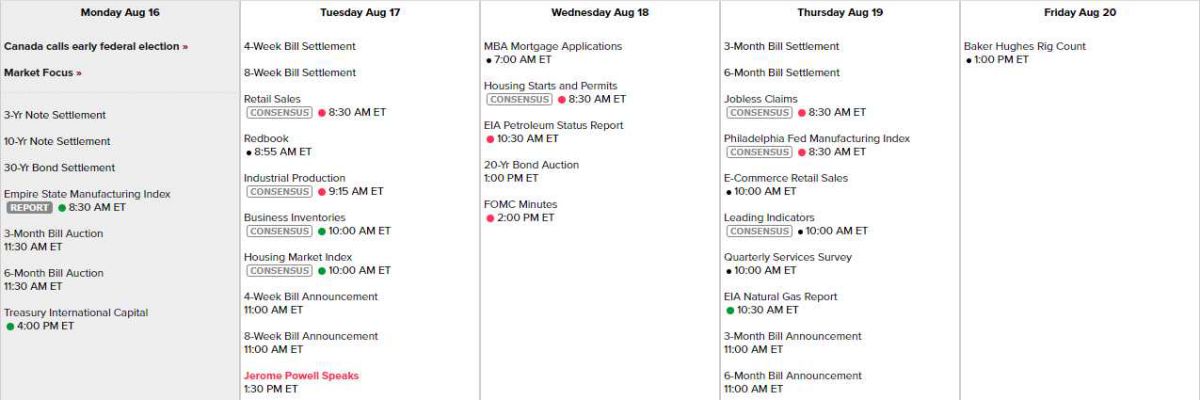

We have Fed Minutes this week and Powell is speaking tomorrow and Friday is options expiration day, so plenty to keep us busy. Empire State Manufacturing already came in at 18.3, almost half of the 30.1 expected and such a steep drop from last month's 43. Shipments fell from 43.8 to 4.4! Tomorrow we get Retail Sales, Industrial Production, Business Inventories and the Housing Market Index. Housing Starts and Mortgage Applications Wednesday along with the Fed Minutes at 2pm and Thursday is busy with the Philly Fed, E-Commerce Sales, Leading Indicators, and the Services Survey:

And look at all the earnings that are still coming in:

We are doing our portfolio reviews this week and deciding if we want to keep playing in this market or go back to cash – I'm still leaning towards cashing out.