Nice move on /NG this morning.

Nice move on /NG this morning.

We hit our goal at $5.32 this morning – as we predicted in Wednesday's Live Trading Webinar (replay available here) giving us a $3,200 per contract profit in two days – congratulations to all who played along (we are done with this trade)! Our original set (this was a bonus round) was played on Tuesday, when I said:

So basically we want to lock in $1,000 – so that's the stop but over $5.10 and that becomes the stop but the retrace from $5 would be 0.02 and 0.04, which is where we'd end up stopping out. What do we expect? Well this had a very high potential for reward as we've slipped from $5.80 so it's an 0.80 drop (will consider below $5 while market was closed to be overshoot) so 0.16 bounces means $5.16 would be the weak bounce and the retrace from that would be 0.032 so $5.13 and $5.105 so, on the way up, we watch those carefully to see if they give us trouble. More bullish if they don't.

As I keep saying, the 5% Rule™ is not TA – it's just math. That's why, unlike TA, it actually works. It doesn't work on it's own, however, you have to have the Fundamentals backing you up but the combination of solid support and strong Fundamentals is a winning one. Oil (/CL) is back to $83.50 and the S&P (/ES) is back to 4,550 and both make nice shorts here. As I've mentioned before – we think the GDP Report next Thursday will be a disappointement.

Despite some rocky earnings reports, most notably from Intel (INTC), the market is in a bit of a relief rally as China's Evergrande suddenly made a bond payment (as if one payment fixes everything). Had they not made this particular $83.5M (out of over $300Bn in debt), they would have been in default, been audited and all their financial woes would have been exposed in short order – of course SOMEONE came up with that payment!

SNAP is also getting crushed and other social medias are getting dragged down with it as changes to privacy settings on Apple Phones are affecting their advertising business. SNAP (and those in AAPL's ad ecosystem) have been dependent for a decade on IDFA, Apple's unique device identifier for advertising. But changes in iOS 14 now require a double opt-in from users in order to get direct access, as Snap's Evan Spiegel is pointing out in today's conference call.

FaceBook (FB) is also likely to take a hit when they report on Monday and we'll see how other social media platforms are affected. One social media stock that is doing well is Donald Trum's Digital World Acquisition (DWAC), which is a SPAC that has been set up to buy Trump's worthless media assets. Thanks to the magic of his lemming-like followers, DWAC is up from $10 to $90 and is now trading at a $15Bn valuation, despite having no assets, no business plan and not even any full-time employees (I kid you not).

So Trump is a Billionaire again and is building a multi-Billion Dollar Social Media war-chest ahead of the next election – this time, with a network he will control himself. There will be no cutting him off next time…

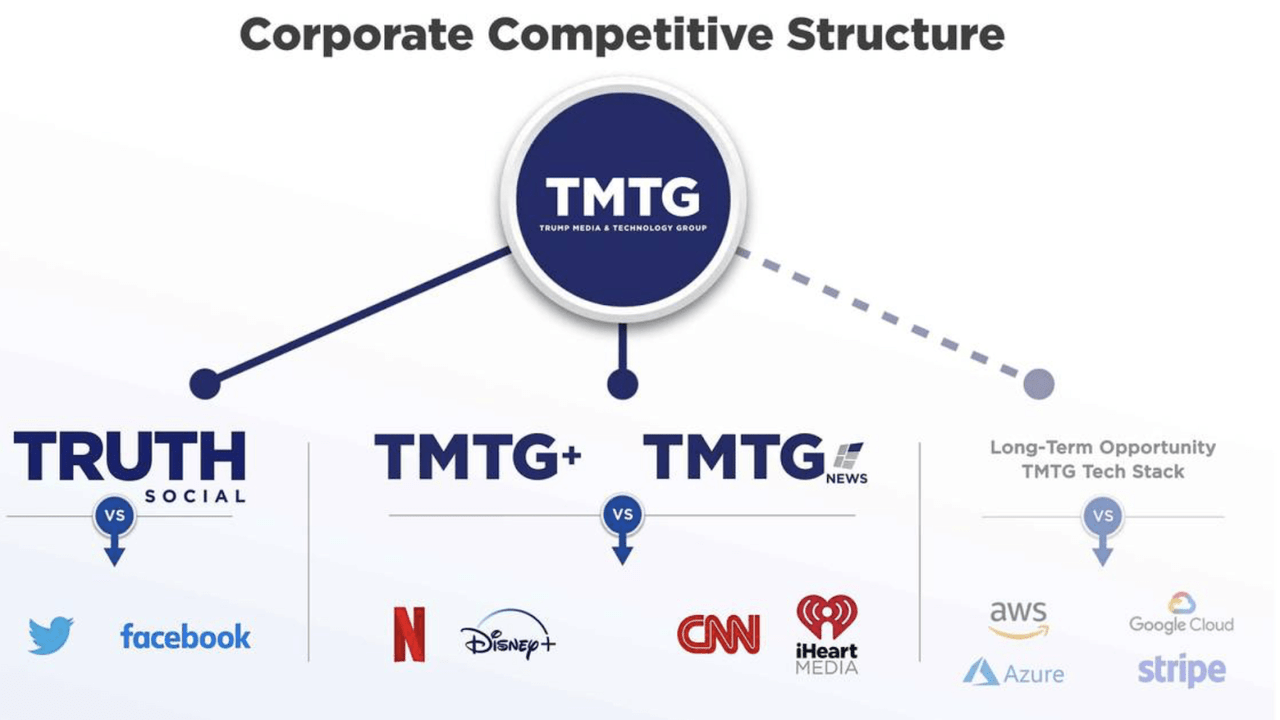

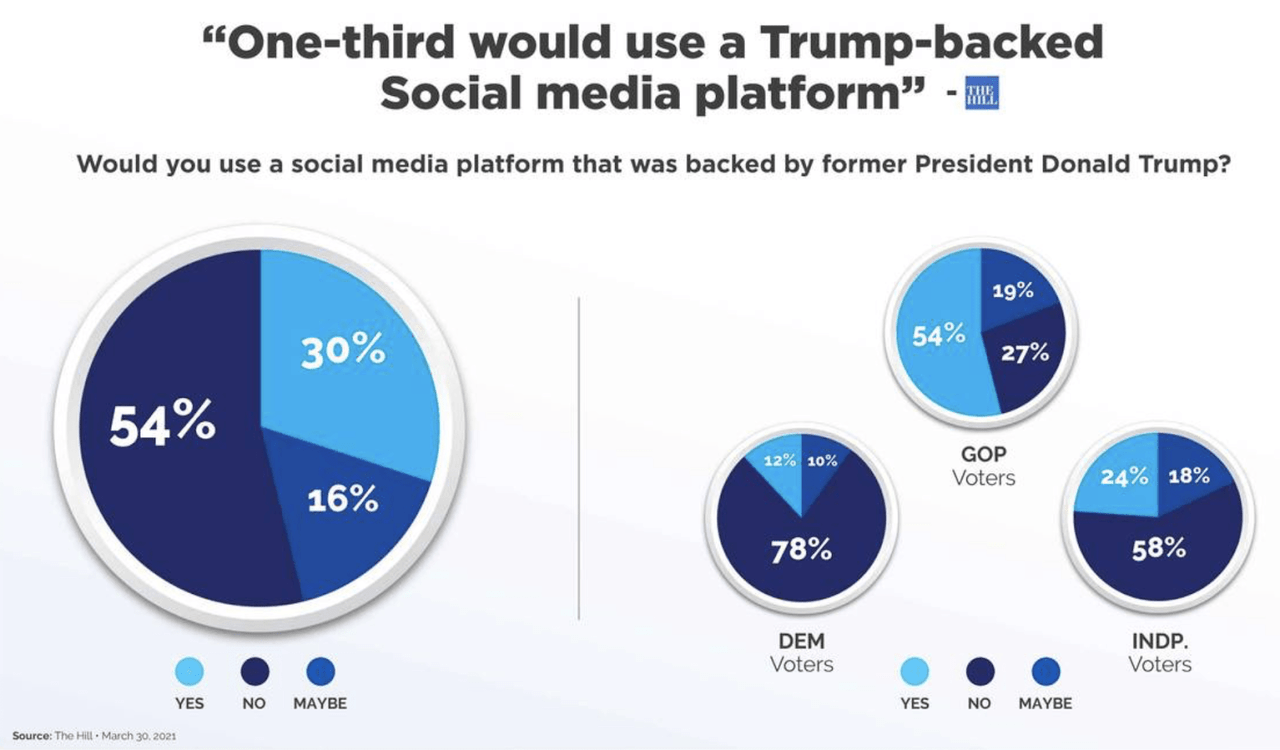

TMTG also expects to challenge AMZN, GOOGL, and Microsoft (MSFT) in the cloud, as well as Stripe in payment processing. What would make TMTG different? It appears that the main draw of TMTG would be its social media platform, which will be called “TRUTH Social.” TMTG notes that one third of people that it surveyed would use a social media platform that was backed by former President Trump.

No wonder there's a waiting list for flights off this planet!

Have a great weekend,

– Phil