Courtesy of Pam Martens

By Pam Martens and Russ Martens

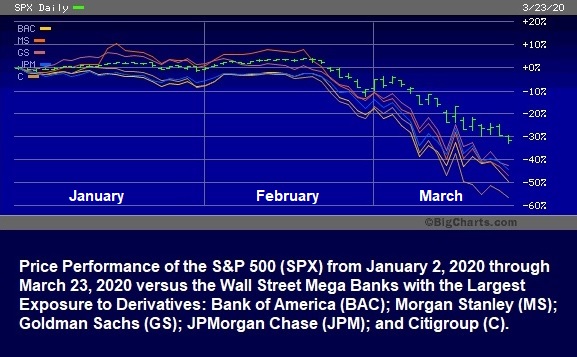

Federal Reserve Chairman Jerome Powell and Fed Vice Chairman for Supervision, Randal Quarles, would desperately like to make three of the Fed’s emergency bailout programs to Wall Street disappear from further scrutiny by Congress or the American people. That’s because the specific details of those programs do not comport with the testimony that Powell and Quarles have provided at Congressional hearings throughout the pandemic. Both Powell and Quarles have told Congress that the mega banks were a source of strength during the pandemic. (The chart above shows what was really happening.)

The three emergency lending programs that the Fed would like to make vanish are the Primary Dealer Credit Facility (PDCF); the Commercial Paper Funding Facility (CPFF); and the Money Market Mutual Fund Liquidity Facility (MMLF).

These are not only the most opaque of the Fed’s “official” bailout programs but they are also the first three emergency lending programs that the Fed stood up in 2020. The PDCF and CPFF were both announced on March 17, 2020 by the Fed. The MMLF was announced the very next day.

…