Not too impressive.

Not too impressive.

Since we crashed the market last week by closing out some of our longs (in these low-volume markets – it doesn't take much), the S&P 500 has bounced back, but basically only on three sudden surges, on Thursday and Friday morningings and pre-market Monday. Other than that, the vast bulk of the action has been sideways now that earnings season is mostly behind us.

You can see why we took advantage to cash out at the top – it's hard to find buyers when you are selling more than a few shares and the S&P dropped 5% in two days last week – it doesn't take much to send these dominioes tumbling over. That's why Powell has a tricky job today (10 am). He has to mke his keynote speach for the Jackson Hole Conference which is being held on-line because Covid has made it too dangerous to hold a conference – even for a few hundred rich people in a luxury mountain hotel.

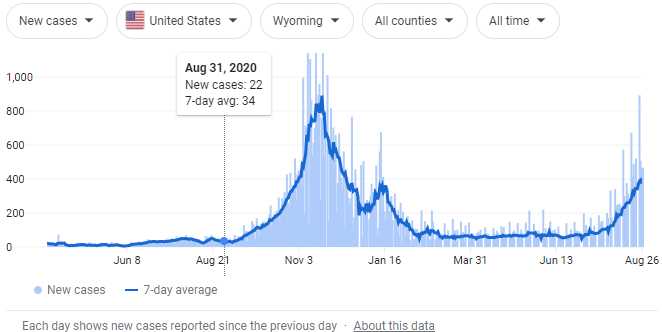

It's hard to say the virus is behind us as an economic factor when your audience just had to cancell a trip to Wyoming because the disease you are pretending is gone just spiked up again – past last year's levels (when the conference was also cancelled).

It's hard to say the virus is behind us as an economic factor when your audience just had to cancell a trip to Wyoming because the disease you are pretending is gone just spiked up again – past last year's levels (when the conference was also cancelled).

Meanwhile, the Fed minions are floating trial balloons about scaling back their monthly stimulus (tapering) from the current $120Bn a month because it has been jacking consumer prices up 10% – and that has been hammering down consumer confidence at a rapid level.

This week we've heard quite a few businesses begin to talk about inflation hitting their margins and giving more downbeat guidance moving forward. We've also heard new about shipping costs and chip prices increasing – the kinds of things that are not at all transitory and can have a cascading effect on the costs of other goods and services.

Wages have been increasing – up 1.1% in July but Personal Spending fell off significantly, up only 0.3%, down from 1% in the prior report. The slower spending growth suggests the recovery has lost momentum amid Delta variant uncertainty. According to the WSJ:

Americans have been shelling out more this summer to travel, dine out, and attend concerts, museums and conferences—activities they had put off for most of the pandemic. But there are signs that such spending is taking a hit and affecting businesses, undermined by consumer fears tied to the Delta variant, staffing shortages and persistent bottlenecks in global shipping networks.

Oxford Economics earlier this summer projected that Consumer Spending would rise at an annual rate of nearly 8% in July through September. But recently they cut that projection by more than half, to 3.5% yet, of course, this has done nothing to make people re-think the record-high prices they are paying for stocks – even though Consumer Spending is 60% of the economy and they missed it by a mile….

U.S. retail sales fell 1.1% in July from June and, as I pointed out earlier in the week – you have to beware of these lagging reports that people hve been using to paint a false picture of how well the economy has been doing this summer. So Powell is in a tricky place this morning, as he has to tell investors to remain calm while he begins to take away $1.44Tn in stimulus (7.2% of our entire economy, which is "growing" at 6.6%) because "all is well" despite the fact that he's giving the speech from his bedroom because the virus is raging out of control – again.

U.S. retail sales fell 1.1% in July from June and, as I pointed out earlier in the week – you have to beware of these lagging reports that people hve been using to paint a false picture of how well the economy has been doing this summer. So Powell is in a tricky place this morning, as he has to tell investors to remain calm while he begins to take away $1.44Tn in stimulus (7.2% of our entire economy, which is "growing" at 6.6%) because "all is well" despite the fact that he's giving the speech from his bedroom because the virus is raging out of control – again.

Last August, in Wyoming, there were 14 cases per day and the Fed decided to cancel a major economic conference and for good reason as Wyoming, with just 575,000 people in the entire state, was getting 800 cases a day in November. As of yesterday, Wyoming is averaging 400 cases per day and risiing rapidly and the daily spikes are already beginning to rival last November, with 891 cases on the Monday.

The big guns at the Fed can afford to cancel their vacations, because they are rich but the average folk who made summer plans are essentially being forced to take them due to cancellation poliicies that are back in place this year. That's forcing middle-class families to risk their children's lives to travel to now-unsafe locations in conditions that are 10 times worse than when we shut everything down last year to attempt to contain the disease – and that barely worked.

Now we've thrown caution to the wind and the bottom 80% have been thrown under the bus and if Delta spike 10 times into this November – they will say "who could have seen that coming".

"While Mona Lisas and Mad Hatters

Sons of bankers, sons of lawyers

Turn around and say good morning to the night

For unless they see the sky

But they can't and that is why

They know not if it's dark outside or light "- Elton John

Have a great weekend,

– Phil