16%.

16%.

That's the percentage of S&P 500 stocks that are trading at their 52-week highs while the index itself is at a record 4,700. That is historicially narrow participation, the kind that often precedes a correction. If you think about it, since ETFs rule these days – the S&P 500 rally SHOULD be the rising tide that lifts all ships but what's really happening is the Banksters, who along with their Top 0.1% clients own 80% of all equities, are manipulating the heavily-weighted stocks to prop up the indexes while they are dumping the bulk of their over-priced holdings – just like they do at the end of every rally. It's their job…

In the Fed's 85-page Financial Stability Report published moments after the market close yesterday, the Fed warned that as Bloomberg put it, "prices of risky assets keep rising, making them more susceptible to perilous crashes if the economy takes a turn for the worse" adding that “asset prices remain vulnerable to significant declines should investor risk sentiment deteriorate, progress on containing the virus disappoint, or the economic recovery stall." You know, what I've been saying all summer but now it's from the Fed – so people might listen.

As noted by Zero Hedge:

The Fed's full view of the current level of vulnerabilities is as follows:

- Asset valuations. Prices of risky assets generally increased since the previous report, and, in some markets, prices are high compared with expected cash flows. House prices have increased rapidly since May, continuing to outstrip increases in rent. Nevertheless, despite rising housing valuations, little evidence exists of deteriorating credit standards or highly leveraged investment activity in the housing market. Asset prices remain vulnerable to significant declines should investor risk sentiment deteriorate, progress on containing the virus disappoint, or the economic recovery stall.

- Borrowing by businesses and households. Key measures of vulnerability from business debt, including debt-to-GDP, gross leverage, and interest coverage ratios, have largely returned to pre-pandemic levels. Business balance sheets have benefited from continued earnings growth, low interest rates, and government support. However, the rise of the Delta variant appears to have slowed improvements in the outlook for small businesses. Key measures of household vulnerability have also largely returned to pre-pandemic levels. Household balance sheets have benefited from, among other factors, extensions in borrower relief programs, federal stimulus, and high aggregate personal savings rates. Nonetheless, the expiration of government support programs and uncertainty over the course of the pandemic may still pose significant risks to households.

- Leverage in the financial sector. Bank profits have been strong this year, and capital ratios remained well in excess of regulatory requirements. Some challenging conditions remain due to compressed net interest margins and loans in the sectors most affected by the COVID-19 pandemic. Leverage at broker-dealers was low. Leverage continued to be high by historical standards at life insurance companies, and hedge fund leverage remained somewhat above its historical average. Issuance of collateralized loan obligations (CLOs) and asset-backed securities (ABS) has been robust.

- Funding risk. Domestic banks relied only modestly on short-term wholesale funding and continued to maintain sizable holdings of high-quality liquid assets (HQLA). By contrast, structural vulnerabilities persist in some types of MMFs and other cash-management vehicles as well as in bond and bank loan mutual funds. There are also funding-risk vulnerabilities in the growing stablecoin sector.

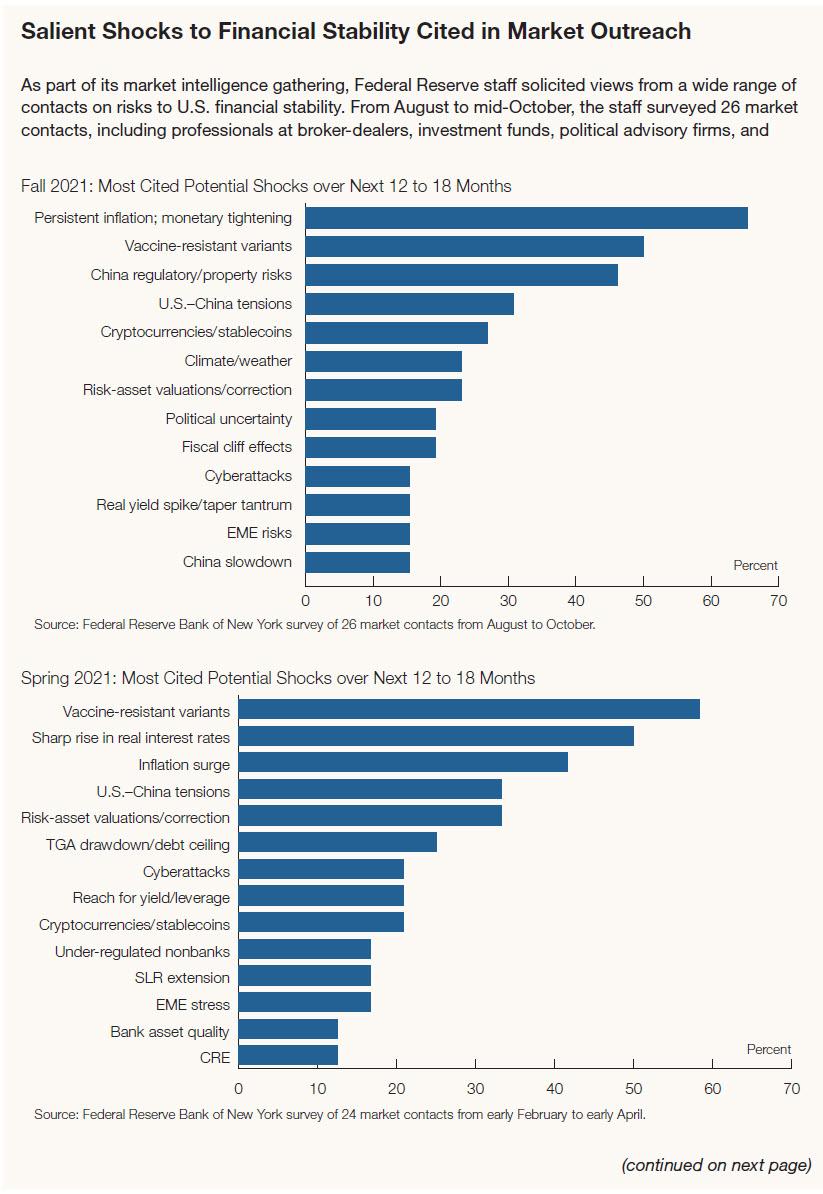

The report also detailed how near-term risks have changed since the May 2021 report based in part on the most frequently cited risks to U.S. financial stability as gathered from outreach to a wide range of market contacts. As the Fed cautions "despite recent improvements, an increase in uncertainty over the course of the pandemic might pose risks to asset markets, financial institutions, and borrowers in the United States and globally. In addition, stresses in the real estate sector in China caused in part by China’s ongoing regulatory focus on leveraged institutions, as well as a sharp tightening of global financial conditions, especially in highly indebted emerging market economies (EMEs), could pose some risks to the U.S. financial system. If realized, the effects of near-term risks could be amplified through the financial vulnerabilities identified in this report."

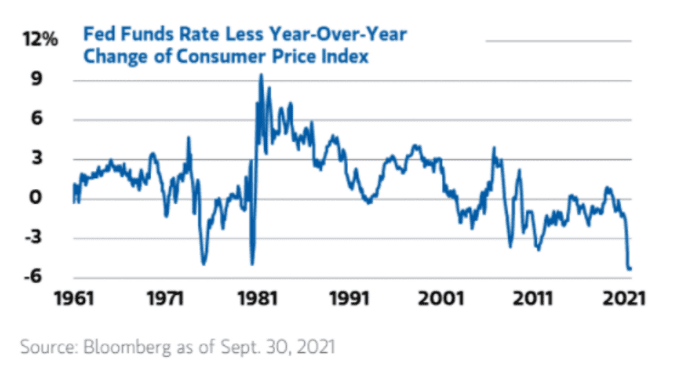

Meanwhile, Lisa Shalett, who is the CIO of Morgan Stanley, said yesterday: "We are concerned that Fed policy is divorced from the fundamentals." MS is, of course, one of the Federal Reserve's Member Banks. The difference between the Fed Funds Rate and the Consumer Price Index, which measures inflation, is the largest ever, the Morgan Stanley Wealth Management note shows.

“Risks of a market bubble are growing,” Shalett said. She suggested that investors “watch labor market data, valuations on 2022 forward earnings and fear/greed positioning gauges, which are closing in on extreme overbought conditions.” Clearly she's read yesterday's PSW Report… “Stocks continue to be stoked by excess liquidity and the Fed’s dovish rhetoric about rate hikes,” Shalett wrote. It’s “a dynamic that rewards devotion to passive investing in the S&P 500 index” and its highly-valued largest constituents, “which depend on a low-rate regime. Negative real rates bolster long-duration and growth-oriented assets,” she said, “but contribute to asset bubbles and the misallocation of capital.”

In other words:

"Nothing is more securely lodged than the ignorance of the experts."

"The more the state "plans" the more difficult planning becomes for the individual."