President Biden signed a bill Thursday evening extending government funding through Dec. 3rd, averting a partial shutdown hours before current funding expired at midnight.

President Biden signed a bill Thursday evening extending government funding through Dec. 3rd, averting a partial shutdown hours before current funding expired at midnight.

The legislation, which also includes $28.6 billion in emergency disaster aid and $6.3 billion to help resettle Afghan evacuees, passed 65-35 in the Senate, and 254 to 175 a few hours later in the House. As we expected, Democrats had initially sought to attach a suspension of the debt ceiling to the funding bill, but Republicans have refused to vote to increase the government’s borrowing limit, tanking that effort in the Senate so the spending bill is moot on October 18th, since we are miles over our debt limit already.

Also still in limbo is Biden's $1Tn Infrastructure Bill but that also won't matter if they don't raise the debt ceiling to allow it to be funded. You can make all the budgets you want but, if they cut off your credit cards – all those spending plans go out the window until you earn more money. And how does the Government "earn" more money? TAXES!!!

That's right, all this GOP nonsense is simply a way to force the Democrats to raise taxes so the Repbulicans can then blame the Democrats for raising taxes and then they get re-elected so they can lower taxes and run up the debt again – until the next Democrat is elected and they will then say what a terrible thing all this debt is.

That's right, all this GOP nonsense is simply a way to force the Democrats to raise taxes so the Repbulicans can then blame the Democrats for raising taxes and then they get re-elected so they can lower taxes and run up the debt again – until the next Democrat is elected and they will then say what a terrible thing all this debt is.

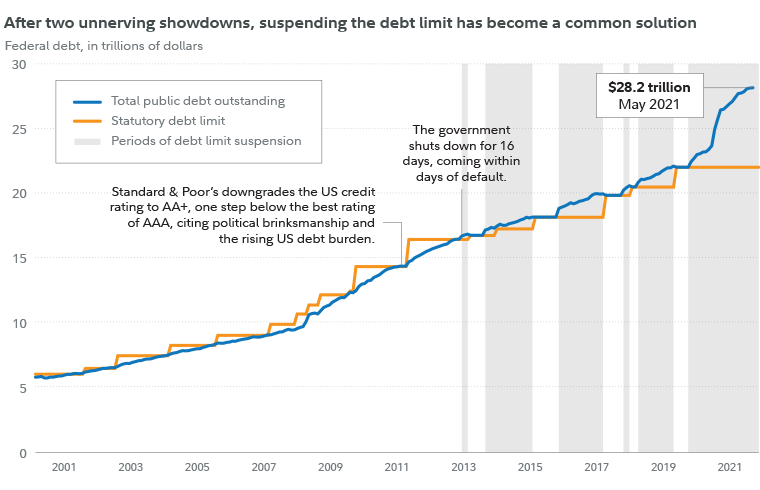

During the 2016 presidential campaign, Republican candidate Trump promised he would eliminate the nation’s debt in eight years (obviously impossible for those familiar with math). Instead, budget estimates showed that he would actually add at least $8.3 Trillion, increasing the U.S. debt to $28.5 trillion by 2025. However, the national debt reached that figure much sooner. When President Trump took office in January 2017, the National Debt stood at $19.9 trillion. As of June 30th, the end of Trump's final fiscal budget, the National Debt had already passed $28.5Tn – 4 years ahead of the worst-case scenario.

Biden's July 1st, 2021 budget (his first) has us running a $3.2Tn deficit into June of next year and another $1Tn of Infrastructure spending would bring that to $4.2Tn and another $350Bn in the proposed 10-year, $3.5Tn spending bill will put us over $4.5Tn – especially as some of that spending is front-loaded. That means we're looking at something like $33Tn of National Debt by next June (165% of our GDP) and our spending limit on the Debt Ceiling (currently suspended) is still at $22Tn after being raised 3 times under Trump before being suspended entirely.

Remember when Greece tanked the World's economy with their debts? Greece has a $200Bn economy and they were $300Bn in debt (150% of GDP) and investors lost faith in their bonds, forcing rates up and rendering the bonds unpayable and the country quickly collapsed into chaos. The US runs up an ADDITIONAL $350Bn in debt each month – ALL of Greece's debts that destablized the Global Economy – EVERY MONTH. Think about it…

The markets are bouncing this morning because Consumer Spending was up 0.8% in August (and Income was up 0.2% so Consumers went 0.6% further into debt – yay!) and Merck (MRK) says they have a very effective Covid pill though again, getting back to "normal" still doesn't justify a 30% gain in the markets since 2019.

Keep that in mind.

Have a great weekend,

– Phil