The climate talks are on.

For two weeks in Scotland, Global leaders will be disucssing climate change and what they intend to do about it but what's the point when even what they SAY they will do is nowhere near enough?

We need to REDUCE carbon in the atmosphere, not keep it the same (which is the current path) or fix it a little (which is what they are discussing this week) but we need to reduce emissions by a lot, soon – or things WILL get worse. Humans have so far warmed the planet 1.1 degrees Celsius (2 degrees Fahrenheit) since preindustrial times, mainly by burning coal, oil and gas for energy, and by cutting down forests, which help absorb the planet-warming emissions created by fossil fuel use. Humanity is already paying a high price: This year alone, blistering heat waves killed hundreds of people in the Pacific Northwest, floods devastated Germany and China, and wildfires raged out of control in Siberia, Turkey and California.

In 2015, 195 nations signed the Paris climate agreement, which for the first time required every country to submit a plan for curbing emissions. While the plans were voluntary, they helped spur new actions: The European Union tightened caps on industrial emissions. China and India ramped up renewable energy. Egypt scaled back subsidies for fossil fuels. Indonesia began cracking down on illegal deforestation. Along the way, there has been some backsliding. The Trump administration rolled back some major climate policies and Bolsanaro allowed deforestation to continue in Brazil.

On the plus side, clean energy advanced far more quickly than predicted. A decade ago, solar panels, wind turbines and electric vehicles were often seen as niche technologies, too expensive for widespread use. But costs have plummeted. Today, wind and solar power are the cheapest new source of electricity in most markets.

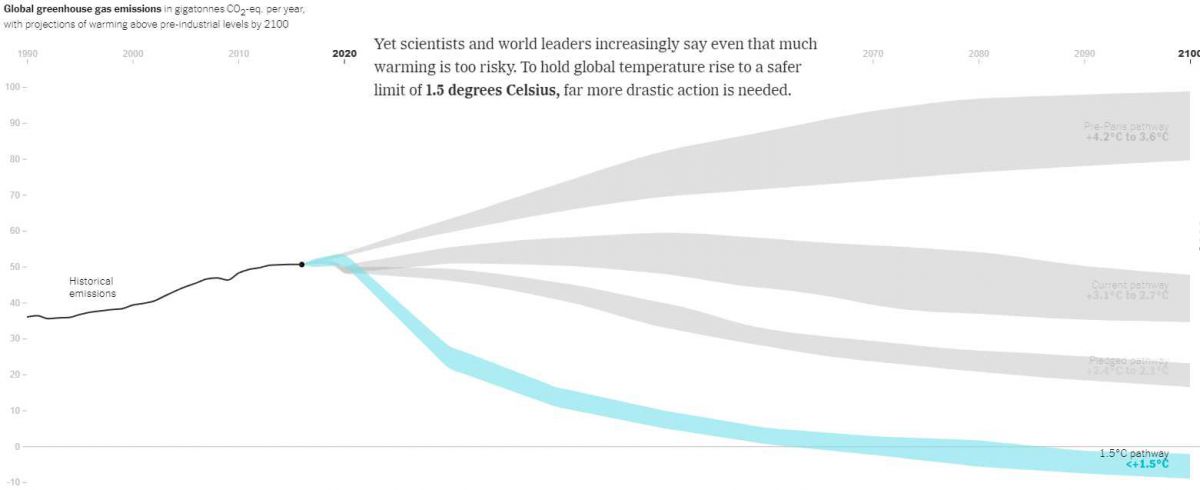

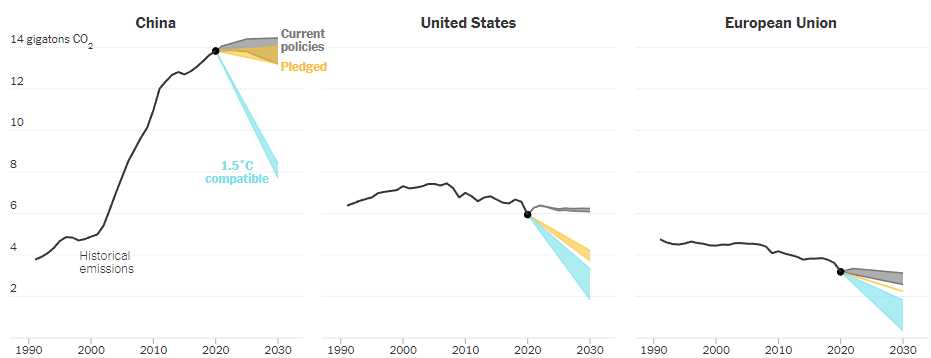

When the Paris agreement was signed, nations agreed that they should keep total global warming “well below” 2 degrees Celsius and make a good-faith effort to stay at 1.5 degrees. But in the years since, a slew of studies have found that 2 degrees of warming is vastly more harmful than 1.5 degrees. 1.5 degrees is a vastly harder target to hit than 2 degrees or 3 degrees. It’s not nearly enough for global emissions to peak in the next few years and then decline gradually. Instead, global fossil-fuel emissions would have to plunge roughly in half this decade and then reach net zero by around 2050.

When the Paris agreement was signed, nations agreed that they should keep total global warming “well below” 2 degrees Celsius and make a good-faith effort to stay at 1.5 degrees. But in the years since, a slew of studies have found that 2 degrees of warming is vastly more harmful than 1.5 degrees. 1.5 degrees is a vastly harder target to hit than 2 degrees or 3 degrees. It’s not nearly enough for global emissions to peak in the next few years and then decline gradually. Instead, global fossil-fuel emissions would have to plunge roughly in half this decade and then reach net zero by around 2050.

The International Energy Agency estimates that current policies worldwide will deliver only one-fifth of the emission cuts needed this decade to stay on track for 1.5 degrees. Without an immediate and rapid acceleration of action, that climate goal could be out of reach within a few short years. “The pathway is extremely narrow,” said Fatih Birol, the executive director of the International Energy Agency. “We really don’t have much time left to shift course.”

By 2030, electric vehicles have to make up more than half of new car sales globally, up from just 5% today. By 2035, wealthy countries would have to shut down virtually all fossil-fuel power plants in favor of cleaner technologies like wind, solar or nuclear power. By 2040, ALL of the world’s remaining coal plants would have to be retired or retrofitted with technology to capture their carbon emissions and bury them underground. New technologies will be needed to clean up sectors like air travel or we simply need to stop doing it – as it's destroying the planet.

By 2030, electric vehicles have to make up more than half of new car sales globally, up from just 5% today. By 2035, wealthy countries would have to shut down virtually all fossil-fuel power plants in favor of cleaner technologies like wind, solar or nuclear power. By 2040, ALL of the world’s remaining coal plants would have to be retired or retrofitted with technology to capture their carbon emissions and bury them underground. New technologies will be needed to clean up sectors like air travel or we simply need to stop doing it – as it's destroying the planet.

See, we lost most of you already? And what's it going to cost? Estimates run as high as $131 TRILLION to clean up the mess we've made OR – we could just keep partying like it's 1999 and let our children pay the piper – that's what our parents did to us so it's only fair we pass the buck, right? Of course the cost of NOT fixing the problem is a lot too – like the loss of South Florida over the next 100 years and the lost of New York and other coastal and river citiies. Catastrophic crop failure, disease, starvation – those things cost money too. You saw what a mess a pile of Covid bodies made last summer – that's nothing comparted to mass starvation!

In 1959-1961, just before I was born, China had a famine and 30-40M people died, China's population was only 667M people then – less than half of what it is now. You may think that couldn't happen in modern times but 5M people just died in North Korea in the 90's during a famine there – and we were trying to help. At the moment, you can't even get a part to fix your car (or a new car) due to global shipping jams – do you really think we are able to send millions of tons of food quickly if a disaster strikes?

“Humanity has long since run down the clock on climate change,” Boris Johnson will say, according to an advance copy of his remarks. “It’s one minute to midnight, and we need to act now.”

Unfortunately, this meeting is called COP26, which means it's the 26th time the nations have gotten together to address climate change. They've been at it since 1992 and 20 years ago the G20 agreed to give $100Bn a year to developing nations to help fight climate change. The total so far given is actually $0. NO ONE actually did anything they agreed to do.

Unfortunately, this meeting is called COP26, which means it's the 26th time the nations have gotten together to address climate change. They've been at it since 1992 and 20 years ago the G20 agreed to give $100Bn a year to developing nations to help fight climate change. The total so far given is actually $0. NO ONE actually did anything they agreed to do.

We did sign the Paris accords in 2015 and that looked serious but then Trump got elected and refused to ratify them so 6 years lost now but the clock is still ticking. Now Joe Biden has to convince World leaders that if America says they will do something, they mean it… this time….

$131Tn is 1.5 times the Global GDP so every country on Earth needs to spend 7.5% of their output fighting climate change for the next 20 years in order to save the planet. For the US, that would be $1.5Tn – about what we spend on the military, less than what we spent on stimulus this year and 1/3 of what we spent last year so it's not that we CAN'T do it – it's just a matter of priorities. Maybe we shouldn't be leaving these decisions up to a Congress where 312 out of 434 Members have less than 20 years to live:

It's our children's future – we're just sticking them with the costs of our living – either way…

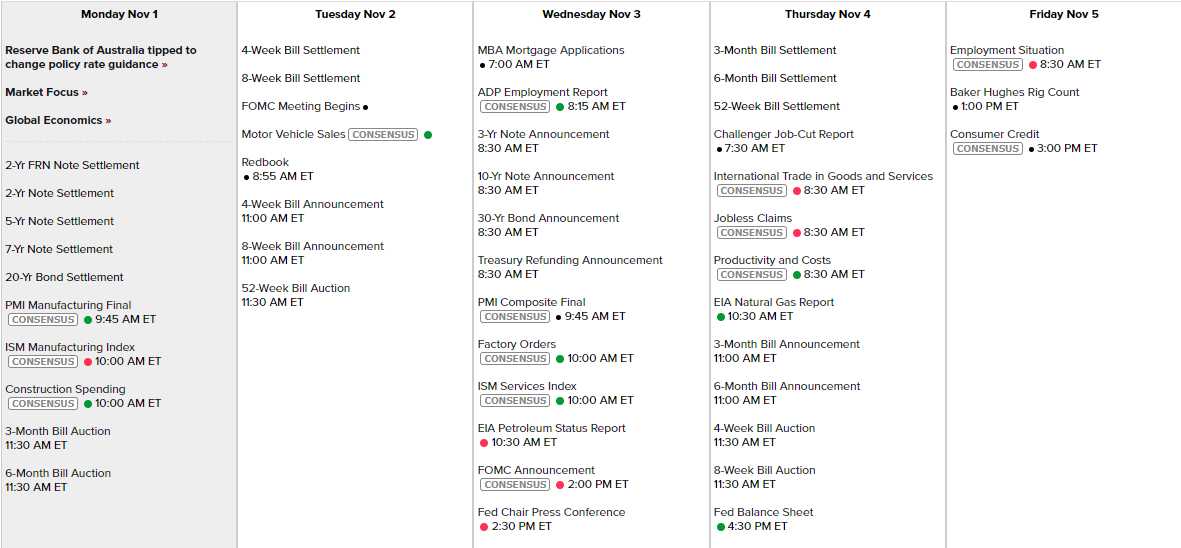

We have a Fed Meeting this week and Powell speaks Wednesday afternoon at 2:30 but not a peep out of the Fed otherwise. Some pullback on QE is expected but probably very little if any at this meeting on the heels of a disappointing GDP Report last week. We're starting this week at record highs so we'll see if we can hold them. PMI, ISM and Construction Spending get us started today, Motor Vehicle Sales tomorrow (we're running out of cars so not good), PMI, Factory Orders and ISM Services ahead of the Fed on Wednesday. Thursday is Productivity and Friday is Non-Farm Payrolls and Consumer Credit:

And, of course, we have lots and lots of earnings: