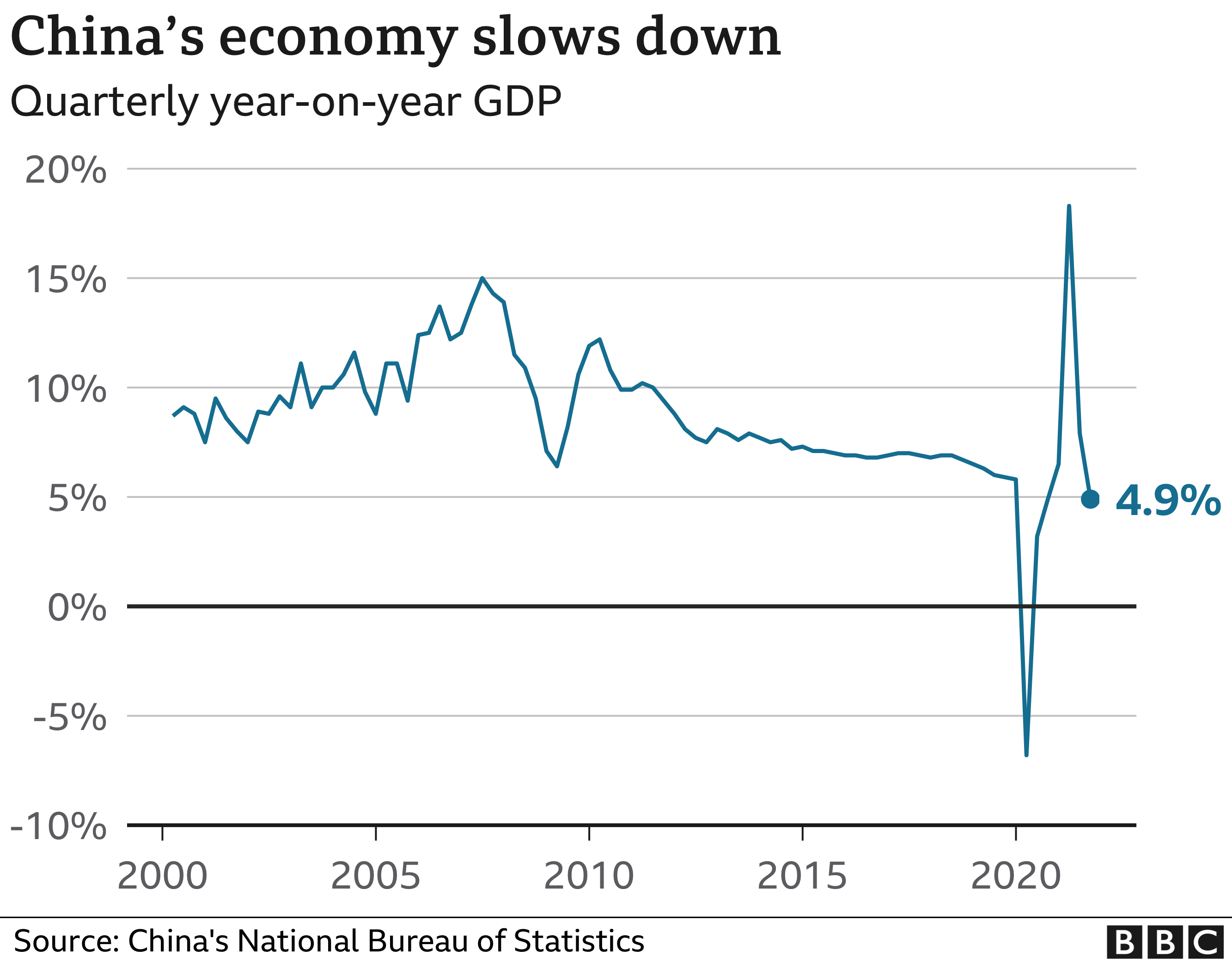

4.9% for Q3 in China.

4.9% for Q3 in China.

That's down from 7.9% in Q2 as China struggled with power shortages (which the US did not have) and supply chain issues (which the US does have) as well as Beijing's efforts to reign in the madness in the Real Estate and Technology Sectors before they form a bubble that wipes out everything else (the US just lets it happen). Delta Covid and the semiconductor shortage were also to blame and will also be factors in our own GDP. Get ready to be disappointed.

Compared to Q2, China's Q3 GDP was up just 0.2%, which was up just 1.3% from Q1 – not a great year at all. In an acknowledgment of the mounting risks to the economy, China's Statistics Bureau said that “There are increasing uncertainties in the external environment, while the domestic economic recovery is unstable and unbalanced.”

On Friday, China Central Bank officials suggested it wouldn’t resort to a relatively large stimulus to drive up the growth rate in the final quarter of the year, for example by flooding the financial system with liquidity or slashing benchmark interest rates. Officials also played down risks from the debt crisis at China Evergrande Group, the country’s most indebted property concern, whose troubles have rattled markets and raised questions about China’s overall economic and financial health.

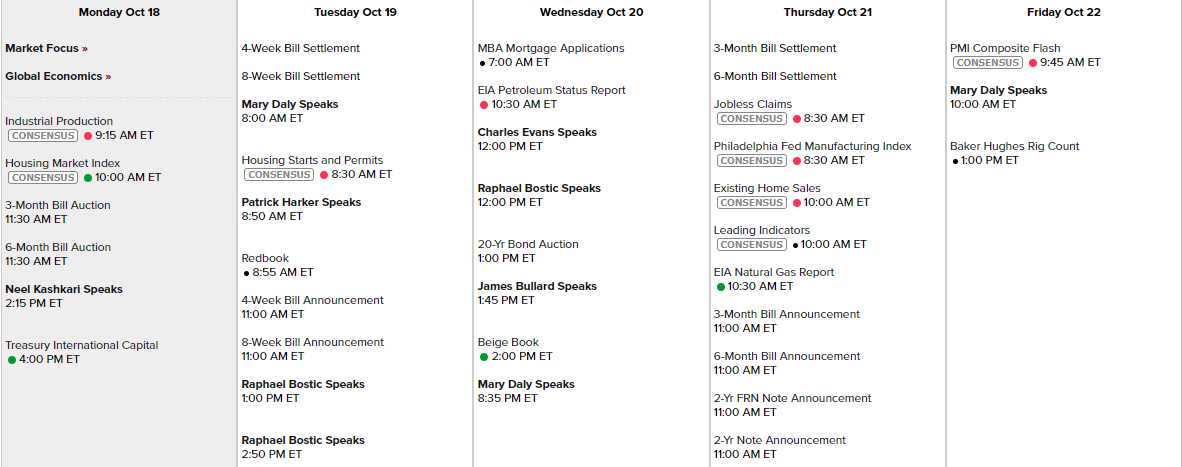

We get our own GDP Report next week but, for now, we'll have to content ourselves with the Beige Book, which is like old Uncle Remus stories (now redacted by Disney) about the economy and has nothing to do with data. This morning we'll get the Industrial Production Report along with the Housing Index, more Housing stuff tomorrow, Wednesday is Beige Book day and Thursday is the Philly Fed along with Leading Economic Indicators and we wrpa it up Friday with PMI.

Earnings, of course, are coming in hot an heavy but it's only the warm-up for Big Tech next week.

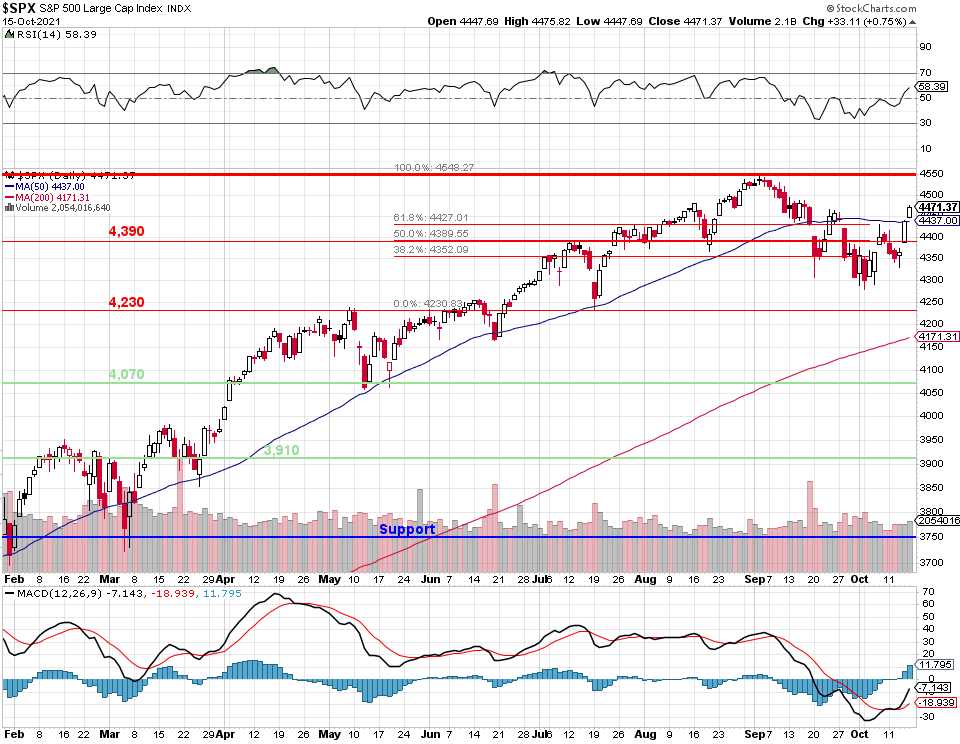

Remember, we are mainly concerned about how companies are dealing with inflation but it also looks like supply and labor shortages are going to give us a disappointing Christmas – that would be interesting but, so far, nothing seems to matter to this bull market, as we start the week back at 4,450 on the S&P 500, 35,100 on the Dow, 15,115 on the Nasdaq and 2,255 on the Russell – well on the way to recovery if we can stay over 4,400:

- S&P 4,550 to 4,300 was a 250-point drop so 50-point bounce lines are 4,350 (weak) and 4,400 (strong)

- Dow 35,500 to 33,600 was a 2,000-point drop so the bounce lines are 34,000 (weak) and 34,400 (strong)

- Nasdaq 15,700 to 14,740 was a 960-point drop so call it 200-point bounces to 14,940 (weak) and 15,140 (strong)

- Russell 2,340 to 2,130 was a 210-point drop so 42-point bounces to 2,172 (weak) and 2,214 (strong)