"It's hard to keep your feet on the ground

'Cause when we like to party

We only want to get down

Woo-oh, what a feeling

When we're dancing on the ceiling"

The Democrats voted yesterday to suspend the Debt Ceiling but (evil music, please) the Republicans in the Senate are likely to vote it down and the US officially runs out of money at midnight. We still have a few bucks in the checking account – enough to get us through the 18th, according to our Treasury Secretary but millions of jobs are in peril but they will be Biden job losses and that's actually considered a win for the Republicans, who are doing anything they can to damage the Democrats ahead of the 2022 elections.

The House passed the debt ceiling suspension in a 219-212 vote. All Democrats except Reps. Jared Golden of Maine and Kurt Schrader of Oregon supported it. Every Republican but Rep. Adam Kinzinger of Illinois opposed it. The Senate could vote on a short-term appropriations plan Thursday that would fund the government until early December. It would then move to the House for approval where it is expected to pass.

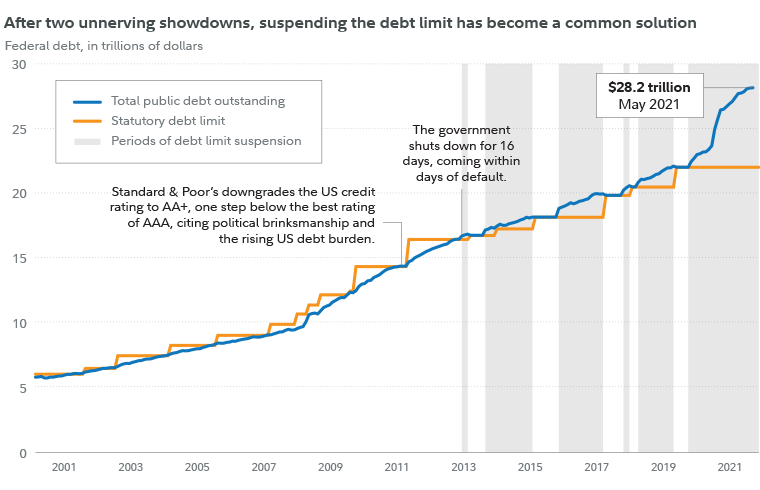

Republicans insist Democrats should raise the limit on their own, leading Senate Majority Leader Chuck Schumer, D-N.Y., to introduce a motion that would allow the Senate to hike the ceiling with a simple majority. It needed unanimous consent, and Minority Leader Mitch McConnell, R-Ky., blocked it on Tuesday. A default could delay Social Security checks and veteran’s benefits, increase borrowing costs and trigger a market sell-off and economic downturn. In 2011, when the Republicans last blocked a borrowing increase, the US lost their AAA credit rating.

Failing to act could spark an economic catastrophe, Yellen also said. “Nearly 50 million seniors could stop receiving Social Security checks for a time. Troops could go unpaid. Millions of families who rely on the monthly child tax credit could see delays. In a matter of days, millions of Americans could be strapped for cash.”

Failing to act could spark an economic catastrophe, Yellen also said. “Nearly 50 million seniors could stop receiving Social Security checks for a time. Troops could go unpaid. Millions of families who rely on the monthly child tax credit could see delays. In a matter of days, millions of Americans could be strapped for cash.”

The Federal Debt is the amount of money the government currently owes for spending on payments such as Social Security, Medicare, Military Salaries and Tax Refunds. “Raising the debt ceiling doesn’t authorize additional spending of taxpayer dollars. Instead, when we raise the debt ceiling, we’re effectively agreeing to raise the country’s credit card balance,” Yellen has said.

The third estimate of the 2nd Quarter GDP came in at 6.7%, 0.1% higher than the last estimate but it's not telling us anything about what happened since June so we'll have to wait a month for the next report. The Futures are drifting higher and we are still working on those bounce lines:

- S&P 4,550 to 4,300 was a 250-point drop so 50-point bounce lines are 4,350 (weak) and 4,400 (strong)

- Dow 35,500 to 33,600 was a 2,000-point drop so the bounce lines are 34,000 (weak) and 34,400 (strong)

- Nasdaq 15,700 to 14,740 was a 960-point drop so call it 200-point bounces to 14,940 (weak) and 15,140 (strong)

- Russell 2,580 to 2,150 was a 430-point drop so 90-point bounces to 2,240 (weak) and 2,330 (strong)

So we're over the weak bounce lines on the S&P, Dow and Russell and at the strong bounce line for the Russell (with the Dow close as well) so we'll be watching those two this morning for signs of recovery but it's really all up to Congress today though we have 4 Fed Speakers (Williams, Harker, Evans and Bullard) during market hours – just in case the market needs more reassurance.

China's Manufacturing PMI fell into contraction this morning at 49.6 for September, the first time since February of 2020 it's been below 50 (when Wuhan shut down). This is much scarier as there's no virus to blame – just a slowing economy. And, don't forget, they've only just begun experiencing power shortages – this data is mostly before that.

Below the headline PMI figure, subindexes measuring production, total new orders, new export orders and hiring all slid further below the 50 line in September as both supply and demand in China’s manufacturing sector slowed, the statistics bureau said. If sustained through the end of the year, the power crunch and resulting production cuts in China’s manufacturing hubs could drag down the country’s gross domestic product by around 1 percentage point in the fourth quarter, Morgan Stanley economists project.

We Americans have a long history of thinking things that happen in China aren't going to affect us – don't make that mistake.

It was a rough road but our oil shorts (which we discussed in yesterday's Live Trading Webinar) are finally paying off and we'll put a stop now back at $74 to lock in a $3,000 gain. We still like Gold (/GC) long at $1,725 and we like Silver (/SI) long at $21.50 – with tight stops below, of course.