An endless series of low-volume rallies is not enough to get you over a major level on the S&P 500 so, once again, we are being rejected at the 4,500 level. On the surface, things look good with a projected $1.8Tn in earnings for the S&P 500 and that's up 28% from $1.4Tn in 2019 but our Government (money borrowed by you and I on their behalf) has spent over $10Tn so our Corporate Masters could make that extra $400Bn – which will be the ANNUAL interest on what we borrowed at 4% (which will be more profits for the banks).

This is like playing Monopoly when the Banker is cheating – there's no way you can win…. Meanwhile, in 2019, the S&P 500 was topping out at 3,000 so 4,500 is 50% higher than we were, not 28%, which would be 3,750. So, EVEN IF there were no stimulus and this were an honest 28% increase in earnings – we are still 20% too high at 4,500. This is not sustainable – especially if the Government isn't going to throw in another few Trillion Dollars to keep things humming next year.

As you can see, it took the S&P 4 years to get from 2,000 to 3,000 (up 50%) and that 1,000 point rally had two 500-point pullbacks along the way. This is our first attempt at 4,500, less than 2 years after crossing 3,000 and that's a 1,500-point rally and the pullback we'll be looking for is 3,750 at some point, which is only down 16.66% – so not too big a deal if it happens (and we hold it).

Again, I'm a bit skeptical because of all the stimulus but stimulus there is so 4,500 we have – for the momemt. Now it's up to the Fed and the Government to decide how much they want to spend to keep Corporate America making this kind of money (while not taxing them) at the expense of the American people. In situations like this – you know better than to expect our Government to be there for the people….

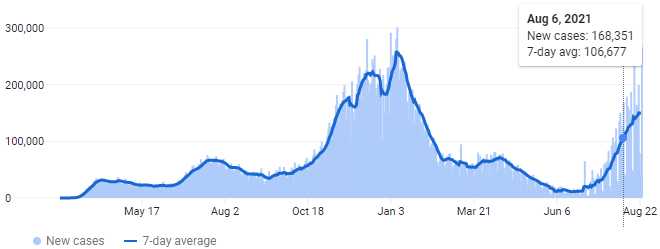

Of course, people will not be a problem in the near future as we have infected another 266,147 of them yesterday with Covid. Only 1,359 people died but that's a lagging indicator as it's only been a month since we started this new cycle but thank goodness we live in this modern civilization with all these great tools at our disposal to fight the spread of a disease, right?

Of course, people will not be a problem in the near future as we have infected another 266,147 of them yesterday with Covid. Only 1,359 people died but that's a lagging indicator as it's only been a month since we started this new cycle but thank goodness we live in this modern civilization with all these great tools at our disposal to fight the spread of a disease, right?

Unfortunately, you can have the greatest tools in the World at your disposal (and we do) but they aren't worth a damn if people aren't willing to use them, are they? China had 46 cases yesterday. The difference between China (1.4Bn people) and the US (0.3Bn people) is that China actually uses science to fight the disease. Their people cooperate and wash their hands before entering a building and they wear masks wherever they go and, guess what – it works!

1,359 people died YESTERDAY because we didn't do those simple things. China has had 94,687 TOTAL cases of Covid and 4,636 deaths (yes, they are way better than us at curing it too) yet we don't just refuse to learn from them – we refuse to let others learn from them. What is wrong with our society? How do we just go about our daily lives and LET this happen. How do we LET another 1,359 people die today without trying to do ANYTHING about it?

This is a completely preventable tragedy that is happening every day, yet we sit here and let it happen and we'll let it happen tomorrow and the day after that. Somehow it's become "un-American" to stop a disease from spreading? WTF people?

This is a completely preventable tragedy that is happening every day, yet we sit here and let it happen and we'll let it happen tomorrow and the day after that. Somehow it's become "un-American" to stop a disease from spreading? WTF people?

And WTF Investors as they are also ignoring the very thing that tanked the market last year and here we are, back near last year's peak infection levels yet somehow everyone believes this time is different and what? We won't have to lock down to stop it? We won't have to borrow Trillions more to fix it or is the borrowing Trillions of Dollars and giving it to Corporate America exactly what they are counting on? Go virus!

Now, we can either join the Covid deniers and the market bulls and assume that rising infection rates are going to be great for the market or we can protect the gains we made from the first $10Tn in stimulus and pull back a little. We did the latter last week, bringing all of our Member Portfolios to mainly CASH!!! positions while maintaining bearish hedges in our Short-Term Portfolio. It's enough to withstand a 20% market correction that is long overdue.

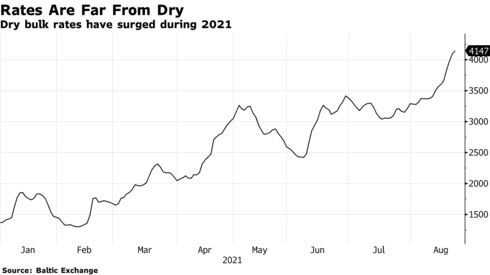

Meanwhile, all this money sloshing around is overheating segments of the economy. Check out this chart for Bulk Dry Shipping Rates that are rising even faster than Covid cases. That's up 30% since July and up almost 200% since the start of the year. This is not "transitory inflation" – the Fed is LYING to you. The Government is LYING to you. How are the prices of goods going to come back down when the cost of shipping them triples?

Meanwhile, all this money sloshing around is overheating segments of the economy. Check out this chart for Bulk Dry Shipping Rates that are rising even faster than Covid cases. That's up 30% since July and up almost 200% since the start of the year. This is not "transitory inflation" – the Fed is LYING to you. The Government is LYING to you. How are the prices of goods going to come back down when the cost of shipping them triples?

Again, this is something Traders are pretending isn't really a thing. How many things can we ignore at one time? Won't a 200% increase in the cost of shipping impact Corporate Profits down the road? They are paying more money for the same delivery – where does that money come from? The price increases we have been seeing are based on April, May, June shipping prices – the next round of data will have July, Aug, Sept with another major increase. Will the market keep taking this in stride?